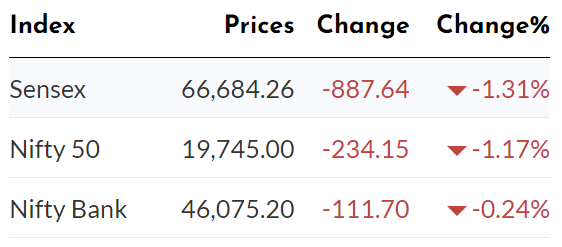

While Sensex dropped by 888 points on July 21, Friday during intra-day trade, Nifty snapped a 6-day winning streak by finishing at 19,745. It’s quite common for Stock Indices to crash, but this is after the first six months had been all about Bulls in the market. The decline was widespread, affected mostly by IT, then FMCG followed by Energy Majors. The disappointing Q1 performance was from INFY (-8.41%) and HUL (-3.82%).

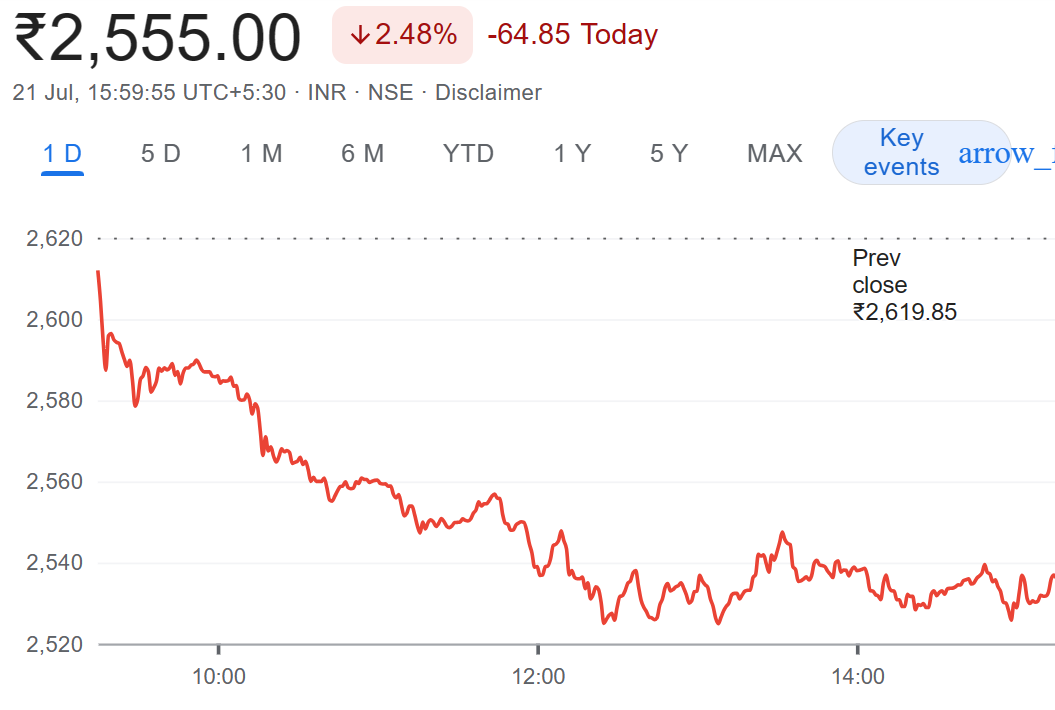

Infosys being the major rundown

It would have been for the first time in history that Nifty would have reached a 20,000 milestone if Infosys hadn’t been the biggest drag today having a weightage of about 5.9% in Nifty. Infosys slumped by 18.8%. The Q1 performance of Infosys was -8.41%. its fiscal revenue guidance fell from 4-7% to 1-3.5%.

IT Industry

Nifty IT index plunged by 4%. Persistent systems ended at 5.6% lower, HCL Tech and Wipro were both 3% lower, Tech Mahindra ended at 2% lower and TCS decreased to 2.6%. The sudden drop in Nifty was unexpected given the performance of the last 6 months and that too concerning the major markets of Nifty.

The NASDAQ Effect

Despite having the greatest six-month market opening in the last four decades, NASDAQ witnessed a 2% drop in the market. This massive downfall of the Tech-savvy NASDAQ resulted in the massive trigger of the software stocks led by Infosys which in turn stimulated the Indian stock to crash. Tesla and Netflix suffered the major plunge to 10% and 8.4% respectively.

Investors Insight

As Nifty crashed down today ending its winning streak, this may have happened due to over speculation of the investors. Given the past six month performance of the Indian Stock market, it was easy to get lured in huge greed which paid with the unnecessary sell-off. Investors are now being requested to await RIL Q1 results and not hassle. Around 1.92 lakh wealth was lost to investors. The market capitalisation slipped from 304.04 lakh crore to 302.12 lakh crore of BSE Listed companies. Revenue growth guidance was affected as the discretionary spending declined in majority. Technically Nifty has breached the important support of 19825, and it is still comfortably trading below which might be a little worrisome and largely negative. Caution is advised to every trader in this risk of return. The cue for tomorrow is to keep precaution. Reliance has witnessed a major downfall in the profit due to the sluggish performance of oil to chemical business. Overall trading has been highly affected and will remain low for some time. India VIX was reported to be down by 2.50% from 11.78 to 11.48 levels. 19700 is still a support for Nifty as the market can take off from this point. If this point is maintained by Nifty, it is expected to bounce back till next week.