The Rise of Chiplets: China’s Strategic Embrace of Cost-Efficient Chip Packaging

Table of Contents

Chinese startup Chipuller has acquired chipset technology from a struggling Silicon Valley company, zGlue, just over a year after zGlue sold its patents. This technology, which allows the packaging of small semiconductors into a powerful integrated unit, has gained prominence in China’s tech strategy over the past two years, according to an analysis by Reuters.

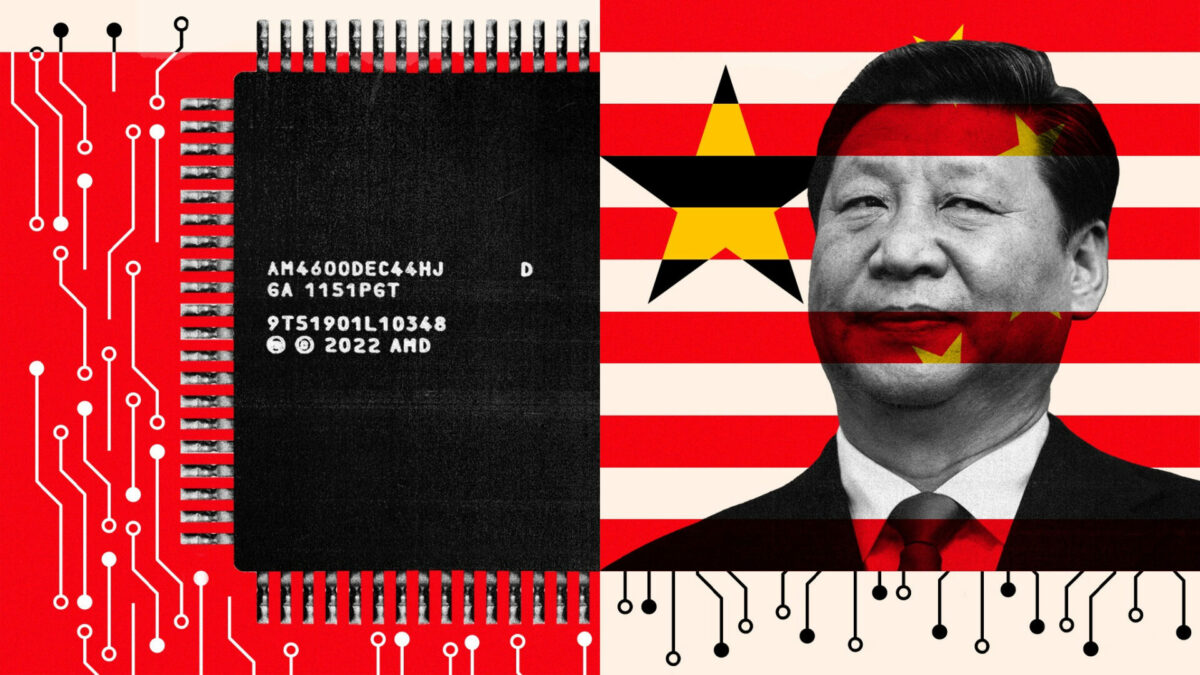

China’s increasing focus on chipset technology comes as it faces restrictions on accessing advanced machinery and materials for producing cutting-edge chips, which has prompted the country to pursue self-reliance in semiconductor manufacturing. Chiplet technology is now considered a critical component in China’s plans to bridge the gap with global leaders in the chip industry, including the United States, Japan, South Korea, and Taiwan.

Chairman Yang Meng of Chipuller emphasized the importance of chipset technology in China’s quest for competitiveness, stating that it puts the country on an equal footing with its global counterparts. While China has traditionally lagged in certain chip technologies, the development and adoption of chipsets have become a strategic priority, as evident in over 20 policy documents from local and central governments highlighting the technology as a key part of China’s drive to enhance capabilities in “key and cutting-edge technologies.”

The significance of chipsets for China becomes even more pronounced due to restrictions on wafer fabrication equipment. By leveraging chipset technology, China can circumvent these limitations and explore alternative approaches like 3D stacking to achieve its semiconductor manufacturing goals. This grand strategy has the potential to level the playing field and foster innovation within China’s semiconductor industry.

China is rapidly harnessing the potential of chipsets across various domains, including artificial intelligence and self-driving cars. Notably, companies such as Huawei Technologies and military institutions are actively exploring the application of chipset technology. Moreover, there are indications of further significant investments in this area, as evident from corporate announcements.

China’s embrace of chipset technology represents a pivotal shift in its semiconductor manufacturing strategy. By strategically investing in and developing chipset capabilities, China aims to overcome restrictions and establish itself as a global leader in the chip industry, paving the way for technological advancements in diverse fields such as AI and autonomous vehicles.

