Digital copying is prevented by Blockchain technology. A cluster of computers governs the technology without a centralised authority. Data is open and transparent because it is shared.

Blockchain ledgers are the foundation of Cryptocurrencies like as Bitcoin, Ethereum, and Facebook’s LIBRA. Some solutions enable individuals and organisations to create legally enforceable “smart contracts,” allowing for precise supply chain network monitoring as well as remote voting and elections.

What exactly is the Central Bank Digital Currency (CBDC)?

It is a digital money backed by a country’s central bank. The CDBC, like the Central Bank’s currency notes, is legal tender and accepted for payment of various transactions within a country.

Second, unlike cryptocurrencies, the CBDC is backed by the Central Bank, giving it more stability and less volatility.

It is referred to as “programmable money.” The Central Bank may authorise the use of CBDC for specific users, such as individuals or financial institutions. If CBDC is made available to the public, it is referred to as “Retail CBDC.” So, just as people use currency for day-to-day transactions, they would be able to utilise CBDC as well.

Finally, the CBDC, like cryptocurrencies, operates on Blockchain technology, so every transaction—the amount, accounts involved, the purpose, and so on—is recorded.

CBDC has the following advantages:

The Subhash Chandra Garg Committee (2019) has recommended a ban on private cryptocurrencies on account of

concerns such as volatility, instability, security risk and risk of funding illegal activities. However, the committee has

highlighted that an official digital currency can have number of advantages such as

• Promotes cashless society.

• Increase in Financial Inclusion

• Increase in effectiveness of Monetary Policy

• Push to development of Fintech sector

• Provide a real time picture of economic activity and hence better GDP estimates and efficient

monetary policy formulation.

• Traceability of transactions would crack down on corruption and money laundering.

• Counter the monopoly of private sector issued cryptocurrencies.

Issuance of CBDC in India

The Committee to study issues related to Virtual Currencies (2019) headed by Subhash Chandra Garg has

recommended that we need to have an open mind regarding the introduction of an official digital currency in India. It

recommended that, if required, a Committee may be setup to examine and develop an appropriate model of digital

currency in India. If such a digital currency is issued, RBI should be the regulator.

The Draft National Blockchain Strategy tabled by the National Institute for Smart Governance has also called for India to develop a Central Bank Digital Rupee.

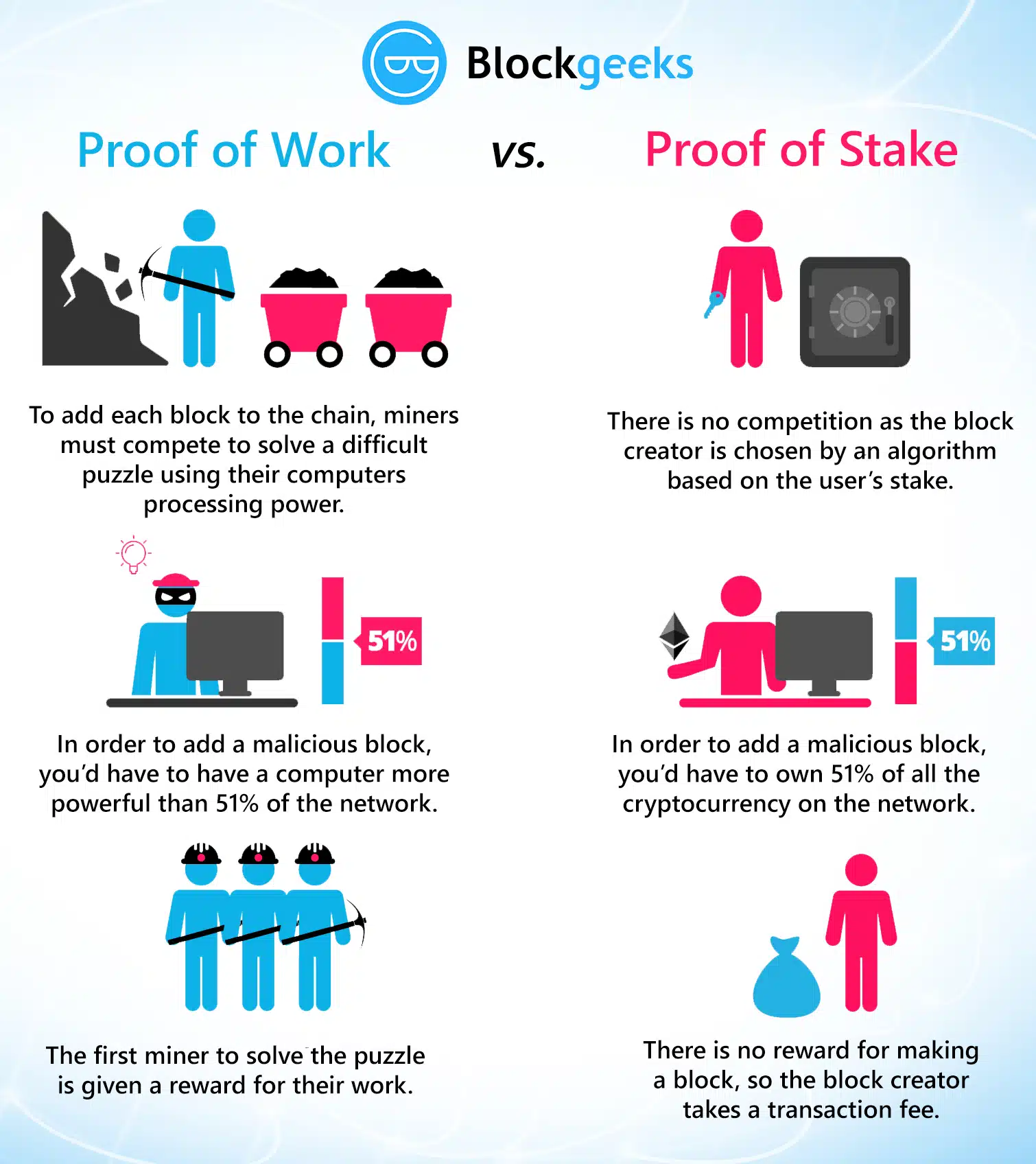

‘Proof of work’ to a ‘Proof-of-Stake’

The Merge is the name given to the complete transformation of the Ethereum blockchain platform from ‘proof of work’ to a ‘proof-of-stake’ consensus mechanism.

Work Demonstration: As a decentralised platform, Ethereum does not have organisations such as banks approving transactions that occur on its network; before, approvals occurred via the Proof of Work (PoW) consensus process.

High Energy Consumption: These mining farms were energy guzzlers, consuming more electricity than entire countries at times, and were thus a major problem in terms of environmental sustainability.

The total annualised power usage of the cryptocurrency is approximately equal to that of Finland, while its carbon footprint is comparable to that of Switzerland.

For a period, European governments considered a crypto mining ban, while China conducted a statewide crackdown on crypto miners, driving them overseas.

Proof of Stake is a new method that would eliminate the need for crypto miners and massive mining farms, which had previously powered the blockchain through a mechanism known as ‘proof-of-work’ (PoW). Instead, it now uses a ‘proof-of-stake’ (PoS) method that selects ‘validators’ at random to approve transactions in exchange for a modest payment.

Validators are individuals who donate a computer to keep the blockchain’s integrity by regularly computing the linkage from the first to the last block.

Benefits:

- This would completely eliminate the need for Ethereum network miners.

- It will save roughly 99.95% of Ethereum’s energy consumption.

- It will make Ethereum network transactions extremely safe.