Introduction Of Blockchain Technology

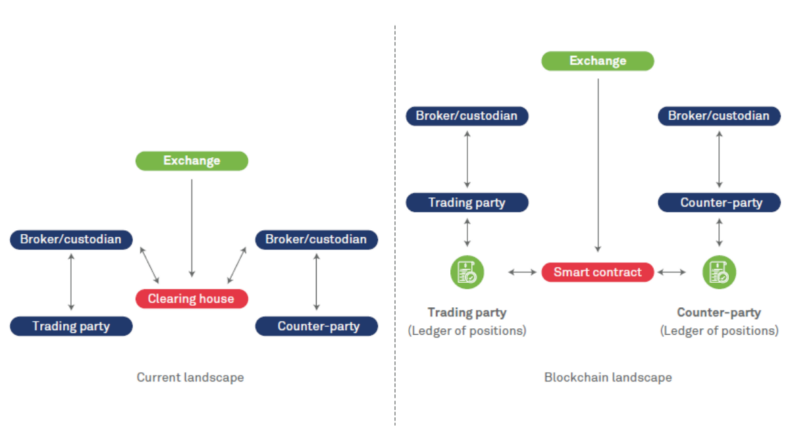

Blockchain technology has the potential to address challenges of interoperability, trust, and transparency in fragmented market systems.

Participants in the stock market, such as traders, brokers, regulators, and stock exchanges, are needed to go through a lengthy procedure (which typically takes three to five days to complete transactions, owing to the involvement of intermediaries, operational trade clearing, and regulatory processes).

Through automation and decentralization, blockchain technology has the potential to significantly improve the efficiency of stock markets.

Blockchain Technology has the potential to significantly lower the enormous fees imposed on clients in terms of commissions while also speeding up the procedure for quick transaction settlements.

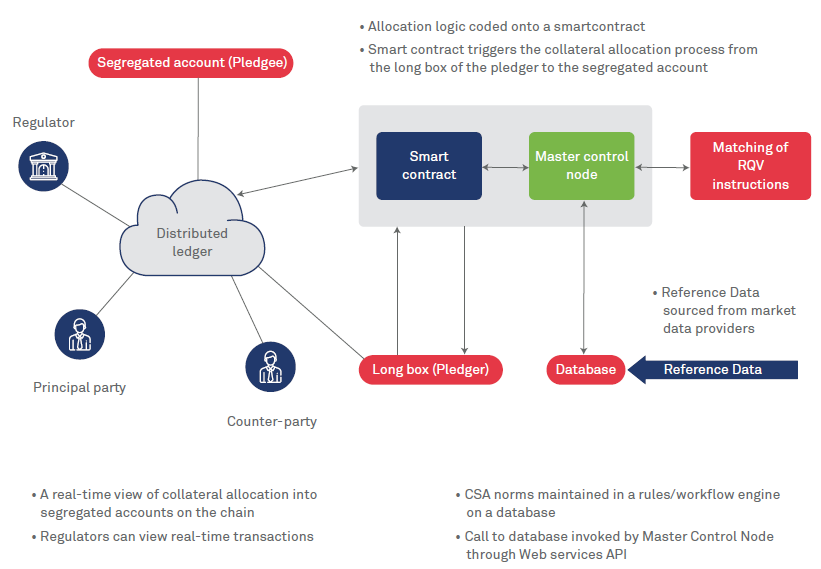

Clearing and settlement are feasible applications for the technology, as is safely automating the post-trade process, facilitating transaction documentation, and legal ownership transfer of the security.

Blockchain technology can largely eliminate the need for a third-party regulator, since rules and regulations would be included in smart contracts and enforced with each trade to record transactions, with the blockchain network functioning as a regulator for all transactions.

