Author: Nidhi Yadav

Dedicated individual currently pursuing BA.LLB.(Hons) at Reva University, Bangalore, passionate about research and writing.

Hindutva activist Yati Narsinghanand recently received a contempt notice from the Supreme Court of India for allegedly making derogatory comments regarding the court and the Indian Constitution in a widely circulated interview. The warning is in response to a petition that was submitted by activist Shachi Nelli, who demanded that Narsinghanand be punished for his disparaging remarks. Background In a letter to the Attorney General of India in January 2022, activist Shachi Nelli requested permission to bring legal action for contempt against Yati Narsinghanand Saraswati, commonly known as Deepak Tyagi. The ‘Dharam Sansad’ hate speech case in Haridwar involved controversial…

In its long-awaited decision on the 1996 Lajpat Nagar bombing case, the Supreme Court of India confirmed the conviction of the two accused and sentenced them to life in jail without the possibility of parole. The convictions of two other former death row inmates who had been released by the Delhi High Court were also reinstated, and they received life sentences that will last for the remainder of their natural lives. This verdict concludes a lawsuit that has been lingering for more than ten years. A bench of Justices BR Gavai, Vikram Nath, and Sanjay Karol rendered the ruling after…

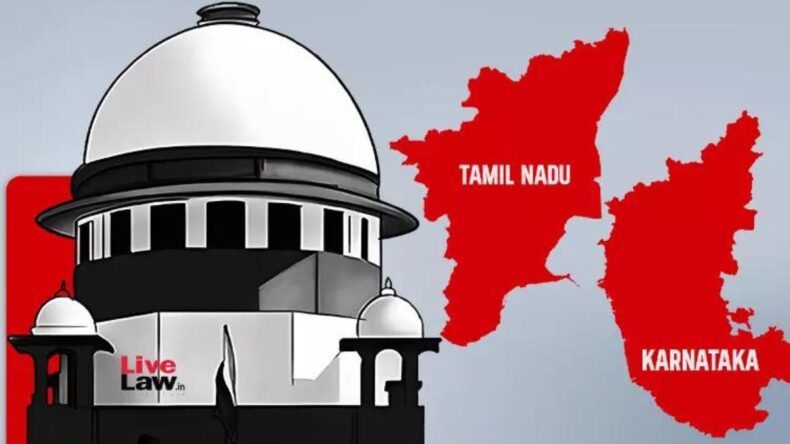

The long-running water dispute over the Penniyar River between the states of Tamil Nadu and Karnataka had a significant development today. The Supreme Court Bench, composed of Justice AS Bopanna and Justice MM Sundresh, recused themselves from hearing the plea filed by the Tamil Nadu Government. The judges cited their regional affiliations as the reason for their recusal, highlighting the sensitivity and complexity of the issue at hand. Background of the Penniyar River Dispute The Penniyar River, also known as the Ponnaiyar River, originates in the state of Karnataka and flows through Tamil Nadu before finally emptying into the Bay…

The hearing in a series of appeals brought by the Enforcement Directorate against the Madras High Court’s rulings has once more been postponed by the Supreme Court of India. In response to a habeas corpus case filed challenging the detention of Tamil Nadu minister V Senthil Balaji in connection with the state’s cash-for-jobs scheme, appeals were made. The high court’s two-judge panel’s dilivered a split verdict on whether the legislator’s arrest constituted unconstitutional detention led to this ruling by the apex court. Supreme Court Requests Expedited Decision The Supreme Court’s division bench, comprising, Justices Surya Kant and Dipankar Datta, declined…

The Delhi High Court has recently asked the Union Public Service Commission (UPSC) to present its preliminary objections regarding a plea filed by several civil services aspirants. The petition challenges the decision of UPSC to publish the answer key of the prelims examination for the Civil Services Examination 2024 only after the declaration of the final result. This article explores the details of the case and the arguments put forth by both parties. Background of the Case On June 12, the UPSC released a press note regarding the declaration of results for the Civil Services Examination 2024. The press note…

To tackle the growing issue of fake GST registration and fraudulent practices, the Central Board of Indirect Taxes and Customs (CBIC) in India has proposed the implementation of biometric authentication and geo-tagging for risky entities under the Goods and Services Tax (GST) system. With over 12,000 bogus entities identified across the country, the CBIC aims to curb these fraudulent activities and protect the exchequer. The Rising Cases of Fake GST Registration The misuse of PAN and Aadhaar details of individuals has led to a surge in fraudulent cases of GST registration. To address this alarming trend, CBIC Chief Vivek Johri…

In a landmark decision, the United States Supreme Court ruled that race-based affirmative action in college admissions is unconstitutional. The court declared the race-conscious admission policies at Harvard University and the University of North Carolina as violations of the Equal Protection Clause of the Fourteenth Amendment to the US Constitution. This decision has significant implications for college admissions and the pursuit of diversity on campuses across the country. Challenging Race-Based Admissions Policies The ruling came in response to an appeal filed by a group called ‘Students for Fair Admissions (SFFA)’, which argued that the race-based admission programs at Harvard and…

In a recent judgment, the Delhi High Court ruled that advocates’ offices run from residential buildings should not be subject to property tax as “business buildings.” The court held that lawyers’ professional activities cannot be considered commercial activities, and therefore, they should not be taxed under the Delhi Municipal Corporation Act. This decision came in response to an appeal filed by the South Delhi Municipal Corporation (SDMC) against a single judge’s ruling, which held that advocates’ services are professional activities and should not be classified or taxed as business establishments. Legal Background Justice Najmi Waziri and Justice Sudhir Kumar Jain,…

In a recent ruling, The Bombay High Court exempted foreign institutional investors (FII) in Singapore from capital gains tax. The court observed that the Singapore authorities have certified that the capital gains income would be taxed in Singapore, regardless of the amount remitted or received in the country. Background of the Case In this instance, the Securities and Exchange Board of India (SEBI) had an assessee who was registered as a FII in the debt category. During the financial year 2010-2011 assessment, the assessee filed its income tax return, declaring a total income of Rs. 33,99,75,350. The assessee claimed a…

In a recent ruling, the Gujarat High Court quashed an assessment order issued by the income tax authorities without granting the petitioner an adequate opportunity to be heard. The court found that the show cause notice cum draft assessment order was issued with an unreasonably short deadline, leaving the petitioner less than 12 hours to respond. This article examines the details of the case and the court’s decision, highlighting the importance of natural justice in assessment proceedings. Background of the Case Dineshkumar Chhaganbhai Nandani is the central figure in the case. In July 2014, he submitted his income tax return…

Contact us:

Copyright © 2024 Asiana Times. All Rights Reserved