The Reserve Bank of India (RBI) announced that it would establish a legal framework to allow (DLG) default loss guarantee agreements for digital lending.

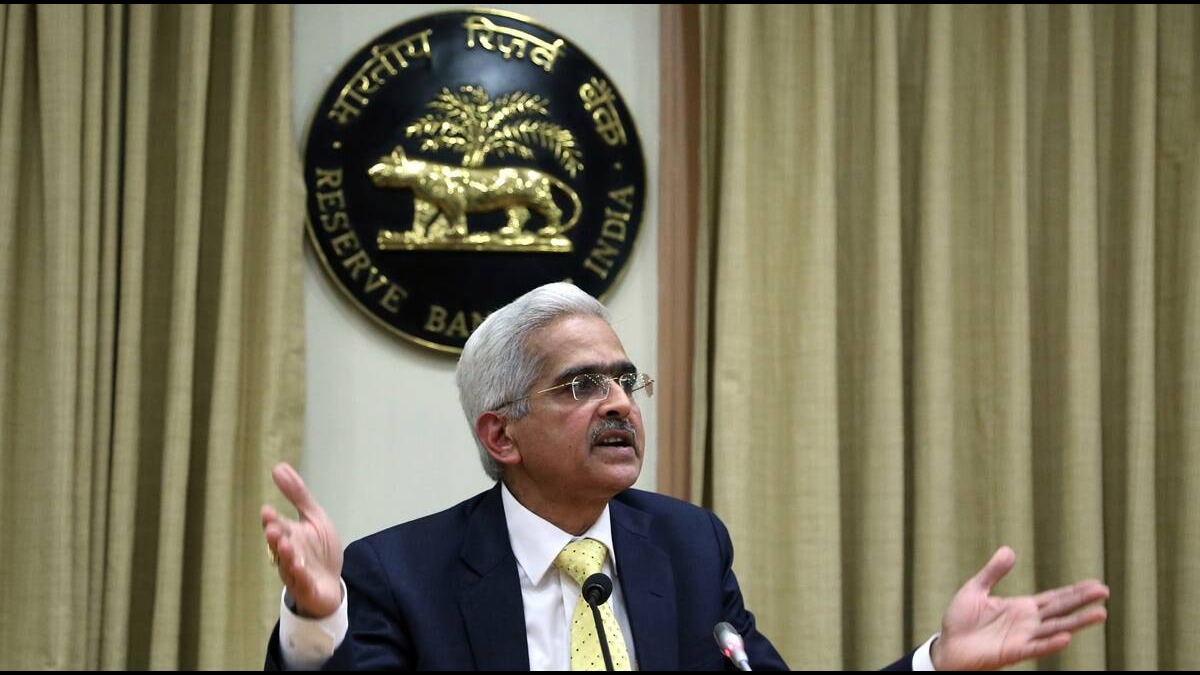

The First Loss Default Guarantee (FLDG) framework has received approval from the Reserve Bank of India (RBI). The RBI announced this on Thursday during the second bi-monthly monetary policy meeting. The FLDG scheme enables fintechs to collaborate with NBFCs and banks. The decision is seen favorably by data-tech NBFCs and fintech companies. Moreover, the decision will enhance the ecosystem for digital financing.

A service like this has received formal approval from the banking authority for the first time. The FLDG amount is, however, limited by RBI to 5% of the overall loan value.

Table of Contents

RBI’s Statement

The RBI stated in 2022 guidelines that it resisted such agreements because they would induce lenders to take on excessive risk. The proposed regulatory framework is “in tune with our objective of maintaining a balance between innovation and prudent risk management,” the RBI stated in the Statement of Developmental and Regulatory Policies.

According to the RBI, the decision was made after significant consultation with various stakeholders.

Since then, the RBI has looked into arrangements containing default loss guarantees (DLG), also known as FLDG, between regulated entities (REs) and lending service providers (LSPs) or between two REs, and it has decided to approve such arrangements subject to the rules. FDLG arrangements that follow these guidelines won’t be considered “synthetic securitization” and won’t be subject to “loan participation” rules, the circular further stated.

These guidelines apply to DLG arrangements made by all commercial banks (including small finance banks), primary (urban) cooperative banks, both state and central cooperative banks, and NBFCs (including housing finance companies), based on the RBI’s circular.

The RBI has stated that before entering into any DLG arrangement, banks and NBFCs must put up a policy approved by the board as part of the due diligence process.

It is a pragmatic approach which will benefit both the fintech companies and the financial institutions. Additionally, it will increase credit penetration and strengthen the digital lending environment.

What is the FLDG Framework?

Following the framework, RBI instructed RE to ensure that the total DLG cover on any outstanding loan portfolio indicated upfront should not exceed 5% of the overall loan portfolio.

FLDG assures banks and NBFCs that fintech comprehends credit risk while also assisting them in covering prospective losses. Under FLDG, fintechs assist banks and NBFCs in recovering losses from default payments by clients.

While some fintech companies only offer coverage for the first month, a few proactive alliances have led to fintech companies guaranteeing losses for up to three months of defaults, hence the term “DLG” (Default Loss Guarantee). Another type of agreement is fintech paying lenders compensation if it’s a portfolio of 100 loans, up to five defaults. With this arrangement, lenders are protected from losses as long as the non-performing assets don’t exceed 5% of their whole portfolio.

The DLG Provider should not take on performance risk in implicit guarantee arrangements, which are more than 5% of the underlying loan portfolio.

Additionally, unless the borrower makes good within that time frame, the RE must activate DLG within a maximum overdue period of 120 days.

Regarding asset quality, regardless of any DLG coverage offered at the portfolio level, it is the RE’s responsibility to identify specific loan assets in the portfolio as NPAs and make the necessary provisions under the current asset classification and provisioning regulations. The underlying individual loans cannot be offset by the amount of DLG declared. According to the terms of the contract, the RE may share any proceeds from the loans on which DLG has been used and realized with the DLG provider.