Author: Saket Singh

Saket Singh is a person with a diverse range of interests and hobbies. As an INFJ, he has a natural inclination towards understanding human behavior, which is reflected in his enjoyment of business, economics, finance, and psychology. Along with pursuing his passion for learning, he also likes to unwind through his hobbies such as cooking, cycling, and reading. This combination of intellectual curiosity and creative expression makes Saket Singh a well-rounded individual with a balanced approach to life.

OpenAI CEO Sam Altman Denies Training GPT-5

Gangster-turned-politician Atiq Ahmad and his brother Ashraf were murdered inside a medical college in Uttar Pradesh, India, where they were being taken for a medical examination. The attackers disguised themselves as media personnel and were later apprehended by police, revealing that they wanted to eliminate the brothers to make a name for themselves. The incident has highlighted the need for stringent laws and a crackdown on the nexus between politicians and criminals in Indian politics. The news of the murder of gangster-turned-politician Atiq Ahmad and his brother Ashraf has sent shockwaves across India. The murder took place on Saturday inside…

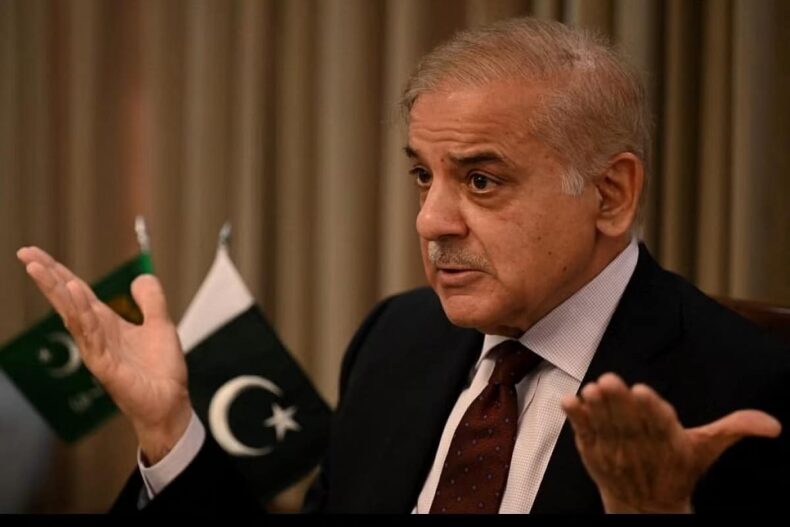

Pakistan has received financial support from the UAE and China totaling $1.3 billion to boost its ailing economy, meet the conditions for an International Monetary Fund bailout, and alleviate its acute balance of payments crisis. Pakistan has received a much-needed financial boost from the United Arab Emirates (UAE) and China, totaling $1.3 billion. The funds come as Pakistan seeks to meet the conditions for the resumption of an International Monetary Fund (IMF) bailout.Pakistan’s foreign exchange reserves, which are currently at a critically low level of $4.04 billion and can cover only four weeks of imports, received a boost from the…

Pakistan may face disruptive effects if it defaults on the repayment of a whopping $77.5 billion external debt from April 2024 to June 2026, warns a US think tank, United States Institute of Peace (USIP). According to the United States Institute of Peace (USIP), Pakistan is confronted with a formidable task of servicing its external debt of USD 77.5 billion between April 2024 and June 2026. This debt amounts to a “hefty amount” for a USD 350 billion economy, and the country may face “disruptive effects” if it defaults, said the report. The government is tackling major economic crises, including…

The labor market in the United States is gradually cooling off, but remains robust, with a high number of job openings despite a rebalancing that may help contain inflation, as the Federal Reserve aims to slow hiring by raising interest rates. The labor market in the United States is gradually cooling off, as the latest government data shows the number of available job openings dropped to 9.9 million in February, down from 10.6 million on the last day of January. Despite the number of unemployed workers, there are still more job vacancies available. The decline in open positions reflects a…

India’s net direct tax collections for 2022-23 increased by 17.63% to Rs 16.61 lakh crore, surpassing the revised estimate of Rs 16.5 lakh crore, with corporate tax collections at Rs 10,04,118 crore, up 16.91% YoY, and provisional gross personal income tax collection at Rs 9,60,764 crore, up 24.23% from last year. Net direct tax collections in India rose by 17.63% to Rs 16.61 lakh crore in 2022-23, exceeding Revised Estimates of Rs 16.5 lakh crore, as per the finance ministry. The provisional gross collection of direct taxes stood at Rs 19.68 lakh crore, a 20.33% increase over FY 2021-22. In…

The US stock market had a volatile week, impacted by the Federal Reserve’s interest rate decision and pressure on the banking sector, but ended on a positive note with stocks bouncing back from earlier losses. On Friday, the US stock market ended the week in positive territory, after a turbulent week that saw early losses due to the Federal Reserve’s interest rate decision and continued pressure on the banking sector. The Federal Reserve increased rates by 25 basis points on Wednesday, earlier this week, setting the range for the fed funds rate at 4.75%-5%, the highest since October 2007. Furthermore,…

Accusing the payments company led by Jack Dorsey of overstating its user counts and understating its customer acquisition costs, Hindenburg Research stated on Thursday that it held short positions in Block Inc. Jack Dorsey, co-founder of Block Inc., experienced a significant decline in his net worth following the release of Hindenburg Research’s latest report. On Thursday, Hindenburg Research revealed that it had short positions in Block Inc. which accused the payments company of ignoring widespread fraud. An investigation conducted over two years found that Block has been exploiting the demographic it purports to help, with a significant percentage of the…

Despite the ongoing challenges posed by the pandemic, geopolitical issues, inflation, and banking crisis, there is a positive news for India. An in-depth analysis of the budgets of the 17 largest states, which together account for nearly 90% of the country’s GDP, has indicated that nine of these states are projecting growth rates that surpass the national forecast of 10.5% for the 2024-24 fiscal year. These nine states have estimated an average nominal GDP growth rate of 14% for FY24, which is significantly higher than the country’s projected growth rate. The states that have projected higher GDP growth rates for…

The economic slowdown has caused anxiety among people, especially those who are struggling to support themselves due to rising prices and limited job opportunities. Businesses are also suffering, leading to job losses and reduced economic activity. Policymakers and economists are monitoring the situation and working on solutions to prevent further damage to the global economy. All eyes are fixated on America as the global economy grapples with a multitude of issues. The current scenario has been worsened by the rise in inflation, the Ukraine-Russia war, and the COVID-19 pandemic. Recently, two banking failures in the US have further raised concerns…

Contact us:

online@asianatimes.com

Copyright © 2024 Asiana Times. All Rights Reserved