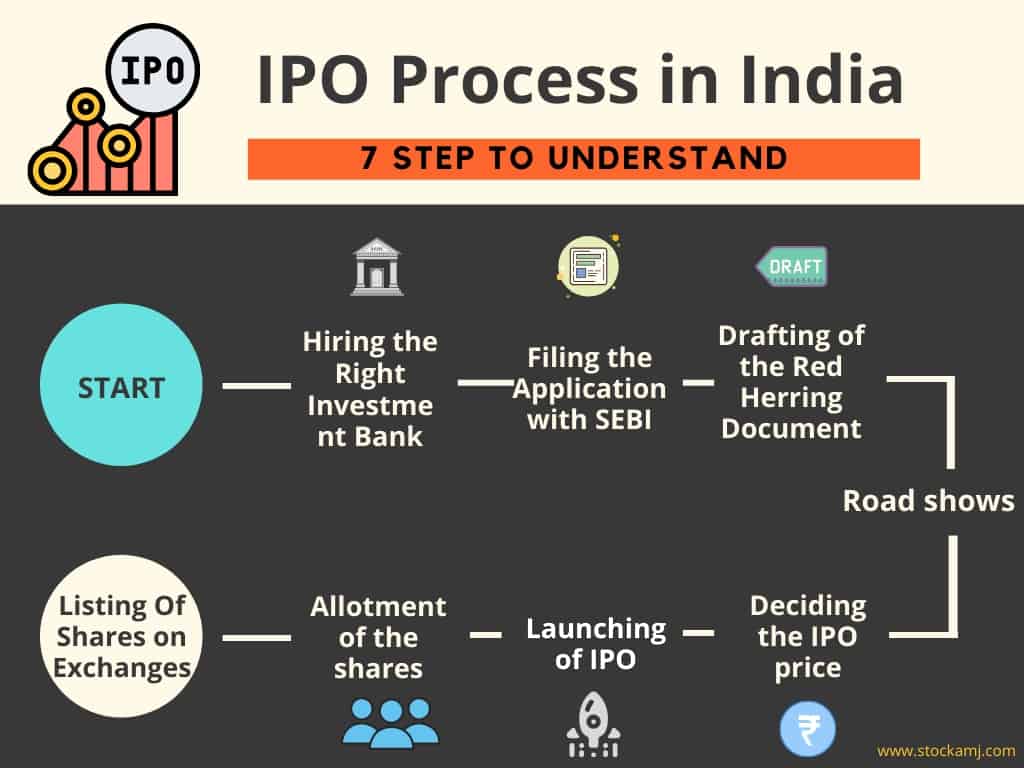

The IPO Process

The public equity offering process has seen several modifications and technical advances over the last few decades, including the growth of intermediaries, financial market innovation, and computerized bookkeeping.

Despite these advancements, the foundations of public equity markets – namely, why corporations choose to do an initial public offering (IPO) and the transaction terms (issuance of shares in exchange for money) – have remained constant.

Today, businesses continue to generate money through the public sale of equity shares, referred to as registered securities. Prospective investors are legally required to receive information about the IPO in the form of a prospectus.

Numerous information asymmetries, on the other hand, have an effect on the present IPO process. Extensive recordkeeping requirements have necessitated internal and external reconciliations, which might result in increased issuance costs.

While underwriting banks in an initial public offering typically utilize computerized bookkeeping, they rely largely on direct interactions with investors, market soundings, and other physical orders.

The procedure necessitates the involvement of a variety of players and intermediaries to ensure that all stages go well and that the firm obtains the best terms possible.

Difficulties inherent In The Present IPO Procedure

- Multiple versions of ‘truth’ exist in the network of issuers, syndicate members, and investors, necessitating a lengthy reconciliation procedure amongst participating systems.

- Inadequate transparency and the use of expensive intermediaries: the existing issuance procedure is opaque owing to the use of intermediaries such as banks and custodians for settlement processing and security custody. In other instances, the procedure might get confusing due to practical considerations such as time differences and varying business hours.

- Given the manual nature of the securities issue process, the existing system has limited audit trails. This results in a minimal to non-existent electronic audit trace of the transaction’s actions.

- In some markets, there is potential counterparty risk because to the lengthy settlement cycle, which leaves the risk open on both sides of the counterparty until the settlement cycle is successfully completed.

- When an individual is required to pay the purchase price of a financial instrument in advance yet gets the security with a time delay, there is a high risk of settlement.

- In today’s financial industry, manual asset servicing is provided by custodians who manage accounts for large institutions. For example, each asset servicing corporate action requires custodians to manage interactions between participants and to ensure that the client’s account is debited or credited appropriately. Any modification to security must be cascaded through all levels of custody (stockbroker, sell-side bank, local custodian, foreign custodian, etc.), which can add to the execution and continuing asset servicing delays and costs.

