Mumbai, Nov 11, the Indian rupee appreciated 62 paise to settle at 80.78 against the US dollar on Friday in hopes of the Federal Reserve reducing the pace of its rate hike after US CPI inflation eased for October.

The local currency had settled at 81.40 against the dollar on Thursday. The US consumer price index declined to 7.7 percent in October from 8.2 percent in September.

Investors now speculate that the Fed may reduce the pace of rate hikes in the coming months as inflation appears to be peaking at the moment. As a result, US and European stock markets have seen a rally, the dollar index has fallen, and oil and gold prices have risen, said a research report by Bank of Baroda.

A. Banerjee, V. President, Currency Derivatives & Interest Rate Derivatives, at Kotak Securities Ltd., said that US inflation probabilities led to a sharp rally in riskier assets and a plunge in the dollar index. The dollar index, which is an estimate of the greenback’s value against six major currencies – the euro, UK pound, Canadian dollar, Japanese yen, Swedish kronor, and Swiss franc – dropped to approximately 107.3.

In the next week, we may see further upside in the rupee against the USD. We predict a span of 80.00-81.10 on the spot, declared Banerjee.

In that week, the local currency increased further than 1% on the probability that the US Federal Reserve could hike interest rates by 50 basis points in December, to 75 basis points, IFA Global documented in a statement. The rise in points was against the earlier probability.

Before this month, the Fed raised its interest rate by 75 basis points to 3.75-4% for the fourth time in a row.

Individually, in the week halting November 4, the country’s foreign trade dropped by $ 1.08 B. to $ 529.994 B.

In the earlier week ended October 28, reserves had increased by $6.56 B to $531.08 B, a tremendous weekly profit in a distant year.

Concurrently, benchmark inventories Sensex and Nifty dropped over one percent today on vital widespread cues and a weak dollar.

The 30-share BSE Sensex settled at 61,795.04, up 1,181.34 points or 1.95 percent. The wider NSE Nifty also settled at 18,349.7, up 321.5 points or 1.78 percent.

Capital markets around the globe, both advanced and formulating, were glancing powerful as inflation data in the United States was even more adequate than predicted. This has practically decreased the ratio of a recession from more than 60% to 40% and the probability of a top standard rate from 5.25% to 5%. This is the initial energy of good news from the United States in an extended time and has also been instrumental in pushing investor beliefs, S. Bhansali, the CEO of Ambit Asset Management, has announced.

D. Jasani, head of retail research, announced that maximum Asian stock markets indicated a slightly less hawkish outlook for interest rates on Friday pursuing slighter than predicted US inflation data, while China alleviated some COVID-related regulations. The isolation saw enormous profits in the local markets. HDFC Securities.

Foreign institutional investors (FIIs) net purchased Rs 3,958.23 crore of stakes from the domestic equity market on Friday, the BSE’s interim data indicated.

What is the Consumer Price Index?

It calculates rate modifications from the

viewpoint of a marketable buyer. It is published by the National Statistical Office (NSO).

The CPI evaluates the distinction in the rate of products and duties such as food, medical care, education, electronics, etc, which Indian customers purchase for usage.

The CPI has numerous sub-groups comprising food and beverages, energy and light, residence and clothing, bedding, and footwear.

Four types of CPI are as follows:

- CPI for Industrial Workers (IW).

- CPI for Agricultural Labourer (AL).

- CPI for Rural Labourer (RL).

- CPI (Rural/Urban/Combined).

Of these, the initial three are assembled by the Labour Bureau in the Ministry of Labour and Employment. Fourth is collected by the NSO in the Ministry of Statistics and Programme Implementation.

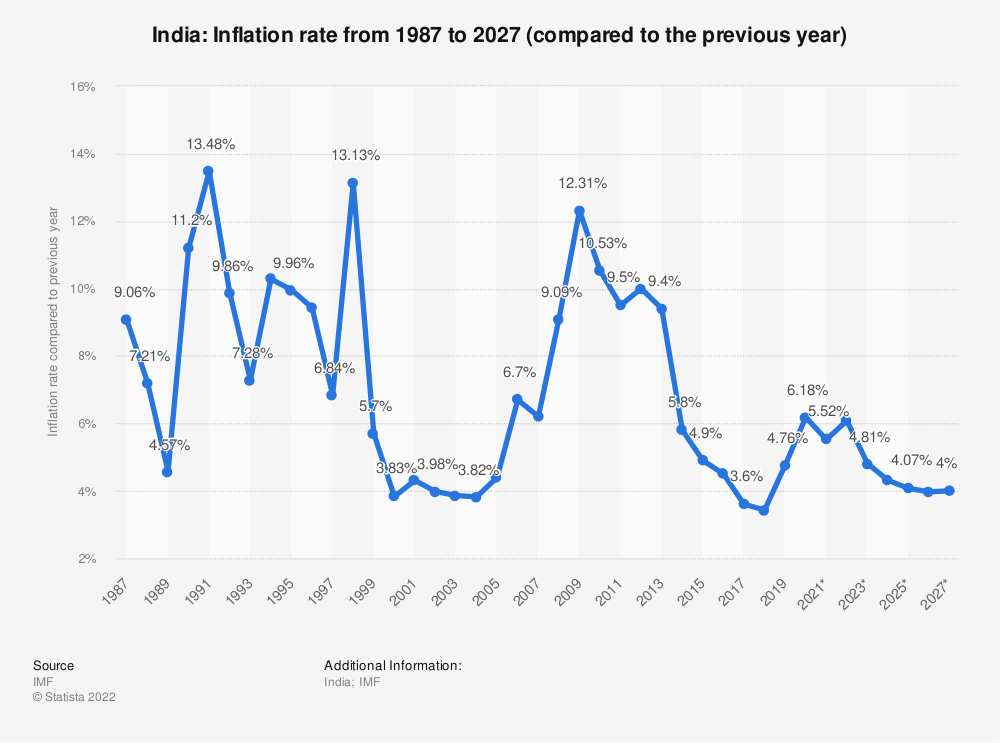

What is Inflation?

Inflation implies the surge in the rates of maximum goods and benefits of day-to-day or mutual use, such as food, clothing, residence, leisure, conveyance, customer staples, etc.

Inflation calculates the regular price modification in a basket of products and duties over the period.

Inflation is signifying the reduction in the purchasing strength of a unit of a nation’s currency.

This could eventually oversee a slowdown in financial advancement. However, a reasonable status of inflation is expected in the economy to assure that output is stimulated.

In India, inflation is mainly calculated by two major inventories – WPI & CPI which calculate wholesale and retail-level rate modifications, respectively.