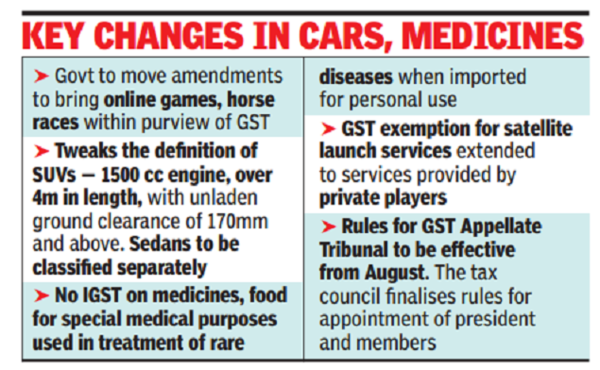

In a recent move by the Goods and Services Tax (GST) Council in India, online games have been subjected to a 28% tax, while the prices of cola and popcorn in movie halls are set to decrease. This decision has sparked discussions and debates among industry players and consumers alike, as the tax implications and impact on entertainment experiences are assessed.

The GST Council, chaired by Union Finance Minister Nirmala Sitharaman, made the decision to classify online games under the 28% tax slab during their recent meeting. This move aims to bring digital entertainment, specifically online gaming, under the same tax bracket as other forms of entertainment. While the intention behind this decision is to ensure a level playing field and uniform taxation, it has raised concerns among gaming enthusiasts and industry stakeholders.

Online gaming has witnessed a significant surge in popularity in recent years, especially during the COVID-19 pandemic when people sought digital avenues for entertainment and social interaction. The classification of online games under the 28% GST slab might have repercussions for the industry, as it could lead to increased prices for gamers and potentially hinder the growth and accessibility of online gaming platforms.

The gaming community argues that online games should be treated differently from traditional forms of entertainment, such as movies or sports events. They contend that online games are interactive experiences that rely on continuous updates, maintenance, and server costs, making them fundamentally different from other entertainment mediums. Moreover, proponents of the gaming industry highlight the positive aspects of online gaming, including its potential for skill development, social connectivity, and mental stimulation.

On the other hand, the GST Council’s decision to reduce taxes on cola and popcorn in movie halls has been greeted with mixed reactions. This move aims to make movie theater experiences more affordable for the masses and boost the struggling cinema industry, which has faced significant challenges due to the pandemic and the rise of streaming platforms. By reducing taxes on refreshments like cola and popcorn, the Council hopes to attract more audiences to movie theaters and provide some relief to theater owners and operators.

While the reduction in prices of cola and popcorn might be seen as a positive step towards reviving the cinema industry, some critics argue that it may not be enough to address the challenges faced by theaters. Factors such as high ticket prices, competition from online streaming platforms, and the ongoing impact of the pandemic have contributed to the decline in theater attendance. Therefore, a comprehensive strategy encompassing various aspects of the cinema experience might be needed to revive the industry fully.

As with any taxation decision, there are always multiple perspectives and considerations to take into account. The GST Council’s move to subject online games to a 28% GST and reduce taxes on cola and popcorn in movie halls reflects an attempt to create a level playing field and provide relief to certain industries. However, the implications of these decisions on the gaming and cinema sectors will only become clear over time.

It remains to be seen how the gaming industry will respond to the increased taxation and whether it will have a significant impact on the availability and affordability of online games. Additionally, the reduction in prices of cola and popcorn in movie halls may entice more audiences to return to theaters, but it is uncertain if it will be sufficient to revive the struggling cinema industry.

Source – Times of India Newspaper

As discussions and debates unfold surrounding these tax decisions, it is important for policymakers to consider the diverse perspectives and potential consequences to ensure a balanced and fair approach that supports the growth and sustainability of all sectors of the entertainment industry.