According to 13 of the 27 analysts polled by Bloomberg as of Wednesday, the Reserve Bank of India’s six-member financial policy panel would increase the repurchase rate by 50 basis points to 5.40, a level last reached in August 2019.

Highlights –

- The Indian central bank is anticipated to announce another half-point increase in its benchmark interest rate.

- The central bank increased the benchmark interest rate by 90 basis points, including a half-point increase in June.

- To prevent the INR from coming under more academic pressure, the RBI should monitor interest rate differences with the US.

On Friday, the Indian central bank is expected to announce another half-point rise in its benchmark interest rate to sign that it is continuing to battle affectation and defend the rupee from new threats.

Bloomberg polled 27 experts, and as of Wednesday, 13 predicted that the Reserve Bank of India’s six-member financial policy panel will raise the repurchase rate by 50 basis points to 5.40, a level last reached in August 2019.

One predicted a 40 base-point change, nine predicted 35 base points and the last forecast predicted a quarter-point increase, which is sufficient to bring borrowing prices back to early 2020 levels before the pandemic.

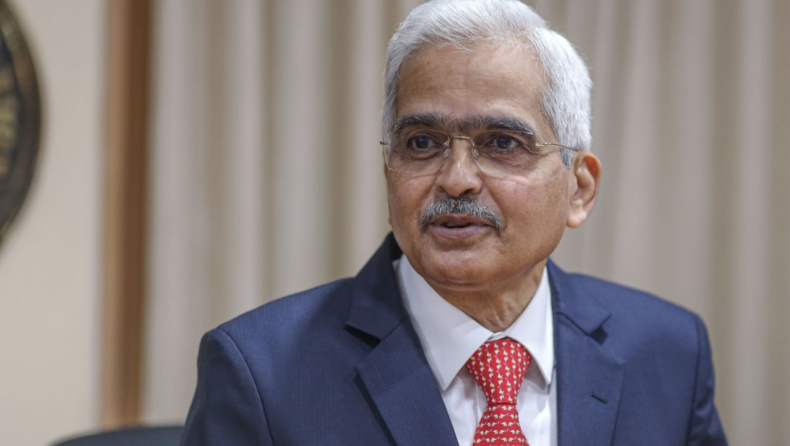

RBI watchers will closely follow Governor Shaktikanta Das’s reflections for any indication of the pace and duration of the financial tightening cycle as he seeks to ensure a “soft wharf” for thriftiness.

Since May, the central bank has raised the key rate by 90 basis points, including a half-point rise in June.

The target for the RBI

Although affectation has remained over the RBI’s target ceiling of 6 since the morning of the time, declining commodity prices may offer the central bank some latitude to indicate that pressures are reducing.

Pankaj Pathak, a fixed-income fund director at Quantum Asset Management Co., says, ” We anticipate the RBI’s statement to soften a little with a recognition that affectation problems are fading.”

According to Radhika Rao, an older economist at DBS Bank Ltd., affectation may have peaked in India.

Along with a hawkish central bank, stable to declining commodity prices are also expected to benefit inflationary prospects, she added.

Bank Hike Path

Economists believe that the peak policy rate—often referred to as the terminal rate—will be achieved sooner than expected in the cycle if the central bank is hesitant to raise interest rates.

According to analyst Abheek Barua of HDFC Bank Ltd., “The RBI is predicted to continue with ‘front-lading’ of its rate rises at the impending policy.”

From a previous projection of mid-2023, Barclays Plc anticipates the policy rate climbing to 5.50 by September.

According to India-based economist Rahul Bajoria, this will signal that the rate has reached a neutral point, where they may assist control affectation without limiting profitable growth. He maintained his protuberance at 5.75 throughout the final rate.

Standard 10-year bonds are extending the rise as we approach the policy review, limiting their first yearly gain this time in July.

From a three-time high of 7.6 in June, yields have decreased by roughly 40 basis points.

Rupee, Liquidity

The rupee has fallen to many lows in recent months, even reaching 80 to the bone in July, but it has since recovered as signs of a resumption of foreign money inflows have emerged.

Prasanna Ananthasubramanian, the chief economist at ICICI Securities Primary Dealership Ltd., stated in a note that the RBI should keep an eye on interest rate differentials with the US to prevent any build-up of academic pressures on the INR.

Additionally, guarantees from the RBI about the availability of sufficient liquidity and its readiness to take action in response to any instances of miserliness would be requested.

Read More – Cryptocurrency to be Authorized as a Digital Commodity – Asiana Times