Source : Wilberforce Okwiri, Standard

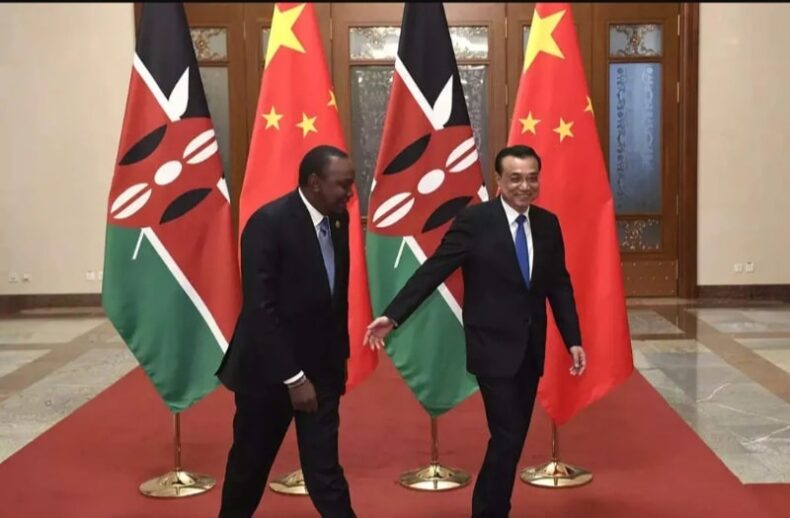

Kenya has fallen behind on interest payments on a loan provided by China, to build a railway line from the port city of Mombasa that opened in 2017.

Kenya disputed on Thursday that it has fallen behind on interest payments on a loan provided by China, to build a railway line from the port city of Mombasa that opened in 2017.

China, the largest creditor, now demands repayment since debts owed by African nations have matured. Both Kenya and Nigeria borrowed money from China, but Kenya is having trouble paying back the loan and interest, and this has resulted in an N4.71 billion punishment.

The so-called “Lunatic Express,” a line established more than a century ago by colonial power, Britain, that was infamous for protracted delays and malfunctions, was replaced by the $5 billion project, which was funded 90% by China.

According to Kenya’s Business Daily, the government was fined 1.312 billion Kenyan shillings ($10.8 million) for failing to pay interest on the loan during the fiscal year that ended in June.

Ukur Yatani, the secretary of the Treasury Cabinet, disputed the allegations as “misinformation,” claiming that the East African economic giant’s financial status was “healthy and solid.”

In a statement, Yatani stated, “We wish to emphasise unambiguously that Kenya has never defaulted on the settlement of its debt service commitments to any of its creditors. “

The Standard Gauge Railway (SGR) was started as a master plan by East African leaders to connect their countries by rail and is the largest infrastructure project to be undertaken in Kenya since its independence from Britain in 1963.

It is intended to eventually connect Mombasa to the town of Naivasha in the Rift Valley via Nairobi, as well as Uganda, Rwanda, South Sudan, Burundi, and Ethiopia.Before being turned over to the Kenyan government, the Chinese contractor was to oversee the railway for five years.

However, it has reported losses, and experts are concerned that the pattern may persist after newly elected President, William Ruto last month changed a rule that required cargo to use the railway.After the World Bank, China is Kenya’s second-largest lender.

China has financed a number of expensive infrastructure projects, raising concerns that Nairobi may be taking on more debt than it can handle.

According to government statistics, the nation’s public debt in June totaled 8.6 trillion shillings ($71.1 billion), an increase of 11.5 percent from a year earlier.

However, loan interest payments have increased significantly recently due to the shilling’s sharp decline in value versus other currencies.

On Thursday, it was trading at 121 to the dollar.Yatani stated that there was no reason for concern because independent sovereign rating studies of the nation are often conducted and extensively disseminated.

He continued, “Kenya has never been reported as defaulting on its external financial obligations.

Read more – Women’s IPL(WIPL) Is About To Start In March 2024

Read more – FLOOD-HIT 1300 VILLAGES OF 18 DISTRICTS IN UTTAR PRADESH

Read more – Is It Too Much… In A Democracy? – Judges Differed On Hijab Ban