On Friday (8th October 2021), 136 out of the 140 countries of The Organization for Economic Cooperation and Development (OECD) agreed on a global minimum corporate tax rate across borders, and here’s a brief account of its status.

To catch you up to pace, let us look at what OECD is precisely and the historically significant tax deal they formulated.

The Organization for Economic Cooperation and Development, with its tagline ‘Better Policies for Better world’, is an international organization that works with the governments of their member nations (36 member countries) to provide evidence-based intelligence for bettering policy implementation across the world and solve a range of economic and political challenges.

One of their primary goals is to eradicate tax avoidance and fight international tax evasion.

In light of this goal, significant reforms of the international tax system were finalized at the OECD by 136 countries representing 90% of the global GDP, barring Kenya, Sri Lanka, Pakistan and Nigeria. They hadn’t yet agreed to the deal.

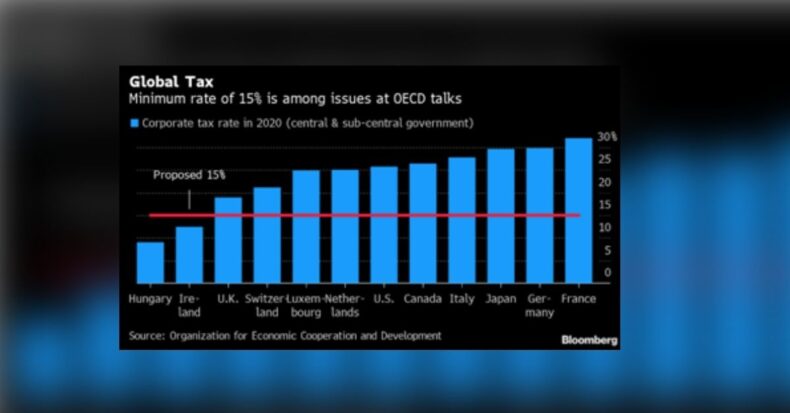

This reform targets MNEs (Multinational Enterprises), subjecting them to a minimum tax rate of 15% from 2024 to ensure that these companies pay a fair share of tax whenever they generate profits through international trade.

A significant barrier to a balanced multilateralism, due to which this reform was set, is increased tax avoidance backed by tax havens in developing and developed countries that disturb the international tax arrangements are causing trade tensions.

The issue of evading taxes was aggravated with the increased digitalization and globalization of the world economy.

After intense negotiations with the 140 countries, OECD/G20 Inclusive Framework on BEPS, the Two-pillar strategy framework to address the tax challenges arising due to global digitization, was set in place to reform tax rules fundamentally, internationally.

The reform places mutually agreed limitations on tax competition, benefitting global revenue distribution of around USD 150 Billion.

Tax competition essentially means using tax cuts, loopholes, corporate tax reduction and subsidies etc., by countries to attract investment, employment and wealthy individuals. In this process, taxpayers (MNEs and corporate giants) move themselves or their businesses from high tax jurisdictions to low tax jurisdictions, called ‘Tax Havens’.

Tax havens are common tax jurisdictions that offer no or minimal tax liabilities and financial secrecy to international businesses to attract financial gains.

With the introduction of this tax deal, reforms are expected to reduce the emergence and significance of these tax havens. According to a report from OECD, pillar one of the two-tiered strategy would entail the relocation of taxing rights on profits of more than USD 125 billion to market jurisdictions every year.

Developing countries are expected to benefit more than the advanced economies in terms of revenue gains as the proportion of current revenues.

While Pillar Two introduces a 15% global minimum corporate tax rate internationally. Businesses with revenue estimations over EUR 750 million will be the main targets of the minimum tax rate and it is estimated to generate around USD 150 billion in additional global tax revenues annually.

Further benefits will also arise from stabilizing the international taxing infrastructure and increasing certainty for taxpayers and international administrations.

The baseline of the deal is that the countries would be allowed to keep any rate of corporate tax locally. Still, if a country pays a meagre tax rate in a specific country, their home/resident governments would have tos extract the difference in the rates to bring it up to the 15% minimum tax rate.

In a way, it creates a price floor for the international tax regime. Since having a tax floor would now mean that engaging with tax havens would be a futile activity, this reform is said to be a “once-in-a-century-ground-breaking deal”.

However, proceeding with this reform involves endorsement of the bill by the Finance ministers of the G20 by the end of this month and stabilizing the unsure forces in its implementation given the tight time frame.