IKIO Lighting Ltd., a company that specializes in LED lighting solutions, will begin accepting subscriptions for its initial public offering (IPO) on June 6.

The firm is a producer of light-emitting diode (LED) lighting solutions, with a primary emphasis on creating LED products that are both environmentally friendly and low in energy consumption.

Its primary focus is as an Original Design Manufacturer (ODM), and its product range includes, among other things, LED lighting, lights for refrigeration, ABS pipe, and other items. The initial public offering (IPO) of IKIO Lighting has a value of more than 607 crore, which places a value of around 2,200 crores on the firm.

IKIO Lighting’s initial public offering is scheduled to begin trading on June 6; the price range has been established at 270-285 yen per share. The following is a list of the top ten facts you should know about the IKIO Lighting IPO:

1. The dates for the bids are June 6 through June 8

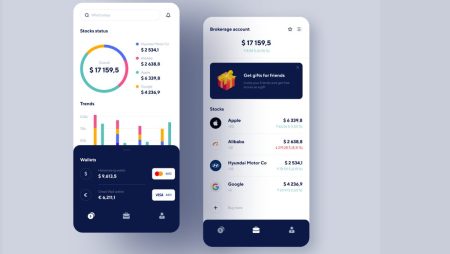

2. The pricing range for the first offering would be 270 to 285 yen per share

3. The size of the issue: The initial public offering (IPO) of IKIO Lighting will have a total issue size valued at 607 crore rupees. This will be comprised of new issuance of equity shares valued at up to 350 crore rupees and an offer-for-sale (OFS) of up to 90 lakh equity shares by the company’s proprietors.

4. Lot Size The minimum investment amount for individual investors is 14,820 since the lot size for the IKIO Lighting IPO is 52 shares and the lot size is 52 shares. Up to 13 lots are up for bidding for retail investors.

5. Basis of allocation On June 13, the basis of allotment of IPO shares will be determined, and on June 14, the process of initiating refunds will begin. On June 15, the first public offering shares will be credited to the demat accounts of qualified investors.

6. The day when IKIO Lighting shares will be listed on the BSE and NSE markets is the sixteenth of June.

7. The goal of the offering is to raise capital for the firm, which will use the money to pay off existing debt, make an investment in its wholly-owned subsidiary IKIO Solutions, and cover other general business expenses.

8. Kfin Technologies is the issue’s registrant, and IKIO Lighting’s initial public offering is being handled by them.

9. Book-running lead managers: Motilal Oswal Investment Advisors is the only book-running lead manager for the initial public offering (IPO) of IKIO Lighting.

IKIO Lighting IPO grey market premium (GMP) today is 50 per share. 10. IKIO Lighting IPO grey market premium (GMP) today. The IKIO Lighting IPO GMP on June 2 has stayed the same as the GMP on June 1, which indicates that there has been no change. On the 31st of May, the GMP was 20.

According to the GMP from June 2 of 50 and taking into consideration the upper price range of 285, the anticipated listing price for IKIO Lighting shares will be 335 per share.

Various other specifics

Hardeep Singh and Surmeet Kaur, who are the promoters of IKIO Lighting, are planning to sell up to 90 lakh shares in the OFS. During the initial public offering (IPO), the business has set aside 35% of the shares for the category of retail investors, 15% for the category of non-institutional investors, and 50% for the category of qualified institutional buyers (QIB).

IKIO Lighting has four production sites, one of which can be found at the SIDCUL Haridwar industrial park in Uttarakhand, while the other three can be found in Noida, which is located in the National Capital Region.

IKIO Lighting recorded a net profit of 50.52 crores for the financial year that ended in March 2022. This figure represents a significant increase when compared to the company’s net profit of 28.81 crores for the previous fiscal year.

The firm reported a net profit of 51.35 crore rupees for the fiscal period that ended in December 2022, while its sales for the period were 332.79 crore rupees.