Author: Chahat Saini

I am a commerce student pursuing B.Com (Hons.) from Shri ram college of commerce.

Last month, YES Bank agreed to sell a bad loan portfolio worth Rs 48,000 crore ($5.9 billion) to JC Flowers’ ARC, a move Prashant Kumar claims will assist the bank’s profitability.YES Bank, which nearly went bankrupt due to bad loans two years ago, is now looking to buy stressed assets from other lenders. Through retail banking and asset management services, it provides a wide range of unique solutions for corporate and retail consumers. [8] The Reserve Bank of India (RBI) took control of the bank on March 5 in an effort to prevent its collapse due to an overwhelming volume…

On Friday, the RBI is likely to sell dollars through state-run banks after the rupee fell below 82 to a historic low versus the dollar due to concerns about the US Federal Reserve’s rate outlook. The Reserve Bank of India is expected to sell dollars through state-run banks on Friday after the rupee fell below 82 to a historic low versus the dollar on concerns about the Federal Reserve’s rate outlook in the United States, dealers told Reuters. The rupee was recently trading at 82.2675, down from 81.88 the previous day but still higher than the session low of 82.33. …

The Swiss challenge auction sparked by NARCL’s Rs 3,570 crore offer for the Rs 9,234 crore debt held by nine public sector lenders has allowed it to match the winning bid and take over. Next month, state-owned financial institutions that provided loans to Jaypee Infratech will be able to recover their funds. According to the Economic Times, however, 24,000 homeowners, holders of fixed deposits, and private lenders will have to wait until the bankruptcy court approves the winning bidder’s resolution plan. This is because the government-sponsored National Asset Reconstruction Company (NARCL) has promised only to acquire loans held by public…

HDFC Bank was established in Mumbai, Maharashtra, India, in 1994 as a Housing Development Finance Corporation subsidiary. Manmohan Singh, the Union Finance Minister at the time, opened the company’s first corporate office and full-service branch at Sandoz House, Worli. On Tuesday, the private HDFC Bank reported that loans increased by 23.5% to Rs 14.80 trillion in the second quarter of this fiscal year. The private HDFC Bank said on Tuesday that loans increased by 23.5% in the second quarter of this fiscal year to Rs 14.80 lakh crore. As of September 30 of last year, the credit book stood at…

India’s central bank is the Reserve Bank of India (RBI), which was established on April 1, 1935, under the Reserve Bank of India Act. The Reserve Bank of India is in charge of regulating the currency and credit systems of India and uses monetary policy to maintain financial stability there. The RBI’s primary mission is to oversee the entire Indian financial sector, which includes commercial banks, other financial institutions, and non-banking finance companies. Restructuring bank inspections, implementing off-site surveillance of banks and financial institutions, and expanding auditors’ responsibilities are just a few of the RBI’s initiatives. India’s monetary policy is…

Retail inflation is expected to be under control at 5.2% in the upcoming fiscal year, which begins in April. This is a decrease from the current year’s 6.7% that the RBI predicted. According to a report from the RBI, persistently high inflation remains a key policy concern for the Reserve Bank, which has raised rates aggressively thus far this year. However, the pressure may ease next fiscal year assuming normal rainfall and further normalization of global supply chains without any external shocks. The rate of change in the prices of particular goods and services over time is known as inflation…

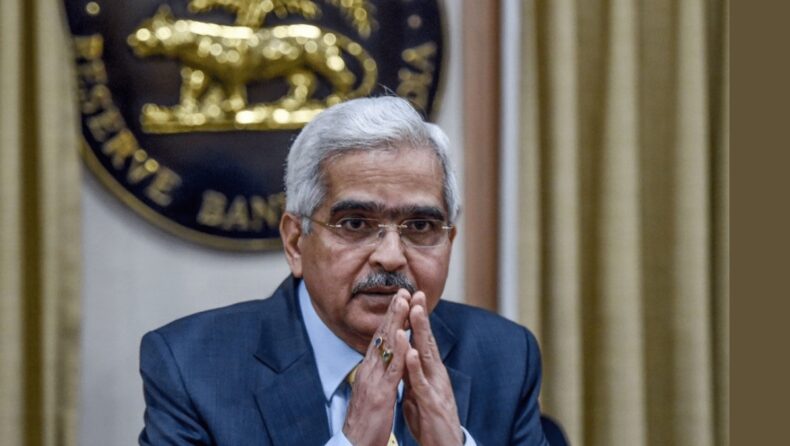

On Friday, Governor Shaktikanta Das of the Reserve Bank of India stated that, despite market uncertainty, the central bank’s forex reserve umbrella has maintained its strength. He said that the RBI has been constantly evaluating the current and changing circumstances when it has intervened in the forex market. The governor stated that valuation adjustments brought about by a stronger US dollar and higher bond yields in the United States account for approximately 67% of the decline in reserves that occurred during the fiscal year that began on April 1st. On a balance of payments (BOP) basis, the governor stated that…

The Reserve Bank of India (RBI) is India’s central bank and statutory body. It is in charge of printing currency notes and serving as custodian for other primary banks. In April 1934, the Hilton-Yong Commission, also known as the Royal Commission on Indian currency and finance, recommended that the RBI be established. The establishment of the RBI was primarily motivated by the desire to provide additional banking services and separate the government’s control of the currency. The RBI governor, who is appointed by the central government of India, is in charge of directing the institution’s operations and is the RBI’s…

Sberbank and JSC VTB, two Russian banks, have been granted permission by the RBI to open Vostro accounts for rupee trade. Continue reading to learn more about the differences between a Vostro account and a Nostro account. Two Russian banks, Sberbank and JSC VTB have been granted permission by the Reserve Bank of India (RBI) to open specialized Vostro accounts for rupee trade. The approval came months after the rules for rupee trade were announced by the Indian central bank. UCO Bank also received RBI approval to open Vostro accounts with Russia’s Gazprom at the beginning of September. How does…

The RBI provides numerous services to the financial market from its Mumbai location. The overnight interbank lending rate is set by the bank. In India, interest rate-related financial instruments are measured by the Mumbai Interbank Offer Rate (MIBOR). The RBI’s primary mission is to oversee the entire Indian financial sector, which includes commercial banks, other financial institutions, and non-banking finance companies. Restructuring bank inspections, implementing off-site surveillance of banks and financial institutions, and expanding auditors’ responsibilities are just a few of the RBI’s initiatives. India’s monetary policy is first and foremost the RBI’s responsibility. The management of the bank wants…

Contact us:

Copyright © 2024 Asiana Times. All Rights Reserved