Blockchain Technology Applications In Public Equity Markets

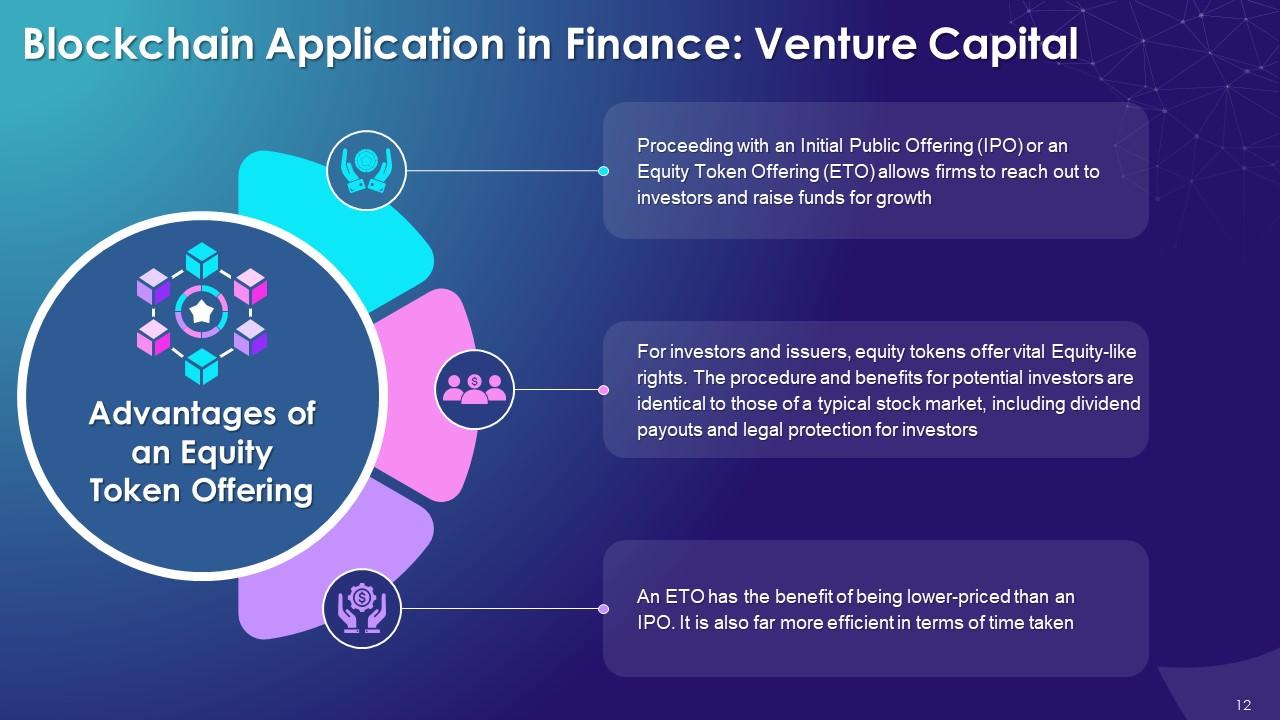

Theoretically, blockchain technology might be used at different phases of the initial public offering (IPO) process.

In principle, blockchain technology might eliminate the need for physical documents and enable the creation of a fully digitalized initial public offering (IPO) on the blockchain.

The potential feasibility of incorporating blockchain technology into the initial public offering (IPO) process:

- The issuer represents the asset’s origins digitally through the creation of a new ‘tokenized’ asset.

- Digital signatures are used to authenticate all blockchain participants.

- On the blockchain platform, the lead manager and syndicate members now have a single view of the master book.

- The master book comprises orders or bids from potential investors specifying the amount and price of shares.

- Tokens would be used by the fund manager to manage the investor’s holdings, which are recorded on the fund ledger.

- If the issuance takes place entirely on blockchain, custodians and banks might function as custodians of tokens represented on a blockchain platform, transferring security/money to beneficiary accounts corresponding to the tokens represented on the platform.

- Money transfers would be facilitated through the use of tokens with buy and sell capabilities.

- Investors’ accounts are credited with digital securities, which take the place of traditional notes and certificates.

- Smart contracts might be used to trigger mandatory corporate events and payouts. These are corporate-initiated events that affect all shareholders.

- Dividends, coupon payments, interest, stock splits, mergers, recapitalizations, and bonus issues, among other things, will be classified as required corporate events and disbursements.

- In principle, reporting connected to the issuing process could be accessed via a comprehensive electronic audit trail that provided total transparency to all parties involved.

- In principle, regulators could audit live data directly on the permission ledger and validate the platform’s transaction history and information.

Conclusion

This application needs additional effort to be practical, especially to suit today’s equities markets’ security, system operations (time), and volume requirements.

However, research shows that adding blockchain to any of these processes has no discernable impact on the pros and cons of an IPO.

Simply said, this is a tokenized version of an IPO with many of the same features as today.

A digital IPO tackles some of the conventional IPO process’s flaws, such as information asymmetry, counterparty risk, high settlement risk, lack of transparency and reliance on expensive intermediaries, lack of audit trail, and manual asset servicing.

In addition to higher transaction security and less likelihood of manipulation, this new blockchain technology may create difficult legal and regulatory challenges that authorities are still attempting to fathom.

Currently, the financial industry ecosystem is skeptical about blockchain technology’s ability to deliver on its promises, notably in capital markets.

The use of blockchain technology also raises questions about maintaining security standards across a decentralized database, legal and regulatory compliance, and scalability.

The current legal and regulatory frameworks separate trading, clearing, and settlement. It is still a long way to go.

Published By: Simran Mulani

Edit By: Khushi Thakur