Earlier this month, RCPL re-launched the iconic soft drinks brand Campa, entering into the turf of US Cola majors PepsiCo and Coca-Cola. The RIL company, owned by billionaire Mukesh Ambani, has entered the FMCG personal and home care category, selling items at a 30 to 35 percent lower price after igniting a price war in the soft drink segment with the relaunch of Campa.

SOURCE- INDIA HISTORY

Reliance Industries (RIL) announced the debut of its made-for-India consumer packaged goods brand “Independence” by establishing Reliance Consumer Products Ltd (RCPL), the FMCG division of Reliance Retail.

The company is on a mission to buy and market domestic Indian brands that have a strong connection to Indian customers and their roots.

SOURCE- THE HINDU BUSINESS LINE

THE FMCG PUSH

The company would sell products ranging from staples to processed foods and other everyday necessities, according to a statement that was later made public. The first strategy was to make Gujarat a “go-to-market” state for its FMCG company in order to achieve excellence in execution, with the goal of quickly rolling out the brand nationally.

The products of RCPL, the FMCG division and wholly-owned subsidiary of Reliance Retail Ventures Limited (RRVL), are currently only offered in a few markets, but the company is working to expand its dealer network to cover the entire country of India and expand the reach of its products through modern and general trade channels.

An industry source stated, “They are developing a unique and focused distribution network composed of conventional dealer/stockists as well as contemporary trade B2B channels.”

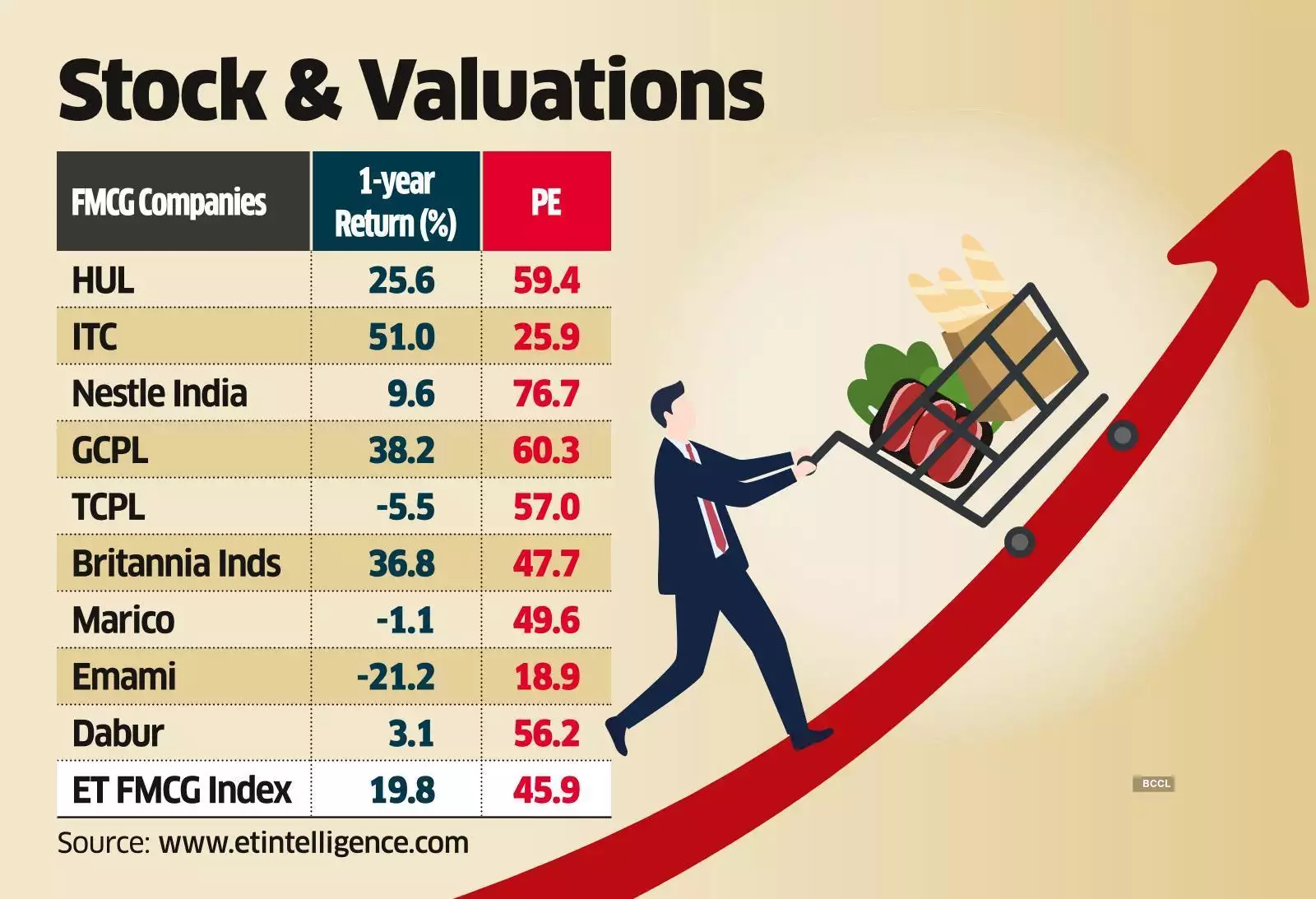

This expresses the desire to compete in the USD 110 billion FMCG market, which is mostly controlled by companies like HUL, P&G, Reckitt, and Nestle.

THE PRICE WAR UNVEILED

Now, coming back to the RIL strategy of making foray in the India FMCG space, the company offers its products at 30-35 percent lesser price than the market prices. Some of which are listed below-

- The company has priced its Glimmer beauty soaps, get Real natural soaps and puric hygiene soaps at rs. 25 which is much lower than the price of leading brands like lux(rs 35 for 100g), dettol (rs 40 for 75g) and santoor( rs 34 for 100g).

- The price of enzo 2 litre front load and top load liquid detergent is rs 250( on jio mart) in comparison to a 2-litre pack of Surf-excel Matic priced at rs 325.

- In the dish wash segment, it has started with the attractive price points of rs 5,10,and 15 for bars and has even launched liquid gel packs at similar competitive prices.

RIL – THE MARKET DESTROYER

It is no news at all that RIL has been and continues to disrupt various markets through its price offerings. The prime example is of the telecom market, which it disrupted successfully with jio market prices.

However, this time around there stands a challenge. Ril has priced its products in comparison to industry leaders like with HUL’s Surf and Lux. They have a product, which is of Rs 25 against Rs 34 of Lux;this is a big inducement for the buyer to try it out onceReliance canonly create a market if the buyer has used it and determined that the product is on par with Lux. But, Reliance won’t be successful if customers think Lux, which is currently among the least expensive options available, is somewhat superior.

GOOD SCOPE TO GROW

This being said, RIL has done its homework and has been successful in the past.

The indian beauty and personal care industry stands at USD 21.65 billion in 2022, as per a report by Expert Market Research .

The Indian FMCG market has grown intriguing as a result of the announcements of numerous companies entering it. Due to the switch from loose to packaged items and increased per capita consumption, it still has favourable margins with room to grow.

SOURCE- THE ECONOMIC TIMES

It has gotten simpler for new and established players to develop and launch brands today thanks to better technology, ingredients, and other support options, including numerous third-party manufacturers who have scaled up in the last five years, as evidenced by the numerous new D2C/consumer brands launched every day across packaged food, beauty, health, wellness, etc.