Credits- the Hindu Business Line

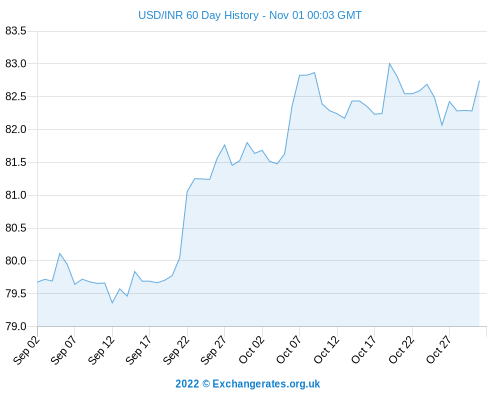

At the interbank foreign exchange market, the local unit began at 82.35 and noticed a high of 82.32 and a downward of 82.80. It eventually resolved at 82.78 versus the American currency, recording a decline of 31 paise over its last close of 82.47.

Credits- Indian Express

The rupee cut its initial increases and resolved 31 paise downward at 82.78 (provisional) versus the US dollar on Monday, tracing the vitality of the American currency in the overseas market.

At the interbank foreign exchange market, the regional unit began at 82.35 and noticed a high of 82.32 and a downward of 82.80.

It eventually resolved at 82.78 versus the American currency, enrolling a decline of 31 paise over its last close of 82.47.

The Indian rupee devalued on Monday among vitality in the US dollar. Though, optimistic domestic equities and fragile crude oil rates softened the downside, said Anuj Choudhary – Research Analyst at Share khan by BNP Paribas.

Also, inflows by foreign investors helped the rupee at a downward level.

We anticipate the rupee to market with a pessimistic prejudice among the powerful US dollar amid gaining odds of a forceful rate hike by the Fed on Wednesday. Some comeback in crude oil rates may also evaluate to Rupee, Choudhary added.

Traders may persist carefully ahead of manufacturing PMI and exchange deficit data, which is anticipated to be disclosed on Tuesday, Choudhary said, adding, We anticipate USD-INR spot rate to exchange in the span of 81.80 and 83.30 in the next couple of sessions. Meanwhile, the dollar index, which measures the greenback’s vitality versus a basket of six currencies, rose 0.28 percent to 111.05.

Worldwide oil standard Brent crude futures dropped 0.93 percent to USD 94.88 per barrel.

On the domestic equity market front, the 30-share BSE Sensex rose 786.74 points or 1.31 percent to end at 60,746.59, while the broader NSE Nifty improved 225.40 points or 1.27 percent to 18,012.20.

Foreign Institutional Investors (FIIs) were net customers in the capital markets on Friday as they bought shares worth Rs 1,568.75 crore, according to trade data.