What happened

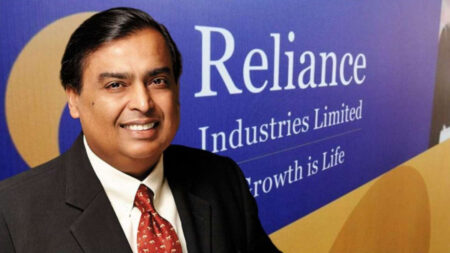

India’s capital market controller limited previous wealthy person Anil Ambani from managing protections for redirecting assets from one of his organizations to other gathering elements and reimbursing obligations.

Ambani, his organization Reliance Home Finance Ltd., and three of its leaders were banished from exchanging protections, either straightforwardly or by implication, until additional orders, the Securities and Exchange Board of India (SEBI).

SEBI has done what?

Anil Ambani is banned from the market over abuse of assets of Reliance Home Finance, for which it’s then evaluators PwC had would not sign the yearly records.

The Securities and Exchange Board of India (Sebi) has banned Anil Ambani and three partners from the capital market to direct assets from Reliance Home Finance (RHFL).

The controller has additionally limited them from the partner with any recorded organization, securities exchange middle person, or any open organization that expects to fund-raise.

The limitations will stay until additional notification. Sebi has said in a time request coordinating Ambani and a few others ‘show cause regarding why further activity and examination shouldn’t be started against them.

So why have they been banned from the market?

The case is connected to the abuse of assets of Reliance Home Finance, for which its then reviewers Price Waterhouse and Co (PwC) had wouldn’t sign the yearly records and afterward surrendered.

Furthermore, the controller had additionally gotten different extortion observing discounts from banks expressing reserves acquired by RHFL was utilized towards reimbursement of advances and so on the request likewise refers to that when an examination was started behind the claims by the banks, it was seen that as the vast majority of the allegations were valid.

Final words by SEBI

As per claims by SEBI, it is noticed that the examination of Sebi has as of now exposed regarding how Notice no. 2(Anil Ambani) (the Promoter/Chairman and the individual under whose influence and impact the Company has acted), has behaved in surpassing his transmit by authorizing credits in net deviations of standards (interior as well as administrative).

By conflicting with the express mandates of the Board of Directors by uprightness of which such advances should have been halted from being endorsed, endorsed, he authorized further GPCL (universally applicable corporate advancement) to different associated substances.

“Such offense concerning Notice no. 2 (Anil Ambani) as the executive of the organization resembles deceitful goal of the top administration of the organization, first, to redirect the acquired assets of the organization intended to be progressed to authentic outsider borrowers to the money vaults of different advertiser bunch substances under the attire of series of farce GPC (general corporate reason) loaning.

Afterward to conceal the misfortunes and NPA (nonperforming resource) emerging out of such exchanges by hiding genuine monetary wellbeing of the organization from the investors and general contributing public, who would never know the genuine monetary status of RHFL by taking a gander at the concocted books of records introduced to them through the stock trades,” Sebi entire time part SK Mohanty said in his request.

Edited by: Mahi Gupta

Published by: Vishakha Verma