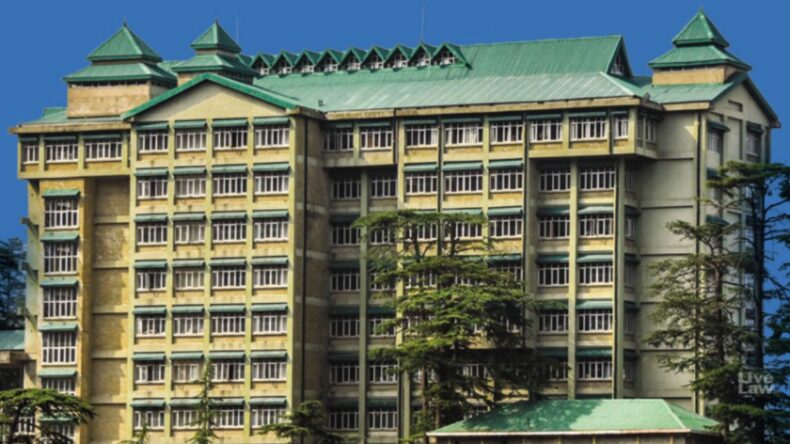

The recent decision by the Himachal Pradesh High Court to uphold the guidelines issued by the National Bank for Agriculture and Rural Development (NABARD) regarding the selection of auditors for Cooperative Banks has brought clarity and assurance to the banking sector. In a writ petition filed by Chartered Accountants registered with the Institute of Chartered Accountants of India, the court dismissed the challenge against NABARD’s guidelines, emphasizing the relevance and rationality of the conditions imposed. This article explores the significance of the court’s decision and the implications it holds for the Cooperative Banks and their stakeholders.

Validating the Guidelines

The High Court acknowledged its limited expertise in evaluating the validity of NABARD’s guidelines and determining the qualifications of auditors. It stated that the imposed conditions appeared reasonable, holding a rational connection to the responsibilities and duties associated with the role of auditors. The court recognized the importance of ensuring qualified auditors conduct thorough audits to protect the interests of depositors and prevent frequent failures of Cooperative Banks.

Purpose and Intent

The guidelines were primarily issued to address the recurring failures of Cooperative Banks and enhance their financial stability. By instructing the Registrar of Cooperative Societies to provide a panel of Chartered Accountants for statutory audits, NABARD aimed to strengthen the regulatory framework and introduce more stringent checks on banking operations. The court upheld the intention behind the guidelines, emphasizing the need to safeguard depositors’ interests and maintain the credibility of the banking system.

Factors for Selection

The guidelines included in NABARD’s letter outlined different criteria for choosing auditors. Experience, qualifications, and the requirement of Information System Audit (ISA) certification were among the key considerations. The court acknowledged the relevance of these factors in ensuring audit quality, especially in light of the growing use of information systems in banking operations. By demanding ISA certification, NABARD aimed to address the evolving challenges and risks associated with data management in the banking sector.

Addressing Concerns

The petitioners raised concerns about the alleged discrimination in the guidelines, favoring larger firms over sole proprietorships and smaller firms. They argued that certain conditions imposed by NABARD were unreasonable and not applicable to branch audits of Cooperative Banks. However, the court clarified that the guidelines did not lead to the exclusion of firms falling in the relevant categories. The categorization of Chartered Accountant firms was based on their qualifications and experience, ensuring a fair and balanced selection process.

Supporting Regulatory Provisions

The court emphasized that state legislatures have the authority, as per Article 243 ZM (1) of the Constitution, to make provisions for the maintenance and auditing of Cooperative Societies‘ accounts. NABARD’s guidelines aimed to assist the respective State Governments in identifying competent auditors for conducting statutory audits. By providing clear criteria and standards, the guidelines facilitated the selection process, ensuring transparency and accountability in the auditing procedures.

Conclusion

The Himachal Pradesh High Court’s decision to uphold NABARD’s guidelines for the selection of auditors for Cooperative Banks reinforces the importance of audit quality and regulatory compliance in the banking sector. The court recognized the need to prevent frequent bank failures and protect the interests of depositors. By setting reasonable conditions and emphasizing the significance of qualifications and experience, NABARD’s guidelines contribute to a more robust and reliable banking system. This decision serves as a precedent for other states, reaffirming the role of qualified auditors in ensuring financial stability and instilling confidence among stakeholders in the cooperative banking sector.