As per reports, the Adani group advocate has filed a plea against Hindenburg’s research founder in the Supreme Court. On Friday, their lawyer, ML Sharma, filed a public interest lawsuit on their behalf, claiming and seeking compensation for those who had invested in the firm.

The Adani enterprise is witnessing one of the worst financial crises in the history of business. The enterprise has lost more than $100 billion and recently announced its decision to withdraw a 20,000 crore follow-on public offer in a recorded video presented on Thursday.

Highlights

Adani profoundly explained the reason behind the same and said “will not be morally correct”, he added that “the interest of his investors was paramount.” The decision came right after the enterprise was labeled with various allegations made by Hindenburg Research.

The group decided to go ahead even after the collapse of group stocks. Subsequently, the stock price fell below the floor price of its initial public offering. The group described Hindenburg as the “Madoffs of Manhattan” and was fixated on the decision to go ahead with the FPO even after the offer price lost its necessity.

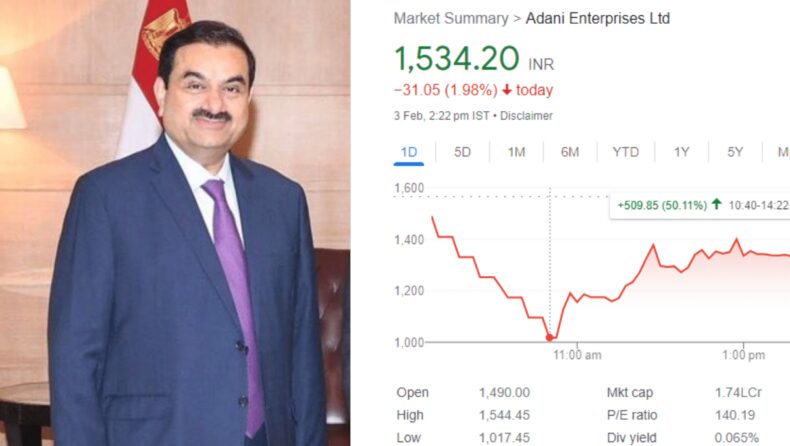

The enterprise’s stock collapsed 28% the next day. According to the report, some of the group’s dollar bonds have been pushed and are traded below 70 cents on a dollar. Reportedly the Reserve bank of India has asked banks for the details of their exposure to the company.

The crises that the group is facing at the moment are much bigger and deeper. Reportedly, market regulators have also begun examining any and every irregularity that led to such a grave situation.

The PIL sought a probe against the firm and its founder Nathan Anderson. They also sought action against Anderson for “defrauding innocent investors” of the company. Senior advocate Rajdeep Sardesai claims that “There are no Shell Companies. All companies are shown on a Balance sheet, nothing is hidden. Hindenburg itself is a shorting firm.” As of February 3, the group shares are up by 40% and they also went below Rs 1000 level.

Adani Enterprise Limited VS Hindenburg Research Report

Hindenburg Research, a forensic financial research firm, recently released a report disclosing that it holds a short position in the Adani companies through US-traded bonds. They have alleged that the group has used improper tax havens and have concerns regarding debt levels.

To the same effect, the group responded by calling the report “unsubstantiated speculations.” The report isn’t backed up with evidence and lacks transparency. The report was also surrounded by speculation because it was released two days before the FPO was open for subscription.

The regulators have launched a “full-scale” investigation into the shares of the company. The report also said that the company have substantial debt and is over-leveraged. They claimed that the group will face liquidity risks due to high short-term liabilities.

Adani group responded by mentioning that the leverage ratios of their company are healthy and will continue to be the same. They also added that they are in line with the industry benchmarks. This is a massive challenge for regulators and there is clearly a need for scrutiny and transparency.

Adani Dismisses allegations pertaining to his connection with PM Modi and his success as ‘completely baseless’ and ‘untrue’

Gautam Adani proposed that he become an “easy target” for such allegations because he and the prime minister are both from Gujarat. The multi-millionaire is amidst one of the most crucial financial crises of his company and has dismissed all claims regarding his connection with PM Modi.

He said in a TV interview that “These allegations are baseless. The fact of the matter is that my professional success is not because of any individual leader.”

India’s biggest conglomerates have lost more than $100 billion in the last six days. India’s biggest lender, SBI, said that its overall exposure to the Adani Group is at 0.88% of the book, or around Rs 27,000 crore. SBI has not given any loans against the shares of the company. They also mentioned that there has not been any refinance request that has arisen from the group’s side.

Additionally, the MPs in both houses have demanded an investigation into the allegation of fraud against the group under the supervision of the Supreme court. Congress president Mallikarjun Kharge said, “All the parties together, we have taken a stand that this wastage of LIC’s money and of money taken as loan from SBI and possibly many other such financial institutions where the hard-earned money of the common ban has been deposited, by investigated either by a joint parliamentary committee or a probe under the Supreme Court with day-to-day updates.”