China’s Growing Edge in Chiplet Technology

The global chip industry has increasingly turned to chipsets—small chips that can be as tiny as a grain of sand or larger than a thumbnail—bringing them together through advanced packaging techniques. This technology allows for the creation of more powerful systems without the need to further reduce transistor size, as multiple chips can function collectively as a unified entity. Notably, prominent tech players like Apple, Intel, and AMD have already adopted chipset technology in their high-end computer lines and more powerful chips.

According to Dongguan Securities, China possesses a substantial portion, estimated at around 25%, of the global chip packaging and testing market. While this provides China with an advantage in leveraging chipset technology, Yang Meng, Chairman of Chipuller, cautioned that the proportion of China’s packaging industry classified as advanced is relatively small.

One distinctive advantage China possesses is the ability to swiftly complete personalized chipsets tailored to specific customer requirements. Yang highlighted that under favourable conditions, China can accomplish this feat in as little as three to four months, offering a unique edge in the industry. Import data from China’s customs agency reveals a substantial surge in the country’s acquisition of chip packaging equipment, reaching $3.3 billion in 2021 compared to the previous peak of $1.7 billion in 2018. However, due to the chip market downturn, the figure dropped to $2.3 billion in the subsequent year.

Since early 2021, research papers on chipsets have emerged from the Chinese military’s People’s Liberation Army, universities under its purview, as well as state-run and PLA-affiliated laboratories. This indicates a growing interest in utilizing domestically produced chipsets for military and defence applications. Furthermore, government documents unveil substantial grants awarded to researchers specializing in chipset technology. Additionally, a multitude of smaller companies has emerged throughout China in recent years to cater to the domestic demand for advanced packaging solutions, including chipsets.

China’s rising prominence in chipset technology showcases the nation’s commitment to enhancing its semiconductor industry. By capitalizing on chipsets and their potential applications, China aims to solidify its position as a key player in the global chip market and foster domestic innovation in advanced packaging solutions.

Chipuller’s Patent Acquisition and China’s Chiplet Advancements Amid U.S.-China Tensions

Chinese company Chipuller has made headlines with its acquisition of 28 patents from zGlue, a Silicon Valley startup. The patents, either owned by zGlue or developed by individuals named on zGlue’s patents, were purchased through a two-step transfer process involving North Sea Investment Co Ltd, registered in the British Virgin Islands. This transaction comes at a time of heightened U.S.-China tensions, prompting scrutiny regarding potential threats to U.S. security.

The involvement of the Committee on Foreign Investment in the United States (CFIUS), a Treasury-led committee responsible for reviewing transactions, is yet to be confirmed. While lawyers specializing in CFIUS affairs state that patent sales alone may not fall under CFIUS authority, it ultimately depends on whether the assets acquired constitute a U.S. business. Representative Mike Gallagher, leading a select committee on China, has called for CFIUS reform, emphasizing the need to prevent China from taking advantage of distressed U.S. companies to transfer intellectual property (IP) to Chinese entities.

Chipuller’s Chairman, Yang Meng, stated that zGlue’s lawyer had engaged with both CFIUS and the Department of Commerce to ensure compliance with export controls during the sale to the North Sea. Discussions did not include Chipuller or the possibility of Chinese ownership of the patents. Yang maintains that all transactions were transparent and followed U.S. law. He considers himself a founder of zGlue, having become an investor in the company shortly after its establishment in 2015 and later serving as a director and chairman.

Chipuller is not the only company actively involved in chipset technology. Huawei, despite being on the U.S.’s restricted list, has been actively filing chipset patents. Anaqua’s director of analytics solutions, Shayne Phillips, revealed that Huawei published over 900 chipset-related patent applications and grants in China last year, a significant increase from 30 in 2017. Other Chinese firms, including TongFu Microelectronics, JCET Group, and Beijing ESWIN Technology Group, have also made substantial investments in chipset technology, with announcements of new factories and expansions in the past two years amounting to over 40 billion yuan.

China’s Ministry of Industry and Information Technology (MIIT) has shown support for domestic packaging companies and the use of chipset technology to strengthen China’s self-sufficiency in computing power. While MIIT did not respond to requests for comment, Chipuller’s Chairman Yang views chipset technology as the driving force behind the development of China’s semiconductor industry. He asserts that it is the company’s mission and duty to bring chipset technology back to China.

Chipuller’s patent acquisition and China’s growing focus on chipset technology reflect the nation’s determination to enhance its semiconductor industry amidst U.S.-China tensions. As Chinese companies invest heavily in chipset-related initiatives, the landscape of the global chip industry is undergoing significant transformations.