Strong refining margins boosted Reliance Industries’ leading oil-to-chemicals business, which led to a 46.3% increase in the company’s earnings for the June quarter.

Reliance Industries Ltd. of India announced a 46.3% increase in quarterly profit on Friday. The company’s leading oil-to-chemicals business was supported by healthy refining margins owing to the intake of cheaper Russian crude and fuel exports, which led to the increase.

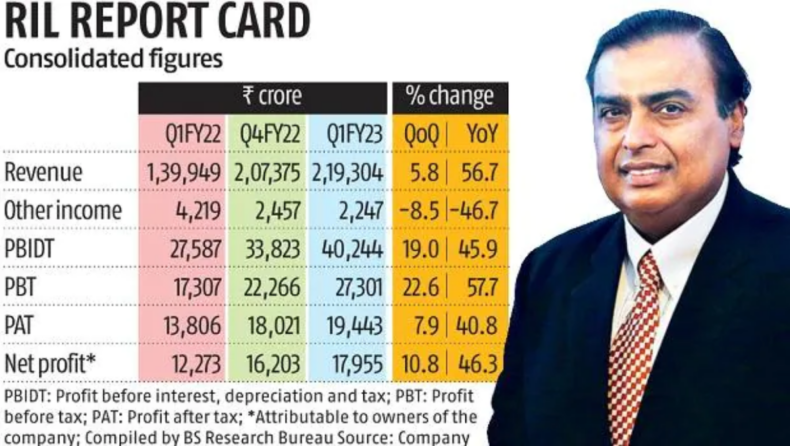

The Mukesh Ambani-led company said that its consolidated profit increased to 179.55 billion rupees ($2.25 billion) in the three months that ended on June 30, as opposed to 122.73 billion rupees in the same period of the previous year.

On Friday, the RIL share completed the trading day at the BSE for Rs 2,502.90, which represents a gain of 0.62 percent. This occurred before the results had been made public.

The index heavyweight has seen a rise of 19 percent during the previous year in addition to a rise of 4 percent so far this year. Other revenue, however, had a significant decrease of 46.7%, going from 4,219 crores to 2,247 crores during the year.

The total amount of money collected in taxes over the period was up by 125 percent, from 3,464 crores to 7,793 crores. These factors could explain why the company’s earnings fell short of the Market’s projections when measured at the net level.

During the same period, the private refiner increased gasoline exports, particularly to European countries struggling with shortages because of the sanctions placed on Russia. “The geopolitical battle that has been going on has generated major upheaval in energy markets and has interrupted the conventional trade patterns.

This, in conjunction with an uptick in consumer demand, has led to tighter markets for gasoline and higher profit margins across the board “Reliance Industries’ current chairman and managing director, Mukesh Ambani, made a statement.

After some western customers avoided purchasing cheap Russian oil in the aftermath of Moscow’s invasion of Ukraine in late February, Reliance emerged as one of the primary importers of this commodity.

The O2C business of Reliance achieved its best-ever quarterly performance, with all-time high sales and profits before interest, tax, depreciation, and amortization. This was the case during the company’s most recent quarter. The rise in the price of crude oil and other products was the primary contributor to the 56.7 percent year-over-year increase in O2C income that reached Rs 1.61 trillion.

As a result of customers coming back into shops, it was reported that there were 175 million customers that entered the establishment throughout the quarter. This figure represents a 19% increase over the footfalls registered before the Covid outbreak.

As a result of the increased footfalls and digital visits, there were 220 million transactions completed during the quarter. This represents a growth rate of more than 60 percent in comparison to the levels that existed before Covid.

After the first quarter, RIL’s consolidated gross debt was calculated to be 2.63 trillion rupees, while the business incurred capital expenditures of 31,442 crore rupees during the period. At the end of June 2022, the net debt was around Rs 57,655 crore, which is much more than the Rs 30,000 crore it was at the end of March 2022.

Ambani made the following statement on the new energy businesses: “Our New Energy company is building alliances with technical leaders in solar, energy storage technologies, and the hydrogen eco-system.” These agreements will assist us in realizing our mission of providing Indians with energy options that are clean, green, and within their financial ability.

The company’s telecom unit, Jio, saw its net profit go up by almost 24%, and its retail unit, which is the largest in the country, saw its gross sales go up by 52%. The company Reliance said that Jio’s average revenue per user (ARPU), which is a crucial performance statistic, was 175.7 rupees per subscriber per month during the quarter.

This represents a rise of 27% from the previous year. In the last month, Mukesh Ambani has turned the keys of the telecommunications branch of his company empire over to his son Akash, so paving the way for a leadership shift inside the Ambani business empire.