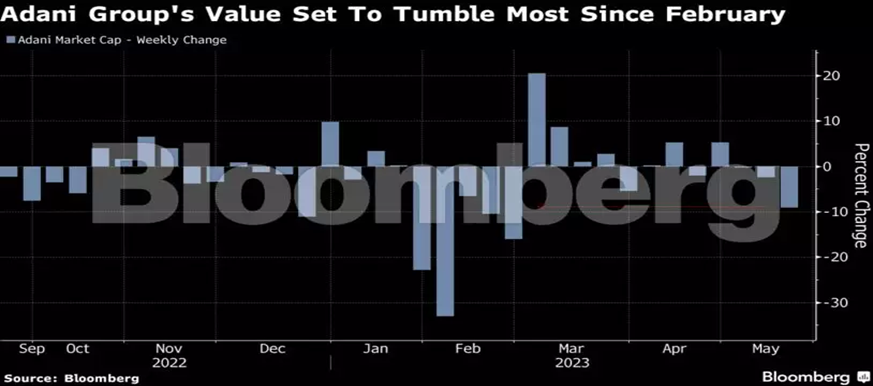

Adani group: A huge loss has been seen by the Adani group this week; a total of 10 billion dollars. The Adani Group’s valuations have decreased this week as a result of the removal of two of its entities, Adani Transmission Ltd. and Adani Total Gas Ltd., from the MSCI India index. According to an earlier prediction made by Brian Freitas, an independent equities analyst who writes for Smartkarma, this action is anticipated to cause passive funds to sell stock worth around $390 million. The group’s flagship, Adani Enterprises Ltd., is also anticipated to post a weekly loss of over 4%.

The market value of the Adani group fell to $107 billion this week, the lowest level since February. Concerns about stock dilution were raised last week when the company’s gearbox segment announced an intention to fund $2.6 billion through a qualified institutional placement.

Hindenburg’s Saga with Adani group

Allegations of fraud made by Hindenburg Research in January caused the group’s market worth to drop by almost $150 billion by the end of February. The losses were reduced during the last two months as early-March stock purchases by emerging market investor GQG Partners in four firms. Adani has refuted Hindenburg’s claims while taking action to allay investor worries about debt and corporate governance in the wake of the study.

SEBI Investigation on Adani group

Additionally, it was discovered during Sebi’s examination into the Adani vs. Hindenburg incident that certain organizations ended up benefitting from the severe decline in the value of the stocks of Gautam Adani’s firms.

Sebi is investigating the matter since Hindenburg’s report was out.

Supreme Court on Adani group

A panel appointed by the Supreme Court stated in its report, which was made public on Friday, that Sebi has also set up that some realities have taken short positions before the publication of the Hindenburg report and have served from squaring off their positions after the price crashed upon publication of the report.

The commission claimed it was unfit to offer any merit- grounded judgments since the matter was still being delved.

As a result, SEBI has applied itself to the data produced by similar surveillance, applying objective criteria, to consider whether the integrity of the natural price discovery process has been compromised.

Serve it to say, it would not be possible to return a finding of nonsupervisory failure on this count. The request capitalization of Adani equities significantly declined in value between January 24 and February 27 — in over Rs12.4 lakh crore. By March 9, this had farther declined to Rs 10 lakh crore.

The panel, which deduced its information from Sebi, estimated that retail investors in Adani equities lost around Rs 3,700 crore. The entire loss rises to Rs 22,000 crore when the value lost by other people, including HNIs, is included. At the end of this week.

Further more on Adani group

Adani TransmissionLtd.’s request capitalization fell by 9.4% to Rs 83,840 Cr.

Adani Gas Ltd. saw a decline of 13.8% by the closing of the week at a market capitalization of Rs 73,319Cr.

SEBI has been given until August 14 to finish its probe, per a Supreme Court order.The six-member panel, which was formed by the supreme court and includes Infosys co-founder Nandan Nilekani and banking industry veteran K V Kamath, contacted co-founders of Zerodha, AMFI, and JM Financial, as well as Nimesh Kampani.

Adani stocks increased by up to 4% on the release of the 178-page study, with Adani Transmission and Adani Power taking the lead. Adani Total Gas was the only stock in the 10-stock group catalog that was in the danger zone.