Author: Anushka Joshi

The Reserve Bank of India (RBI) yesterday raised key interest rates by 90 basis points, to 4.90 percent. August 3-5 is the next MPC meeting According to a report by a global information service provider, S&P Global Market Intelligence, it is anticipated that the Reserve Bank of India (RBI) will raise the repo rate by 35 basis points at its upcoming monetary policy meeting. This will be done in accordance with the prevalent trend of tightening monetary policy in an effort to reduce the rate of inflation. This is the sixth consecutive month that India’s retail inflation has been higher…

In FY22, India got 27.01 percent of its FDI inflows from Singapore, which was followed by 17.94 percent of its FDI inflows from the United States. According to the data that was provided by the Ministry, Singapore has risen to the position of the most important source for FDI, contributing 27.01%, followed by the United States, which contributed 17.94%. The Netherlands, Switzerland, and Mauritius come in third, fourth, and fifth place, respectively, behind the top two countries in terms of their contribution percentages, which are 15.98%, 7.86%, and 7.31%, respectively. According to the UNCTAD World Investment Report (WIR) 2022, India…

After 2.5 years, Franklin Templeton Mutual Fund launches a new program. They announced the Franklin India Balanced Advantage Fund (FIBAF) on Tuesday. Franklin Templeton Mutual Fund (FT MF) will introduce a balanced advantage mutual fund. The fund company has got Sebi’s clearance to create a balanced advantage fund. This is the asset manager’s first new plan since a regulatory issue in April 2020, when it decided to shut six of its debt schemes. “We believe in increasing assets by producing results. Nevertheless, this is a substantial area in which we do not participate. Franklin Templeton’s managing director and chief investment…

EU eases sanctions on Russian oil export so that Rosneft and Gazprom, which are owned by the Russian government, can ship oil to third countries. According to a statement released by the EU Council on Thursday, the EU will make it possible for Russian state-owned firms to engage in the necessary transactions to sell oil to EU nations. According to the statement, “the EU decided to extend the exemption from the prohibition to engage in transactions with certain state-owned companies regarding transactions for agricultural products and the transport of oil to third countries to avoid any potential negative consequences for food…

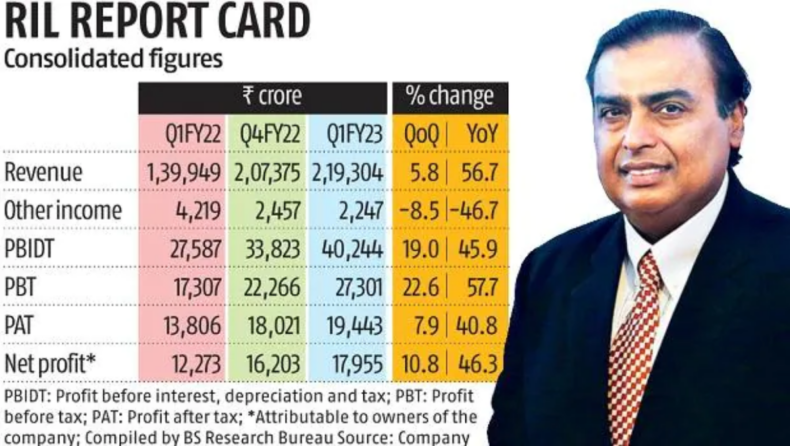

Strong refining margins boosted Reliance Industries’ leading oil-to-chemicals business, which led to a 46.3% increase in the company’s earnings for the June quarter. Reliance Industries Ltd. of India announced a 46.3% increase in quarterly profit on Friday. The company’s leading oil-to-chemicals business was supported by healthy refining margins owing to the intake of cheaper Russian crude and fuel exports, which led to the increase. The Mukesh Ambani-led company said that its consolidated profit increased to 179.55 billion rupees ($2.25 billion) in the three months that ended on June 30, as opposed to 122.73 billion rupees in the same period of…

Reserve Bank of India (RBI) Has Zero Tolerance for Rupee fluctuations. India’s central bank has zero tolerance for volatile and bumpy rupee fluctuations and will continue to interact with the forex market, its governor said on Friday. Governor of the Reserve Bank of India Shaktikanta Das said on Friday that the rupee is doing pretty well in comparison to the currencies of emerging market counterparts and developed economies. Das said that the Reserve Bank of India (RBI) has zero tolerance for volatility and erratic movement of the rupee and that central bank interventions have aided in smoother movement days after the…

Wipro’s share fell more than 2% Thursday morning. Brokers expect a 106% gain or 5% loss for Wipro shares. Wipro had its lowest Ebit margin since September 2018. The Wipro’s share price dipped almost 2 percent intraday on Thursday after the company’s first-quarter earnings fell short of market expectations. On BSE, Wipro shares closed at Rs 414.10 per share, up 0.5%. The information technology (IT) giant’s consolidated net profit decreased by 20.94 percent year-over-year to Rs 2,563.6 crore for the quarter ending June 2022, compared to Rs 3,242.6 crore for the same quarter in the previous fiscal year. The sequential…

Benchmark BSE Sensex rose 630 points and Nifty closed over 16,500 on Wednesday amid strong global market trends. On Wednesday, the benchmark BSE Sensex increased by roughly 630 points. The Nifty finished above 16,500 due to advances in IT and energy amid favourable global market trends. FII inflows and purchases of index heavyweights Reliance Industries, Infosys, and Tata Consultancy Services boosted investor optimism. As a result of the government’s reduction of the windfall tax on gasoline, diesel, jet fuel, and crude oil, shares of companies involved in oil exploration and refinings, such as Reliance Industries and ONGC, were in high…

A government statement said India dropped the windfall tax on diesel and aviation fuel exports by 2 rupees per liter. In response to lower oil prices, the government repealed a windfall tax on gasoline exports. Also reduced taxes on diesel, ATF, and locally produced crude oil. The export tax on diesel and jet fuel (ATF) has been reduced by Rs 2 per litre to Rs 11 and Rs 4, respectively. Additionally, the tax on domestically produced oil was reduced from Rs 23,250 per tonne to Rs 17,000 per tonne, which would help the state-owned Oil and Natural Gas Corporation (ONGC)…

Total Annual Premium Equivalent (APE) for HDFC Life Insurance reached Rs 1,904 crore, gaining 22% from Rs 1,561 crore in the same quarter last year. The standalone net profit for HDFC Life Insurance Company increased by 20.82 percent to Rs 365.29 crore in the first quarter of the fiscal year 2024 compared to Rs 302.35 crore in the first quarter of the fiscal year 2022. The life insurer’s net premium income increased by 22.99% year-over-year to Rs 9271.87 crore in the first quarter of the fiscal year’23 compared to Rs 7538.48 crore in the same period a year before. The entire amount…

Contact us:

Copyright © 2024 Asiana Times. All Rights Reserved