The Chief Financial Officer of the BRICS financial institution, the New Development Bank, has confirmed that the BRICS bloc does not have any immediate plans to create a new common currency. Leslie Massdorp said, while the member countries are definitely putting efforts to conduct more trade with each other in local currencies, they are not ready to challenge the global dominance of the dollar right now.

The development of anything alternative to dollar is more a medium to long-term ambition of the group, he informed. He said that even the Chinese Renminbi is still far from becoming a reserve currency.

Amid the speculations on new currency being discussed at the upcoming BRICS summit, India’s Foreign Affairs Minister, Mr. S Jaishankar said that there are no such plans and the focus is on strengthening the national currency. There are many other issues to be discussed at the meeting and “currencies will remain a national issue for a long time to come”, he said.

BRICS and its New Development Bank

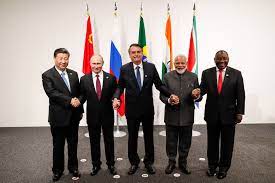

BRICS is a grouping of five members at present, Brazil, Russia, India, China and South Africa representing over 40% of the world’s population and about 30% of global GDP. Formed in 2009, BRICS with its financial institution the New Development Bank (NDB), strives to counterbalance the dominance of the US and traditional allies and international financial institutions such as the World Bank and International Monetary Fund (IMF) dominated by them.

NDB is a key part of the BRICS strategy, it has $50 billion in subscribed capital and plans to add several new emerging market member countries this year in a bid to expand its lending capability, as informed by Massdorp.

The bank already includes Bangladesh and UAE as members in addition to the core BRICS countries and is in the process of adding Uruguay. Maasdorp said, “The intention has always been to create a global bank anchored in emerging markets”.

Upcoming BRICS summit

The 15th BRICS summit is going to be held in South Africa in August. It is majorly expected to have discussions on the long-pending expansion plan of the group. It is likely to induct five new members to the grouping, Saudi Arabia, Indonesia, the UAE, Egypt and Argentina. There are 20 more countries waiting to be a part of BRICS.

After the BRICS foreign ministers meeting in Cape Town last month, EMA S Jaishankar said that the expansion of BRICS bloc is a work in progress. However, India had insisted to have a well-defined criterion for the expansion of BRICS.

It is speculated that the group members are going to have a discussion on a dollar rivalry currency in the upcoming summit. All BRICS nations are critical of the dollar’s dominance but for different reasons.

BRICS members on de-dollarisation

Russia has desperately been looking forward to de-dollarisation to have some relief from the west imposed sanctions, especially since the Russia-Ukraine war. Due to these sanctions, Russian banks have been unable to use SWIFT, the global messaging system that enables bank transactions.

Leaders of both Brazil and South Africa also have questioned the dollar’s domination. They look forward to having talks on the same in the upcoming August meeting.

Coming to China, it is very well known that China is looking forward to de-dollarisation and increasing the use of its own currency, Yuan, in its trade with other countries. The Chinese government has clearly put out its concern with the dollar dominance, labeling it as the main source of instability and uncertainty in the world economy.

China is trying to expand the use of the Yuan through its economic development strategy as well. In the recently held virtual SCO summit, hosted by India, all the member countries signed the economic development strategy by China, except India. China is looking forward to implementing the strategy through its Belt and Road Initiative (BRI) and having a dominant presence throughout the SCO member countries.

BRI includes the China-Pakistan Economic Corridor project (CPEC) passing through PoK, to which India will never agree. India reiterated its longstanding stance on the CPEC project at the SCO summit and refused to sign. Also, the emerging dominance of Yuan against Dollar is not what India is looking for.