UK government should introduce a separate law to deal with the crypto currency assets and to make them eligible as a collateral against the loans advanced says the UK legal reform body in today’s published report.

Tailored Framework:

The Law Commission funded by the Ministry of Justice on Today’s Report

Stated that U.K. should built a tailored framework for Crypto currency assets so that in the future the crypto assets can be treated as collateral.

1st Ever Law Commission on Cryptos and NFTs in UK:

The Law Commission was initially set up to analyse how to accommodate the Crypto currency and Non- Fungible Tokens in the existing legal frame work. It is to be noted that it was the 1st law commission of England and Wales appointed for NFTs and cryptos.

Digital Assets To be Treated as Property:

The report starts by “Digital Assets are Fundamental to modern society….”. The report states the importance of the digital assets by explaining its role in Today’s society and have stated it as a “complex yet evolving”.

Digital assets will include digital files, digital records, email accounts, domain names, in-game digital assets, digital carbon credits, crypto token and non-fungible tokens. Says the Report.

Laws Of England and Wales are Flexible To Adapt Changes:

Being the common law system, the Laws of England and Wales over the last 15 years or so has proven its flexibility in adapting the changes by recognising certain digital assets as things to which personal property rights can relate.

Areas of Legal Uncertainty Are High and Complex:

Even though certain digital assets are being recognised still it is not sufficient to clearly navigate them and there is a high rate of legal uncertainty. The digital assets is a complex area and still it continues to evolve with the growth of technology.

Law reforms are not enough:

Initially they were appointed to give recommendations on how to accommodate the NFTs and cryptos in the existing legal Framework and give recommendations but they ended up giving recommendations to introduce a new law which is completely against the purpose for which it was constituted.

The Reform Committee stated that even though Law reforms can be brought and changes can be made to the existing personal property rights.

Third Category is the Need of the Day:

The Report in their summary of recommendations states that

“We conclude that some digital assets are neither things in possession nor things in action, but that nonetheless the law of England and Wales treats them as capable of being things to which personal property rights can relate.”

The report states that There should be a third category to accommodate the Digital assets since they won’t fall into the first two category namely:

Thing in Possession (eg. Car) and Thing in Action (eg. Debt.). Since these two category cannot be applied for all the Digital assets There should be Third category which personal property rights can relate.

Panel of Experts Should be Constituted:

Another recommendation of the Group was to appoint a panel of Expertsto advise the court on legal issue relating to digital assets.

UK to become a Global Hub for Crypto assets:

Current PM Rishi Sunak, when he was a Finance Minister on April 2022, stated that he wanted to make Britain a Global Hub for crypto asset technology.

He asked the Law Commission to review whether current laws can accommodate digital assets was the seed sown for Today’s Report.

Committee states the recommendations put forth before them is a way closer to achieve their dream of UK becoming a “Global Hub” in the future.

The Recommendations are welcomed by authorities:

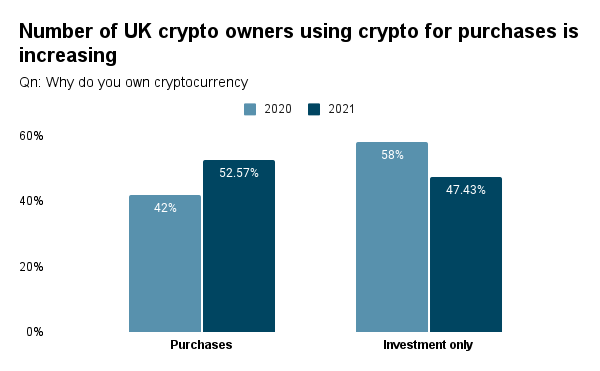

Sarah Green, Law commissioner for commercial and common law said that the use of digital assets has grown significantly in the last few years.

Is UK ready for the Change?

If the recommendations are to be accepted then UK will open the doors of its country’s law for the third category named as Digital Assets.