By Zoya Saleem

May 26, 2024

New AI methodologies are becoming increasingly important for sustained advancement in chip production as artificial intelligence drives demand for more sophisticated semiconductors.

After its excellent sales estimate revealed that Wall Street has yet to price in the potentially game-changing potential of AI, Nvidia Corp (NVDA.O) soared 24% on Thursday, one of the highest one-day jumps in value for a U.S. stock.

The increase more than doubled the stock’s value for the year and brought the market value of the chip designer up to over $939 billion, an increase of roughly $184 billion.

Nvidia is now twice as big as TSMC, the second-largest chip manufacturer in Taiwan.

Both Nvidia’s earnings and sales increased by 19% and 26%, respectively, in the most recent quarter, handily above Wall Street analysts’ predictions. Additionally, Nvidia’s prognosis for the upcoming quarter was considerably – by approximately 50% — higher than experts’ forecasts.

Nvidia: Leading maker of AI chips

Artificial intelligence (AI) started to take on a life of its own and become useful in a variety of tasks, including assisting with speaking, coding, and cooking.

But without some extremely potent computer technology, none of that would be conceivable.

And one hardware company in particular, Nvidia, based in California, has emerged as a key player in the AI bonanza.

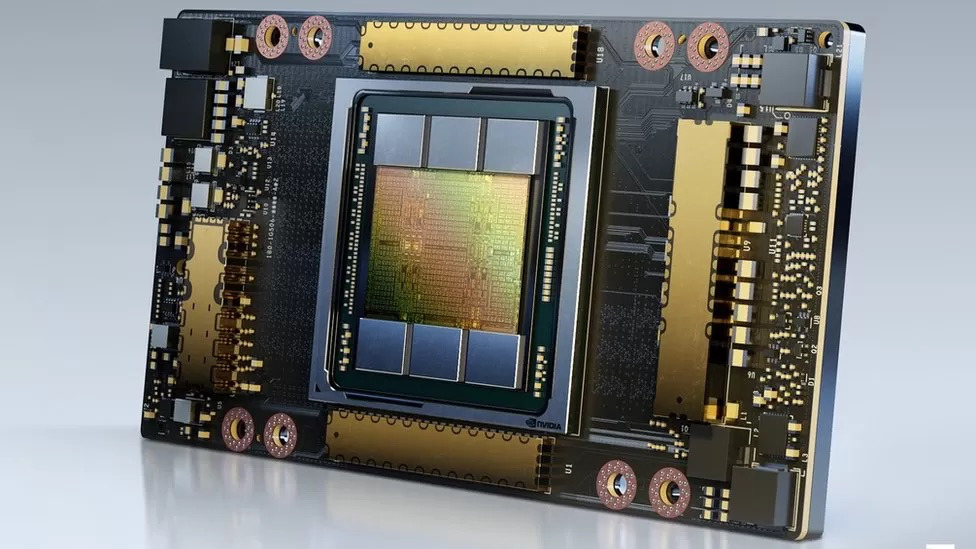

Image Source: BBC.com

Nvidia technology is the foundation of the majority of AI applications today. Nvidia was first renowned for producing the kind of computer chips that process visuals, particularly for computer games.

10,000 graphics processing units (GPUs) from Nvidia were grouped together on a Microsoft supercomputer to train ChatGPT.

Sales of gaming chips are still low

In the meantime, first-quarter sales for Nvidia’s gaming chip division fell 38% year over year to $2.24 billion. Lower shipments to normalize channel inventory levels and reduced demand as a result of the macroeconomic recession were the causes of the decline, according to Kress.

The beat-and-raise report from Nvidia was lauded by Wall Street analysts.

As soon as new GPUs were released, scalpers—some of whom were scrambling to survive after losing their jobs due to the pandemic—used bots to seize the in-demand cards and sell them at exorbitant prices. Some people started mining cryptocurrencies with high GPU demands.

GPUs are particularly good at parallel processing, which involves handling lots of little jobs at once (for instance, managing millions of pixels on a screen).

By making investments in the creation of new GPU types more suited for AI as well as more software to make the technology easier to use, Nvidia pushed their lead.

Image Source: NVIDIA

Through Wednesday’s close, NVDA stock has increased 109% year to date due to investor interest in the company’s pivotal position in the developing field of artificial intelligence. Nvidia announced agreements with Microsoft (MSFT) and Dell Technologies (DELL) for AI technologies on Tuesday.

Additionally, Nvidia and ServiceNow (NOW) collaborated to create enterprise-grade generative AI capabilities last week.

The IBD Leaderboard and Tech Leaders lists both include NVDA shares.

According to IBD Stock Checkup, Nvidia is ranked fourth out of 37 stocks in the fabless semiconductor business category. The IBD Composite Rating for NVDA stock is 98 out of 99.