Do you want to take your investments up a notch?

Then unlock the potential of prop trading experts. They are professional investors who have expertise in high-risk, short-term trades. Their experience and knowledge can help accelerate your success with investing and give you an advantage on the stock market.

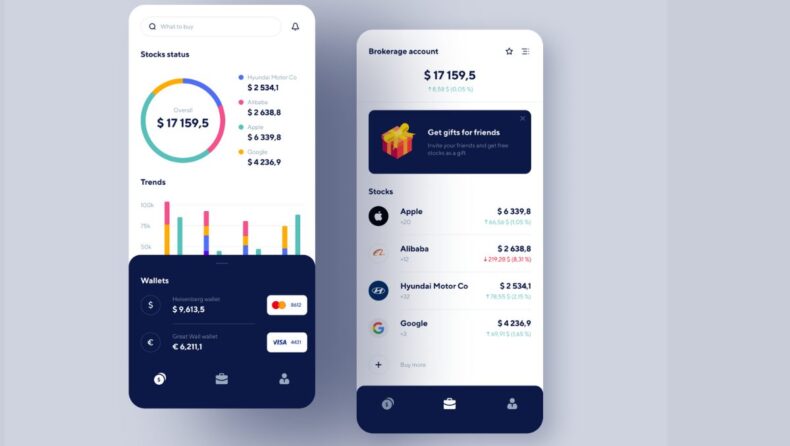

With Maven’s expert traders, you’ll get access to numerous strategies known for delivering exceptional returns. Even if you’re new or experienced with investing, learning to use prop trade pros will upgrade your portfolio performance and maximize profits. So get ready for what is sure to be an incredible journey into investing.

Understanding Proprietary Trading: An Overview

Prop trading, sometimes known as proprietary trading, is a form of stock market investing that involves taking various high-risk positions to make money. It usually requires putting hefty capital at stake to speculate on price movements and fluxes in different markets.

Prop trading firms help you leverage practices such as short selling, margin dealing and futures contracts. Trading can be rewarding if done right, but you must thoroughly understand the risks involved before diving into this type of investment.

The biggest upside of proprietary trading is that it gives investors much more control over their investments when compared to using outside advisors and brokers. This, in turn, reduces all those extra fees and commissions for external services –- something which can really add up if you’re investing a lot.

Prop traders also have access to plenty more information than your average investor, as they are able to quickly sift through market data and make sense of it faster than anyone else out there – giving them an edge on the competition. That’s why being well-informed about current affairs makes all the difference in today’s fast-paced financial markets.

How to Keep Track of Your Trades When You Have a Full-Time Job

The answer is simple: work with professional traders. These seasoned prop traders have the advantage of having specialized knowledge and experience in understanding potential price movements, trends and other market nuances that others may not be able to spot.

Moreover, they don’t require a third party like brokers or exchanges for order executions, giving them an edge when opportunities arise as they can act on it right away rather than requiring someone else’s approval first.

And most importantly, being involved with proprietary trading is highly rewarding if done correctly but carries higher risk levels than investing instruments such as mutual funds or exchange-traded funds (ETFs).

The Role of Maven Trading Professionals in Prop Trade

Maven trading professionals are an essential part of the success of prop trading. Prop trading stands for proprietary trading, meaning a financial transaction where traders or firms invest their own money rather than customers’ funds to make profits. These folks go by names like “prop traders” or “prop shops” and primarily manage stocks, futures as well as foreign exchange (forex).

How to Make Serious Money Trading

If you want to make it big in the prop trading game, you need certain skills. Technical analysis and risk management both play a key role here. Luckily for you, Maven Trading Professionals have just what you need to get you going — experience analyzing market trends and knowing when is the best time to initiate or exit trades.

Not only this, but they also know how to manage risks effectively so that any possible losses are minimized while gains can be maximized! This kind of knowledge really puts them ahead of the game and makes all the difference between success and failure.

Pros Understand the Best Trading Strategies

Maven Trading professionals have a deep understanding of different trading strategies that can help increase profits over time consistently across all trades the investor/trader enters into.

Strategies such as swing trading (buying low and selling high), scalping (entering and exiting quickly), or momentum investing (jumping on strong trends early) are just some tools in their arsenal.

By combining these techniques with fundamental analysis, mavens can help investors/traders take full advantage of market opportunities while managing risks so losses remain minimized even if one or two trades don’t turn out well at first.