The company show a good amount of growth and achieved its milestone of operational profitability much ahead of its September guidance. While controlling indirect expenses and also saw an increase in shareholding by domestic investors and foreign investors.

Table of Contents

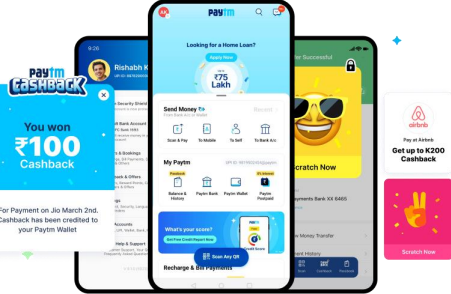

About Paytm

Paytm is a Noida-based financial technology company founded by Vijay Shekhar Sharma that focuses on digital transactions and financial services. The parent company of Paytm is One97 Communications. The company provides mobile payment facilities to customers and enables merchants to receive payments through point of sale, QR codes, and online payment gateway offerings. In collaboration with different financial institutions, Paytm offers financial services such as small loans and buy now, pay later services to its users. The company also provided online ticketing and online gaming services.

Image Source: Equity Pandit

Image Source: Equity Pandit

Different Products and Services of Paytm

The company has a wide range of products to offer to the customers such as Paytm Insider, Paytm Payments Bank, Paytm Money, Pay Pay, Insurance, First Games, and services such as Payment system and Mobile transactions facilities.

Image Source: Paytm

Image Source: Paytm

Growth seen as compared to Quarter March 2022

The company’s Monthly Transaction Users (MTU) grew up to 27 percent as compared to the previous year, MTU on average three months ended March 2022 was 71mn and on March 2024 it increased to 90mn.

Total Subscription Merchants (Payment Devices) as per Quarter March 2022 was 2.9mn and it increases to 6.8mn as per Quarter March 2024. Therefore, we saw 3.9mn growth in payment devices.

Gross Merchandise Value (GMV) was 2.59 INR Lakh Crore as of the Quarter ended March 2022 and it increased to 3.62

INR Lakh Crore as of the Quarter ended March 2024. An overall Y-O-Y growth of 40 percent.

The value of loans shows significant growth from 3,553 INR Crore as of the Quarter ended March 2022 to 12,554 INR Crore as of March 2024 with an increase of almost 253 percent and the number of loans grew from 6.5mn to 11.9mn which increased 82 percent as Y-O-Y growth.  Image Source: Paytm.com

Image Source: Paytm.com

Change in Shareholding Pattern

The company has seen an increase in the shareholdings of Foreign Institutional Investors and Domestic Investors.

Domestic Institutional Investment grew from 1.9 percent to 3.2 percent while the increase in investment by mutual funds and alternative investments. And the overall holding of mutual funds companies increased by almost 1 percent.

Foreign Institutional Investment grew from 6.7 percent to 11.5 percent while FPIs increased their stake in the company

substantially. Foreign Direct Investment reduced to 60 percent from 66 percent after Alibaba sold its stake holdings.

Image Source: Share Market Help

Image Source: Share Market Help

Control in Expenses

Paytm focused more on reducing the indirect expenses such as sales, technology and marketing expenses. The company’s management said “they have ramped up indirect expenses from last few quarters in the main three areas” mentioned above. The company is using strategy of low Customer acquisition costs (CAC) by making UPI, money transfers, in-store payment and bill payments services efficient and preeminent means to acquire customers.