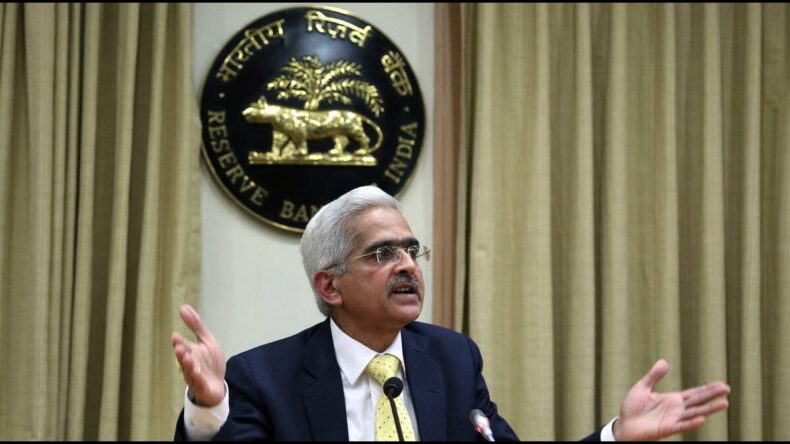

Following today’s meeting of the RBI’s monetary policy committee (MPC), Governor Shaktikanta Das announced the MPC’s decision to maintain the current interest rate.

As banks have sufficient liquidity to satisfy lending needs in the short term, the RBI MPC voted unanimously to maintain the current repo rate of 6.50%.

The governor of the RBI reaffirmed that the RBI MPC had opted to keep interest rates unchanged despite the fact that the money supply had increased by 10.10 percent year over year and non-food bank lending had increased by 15.6 percent.

RBI Governor Shaktikanta Das made a statement that has been widely reported, noting that the average daily absorption under the LAF climbed to 1.7 lakh crore during April-May from 1.4 lakh crore in February-March. On May 19, 2024, the money supply (M3) and non-food bank loans both increased by 15.6 percent from the previous year.

The value of India’s foreign currency reserves as of June 2, 2024, was estimated at $ 595.1 billion.

Despite this, analysts say that, since the removal of 2000 notes, India’s banking system and economy have gained access to excess cash. They did, however, say that factors like India’s higher-than-expected GDP, excellent GST collection, inflation below the targeted 2-6 percent, etc., had a part in the RBI’s decision to leave the repo rate alone at this month’s monetary policy meeting.

Withdrawal of 2000 bills proving effective

Sujan Hajra, Chief Economist & Executive Director of Anand Rathi, stated, “Today’s RBI monetary policy rate pause was anticipated.” Hajra attributed the status quo result to the removal of 2000 notes. It was expected that the monetary policy would transition from a liquidity withdrawal to a neutral position as a result of the recent, larger-than-expected drop in inflation. However, after much deliberation, the MPC has chosen to keep things as they are. The demonetization of Rs. 2,000 banknotes is largely responsible for the current rise in currency availability.

While the RBI’s inflation goal of 4% has been predicted to be surpassed every month of the current fiscal year, an Anand Rathi expert has insisted that this would not occur. Though the RBI’s policy stance remains unchanged, which is somewhat disappointing, the central bank’s cautious approach in light of upside risks appears justified and well-articulated, such as the potential impact of El Nino on India’s monsoon and the continuation of monetary tightening by the world’s major central banks. As a result, we believe the monetary policy statement will have little impact on the market.

According to Trust Mutual Fund CEO Sandeep Bagla, “it is a pause, and the possibility of the next move being cut is far higher than that of a hike” when asked about why RBI opted to keep interest rates the same despite abundant liquidity after the removal of 2000 notes. As the labor market remains tight and the threat of a wage-inflation spiral persists, growth is robust, and inflation, albeit now reducing, may increase in the future. Rate increases have resumed in Australia and Canada after a brief hiatus. There is still work to be done. As Rs.2000 notes gradually enter the banking system’s liquidity, the excess of liquid funds will need to be decreased. As the Reserve Bank of India (RBI) waits for fresh economic signals amid persistent global contradictions on the inflation and GDP fronts, market rates may climb by a few basis points.

Anu Aggarwal, President and Head of Corporate Banking at Kotak Mahindra Bank, had this to say about the macro factors that helped RBI keep interest rates unchanged: “Leaving the policy rates unchanged was expected with inflation cooling down partly due to base effect and partly with oil at $70 (compared to $ 115 in June 2022). Given the downward pressure from global macro on firms, RBI’s move will be a welcome boost to domestic demand and economic expansion.

An official from Kotak Mahindra Bank went on to say that interest rate stability will promote capital expenditure plans, the majority of which have been pushed by the government up to this point. Investment expenditure has a far larger multiplier impact than consumption spending.