Operators are in favor of introducing eSIM, while manufacturers anticipate that it will lead to pushing up the costs.

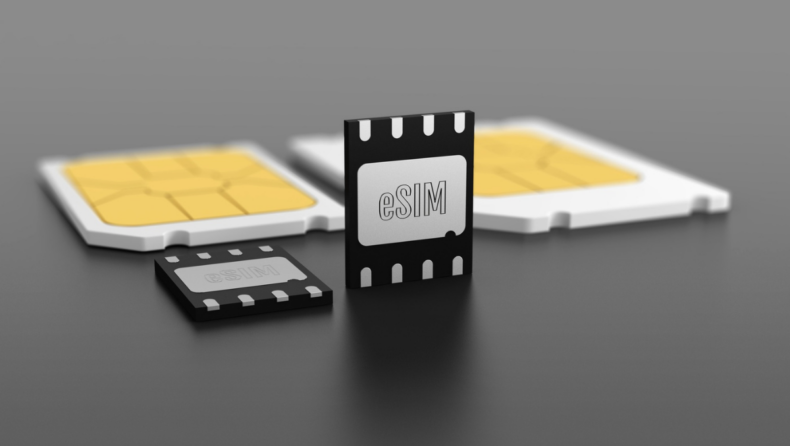

A SIM, also known as a subscriber identity module, is a removable plastic card that fits into your mobile phone. It lets you make and receive calls and texts, uses data on your phone, and holds information like your mobile number.

The ‘e’ in eSIM stands for embedded, and they are intended to replace traditional physical SIM cards. An eSIM is a tiny chip that is integrated into your cell phone and cannot be taken out and placed in another phone. The data on an eSIM is rewritable, which means you can switch networks without replacing your current SIM card.

As a result of a dispute between mobile operators and device manufacturers on e-SIMs, the Cellular Operators Association of India (COAI) has asked the DoT to require handset makers to introduce eSIMs, in addition to the physical SIM slot, in all smartphones costing over Rs 10,000. eSIM shortage

eSIM shortage

- The cause of the dispute is the unprecedented worldwide shortage of semiconductors, which has had a negative influence on the availability of SIM cards globally and caused the price to increase by four to five times. Before 2024, the situation is unlikely to become better.

- The Indian Cellular Electronics Association (ICEA) has flatly rejected the COAI’s suggestion. On August 10, it sent a letter to the Ministry of Electronics and Information Technology warning that such a move would increase costs due to additional hardware and the necessary product design adjustments.

- eSIMs are currently only available on expensive phones. Only about 1 percent to 2 percent of subscribers actually have them. The ICEA estimates that over 80 percent of the market’s volume is made up of phones that cost more than Rs 10,000.

- The ICEA contends that making the eSIM mandatory will drive several players to create new product designs specifically for the Indian market because other nations have not at all mandated such a move. This will increase the price of mid-range mobile devices, which make up 50 percent of the market and currently cost between Rs 10,000 and Rs 20,000.

Last but not least, the cost of a SIM is small, and even if it climbs by a factor of five, it will still be less expensive than integrating eSIM functionality into mobile devices, which will be extremely expensive due to design and implementation costs.

According to the ICEA, requiring the eSIM on all mobile devices will harm both the mobile industry’s expansion and the export aspirations of the device manufacturers.

Estimated duration of the shortage ( eSim )

Even the expected duration of this scarcity is under dispute between the two industry bodies. The ICEA believes that cell operators’ demands for mandated eSIMS are overly exaggerated and are solely motivated by the current shortage of semiconductors. The ICEA, which is less pessimistic, thinks that the shortfall will soon end and even go back to normal in 6 to 9 months.

According to the COAI, certain international telecom companies are aggravating the shortfall by purchasing and stockpiling SIM cards at extremely high prices and with 100 percent advance payments. The COAI’s conversations with SIM suppliers indicate that there is little chance that the supply issue would improve before 2024. The steep depreciation of the rupee hasn’t helped matters. The cost of SIMS has increased as a result.

Given that consumers and retail channels appear unaware of rising costs and dwindling supply lines, the COAI has been looking into ways to reduce eSIM waste. The association has been exploring alternative solutions to the current situation because of these factors.

The COAI claims that the introduction of eSIMS at the pricing point they suggested will eliminate a respectable number of physical SIMS. Additionally, it will lessen SIM waste brought on by mobile number portability without sacrificing the flexibility of portability.