Yes, you heard it right. Your newly owned Rolex is an appreciating asset, and it might yield you more return than your investment in the traditional stock market.

Let me walk you through the entire process.

Watches have long been one of the most popular accessories, regardless of age or gender.

Watches tend to create a bold fashion statement, but they are not just restricted to fashion; they are much more than that.

Watches are seen as status symbols. They have always been an essential aspect of the luxury market since they communicate class and taste.

And amongst all the countries globally, it wouldn’t be wrong to say that Switzerland dominates the luxury watchmaking industry.

Swiss watches are unrivalled, to the point where the name “Swiss watch” has become synonymous with superior quality and timeless value.

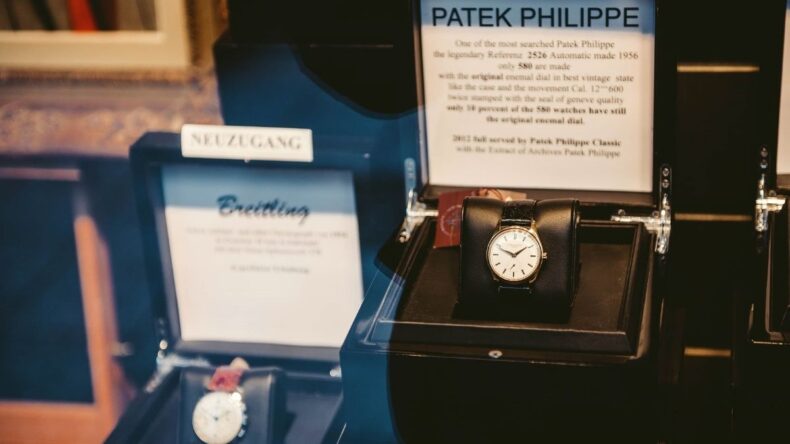

And contributing to such timeless value are brands like Rolex, Patek Phillip, Omega and many more.

These brands have always been the preferred investment choice, as they have been able to maintain the demand for their products for many decades now.

Just like other industries, this industry also took a hit during the pandemic.

Still, it is slowly and steadily getting back on its feet, as the rich spend the excess of their incomes saved in the pandemic to acquire these timeless assets.

But, lately, we see a significant shift in the watch industry. People are interested in buying new watches and are, in fact, more inclined to buy pre-owned watches.

The value of vintage watches in the market is increasing daily, and so is the demand.

This demand is so prominent that it created business opportunities for giants like Chrono24, which deals in the Direct to Consumer (D2C) business model.

These vintage watches are not just an emotional investment now; they are now a prized family heirloom. And so, the demand for pre-owned watches is constantly increasing.

It is expected that the demand for pre-owned watches will cross the $30 billion mark by 2025, making it one of the fastest-growing segments of the luxury industry.

It should also be noted that the pre-owned industry is more prominent online than offline.

The online share of the second-hand market is predicted to reach 30%, which is six times larger than the first-hand market.

Chrono24 shared its 2020 data, which showed that its transaction value rose by 30%, with pre-owned watches amounting to two-third of the sale.

Rolex was the most frequently asked for and demand brand with 37% of the total request.

Omega scored the second position with 11% of the total bid, whereas Cartier vintage models were requested even more than their current collection.

About 82% of the demand for Cartier watches can be traced back to their vintage collection.

But after looking at all these figures, there is an obvious question lingering in all of our minds- What is the rate of appreciation of these watches?

Predicting the actual price in this industry can be tricky as it is difficult to track the original price of these pieces as some of them can even date back to a century.

However, it is estimated that brands like Rolex, Patek Phillip and Audemars Piguet can appreciate up to 25%.

And so, from all the above analysis, it wouldn’t be wrong to say that investing in Swiss timepieces is a good investment option!