HCL Tech stock jumped a day after the business released profits after the market closed. HCL Tech said its consolidated net profit for the September quarter climbed 7.05 per cent year on year to Rs 3,489 crore on October 12.

HCL Technologies Ltd. has been awarded by the market for its exceptional quarter 2 the fiscal year 2024 financial performance. In early trading on Thursday, the company’s shares surged roughly 3.5% on the NSE.

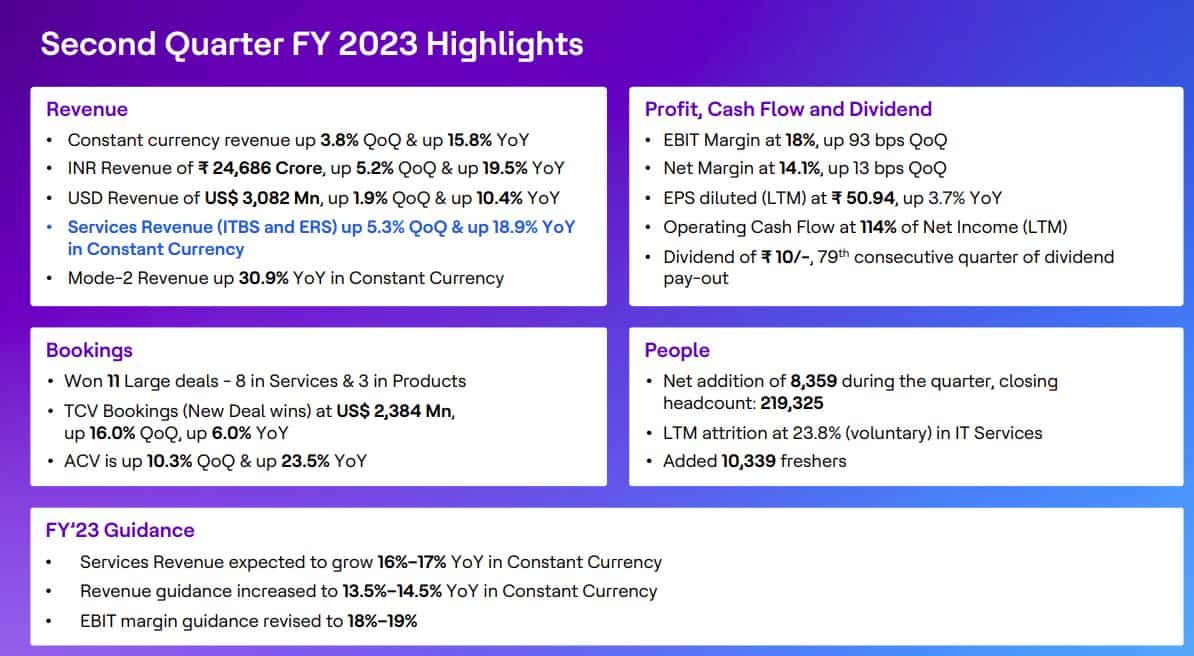

Revenue from activities increased by 19.5 per cent to Rs 24,686 crore. Revenue increased by 5.2 per cent sequentially, while profit increased by 6.27 per cent.

Located in Noida, Uttar Pradesh, HCLTech is a global Indian IT services and consulting company that was once known as Hindustan Computers Limited. It belongs to HCL Enterprise’s division. When HCL entered the software services industry in 1991, a portion of its research and development division that had previously been a separate entity became an independent company. The company has offices in 52 countries and around 210,966 employees.

The company’s 3.8% sequential gain in constant currency revenue, driven by its IT Services segment, was a noteworthy takeaway for investors. In addition, HCL has increased its fiscal year 2024 constant currency sales growth estimate to 13.5-14.5% from 12-14% before.

Despite the impact of pay increases, the company’s operating margin for the July-September quarter was 18%, up 100 basis points over the previous quarter. According to the company, higher utilisation, pricing improvements, currency tailwinds, and an improved staff pyramid drove margin rise.

HCLTech’s chief financial officer, Prateek Aggarwal, stated that margin growth was driven by stronger client realisation, both from existing renewals, renegotiations, and new deals negotiated in the recent year.

However, due to existing cost pressures, India’s third-largest software services provider by sales reduced its operating margin projection for the fiscal year 2024 to 18-19% from 18-20%.

The acceleration of deals signed in the last 12 months is a key factor behind the company’s updated revenue growth guidance. Analysts estimate a 2.6-3.8% compound quarterly growth rate in the second half of the year.

According to Kotak Institutional Equities analysts, the hurdle rate for reaching the higher end of the guidance band is significant. Nonetheless, HCLT’s growth in services will be the strongest among tier-1 IT and in the top quartile on a consolidated basis. Kotak’s research reported that they ascribe the robust resurgence in growth to the payback from investments in applications and digital competencies over the last four years.

The company reported a new deal total contract value (TCV) of $2.38 billion, up from $2.05 billion in the previous quarter. During the quarter, it recorded 11 significant transactions.

According to the corporation, the TCV includes one major contract with a customer it added to its portfolio through a past acquisition.

According to the company’s concentration on new vista sites, personnel in those regions will rise 10% faster than in traditional locations.

In terms of talent supply, there has been a reduction in demand. As a result, the company won’t see the same kind of pressure in compensation talks, as per Sundararajan, referring to margin pressure caused by high salary costs.

Meanwhile, the corporation announced the appointment of Rahul Singh as its chief operating officer – corporate functions. He has been promoted from the position of president of global financial services.

Sundararajan was promoted to chief people officer from his prior positions as HR head-Americas and global GTM HR leader.

VV Apparao, the company’s chief human resources officer, has been promoted to the chief delivery officer for the nearshore business.

Earlier HCL Technologies, the third-largest provider of IT services in India, changed its brand name to HCLTech.

The go-to-market strategy for HCLTech will be based on its distinctive brand and logo, which stands for a range of services and goods that accelerate digital transformation for businesses on a large scale.