The shares of Vodafone Idea (VIL) have dropped approximately 19% per cent on Tuesday as the debt-ridden Company revealed it was converting a $16,000 crore interest dues liability to the Government into equity. On both the BSE and the NSE, the shares dropped 18.85% to $12.05.

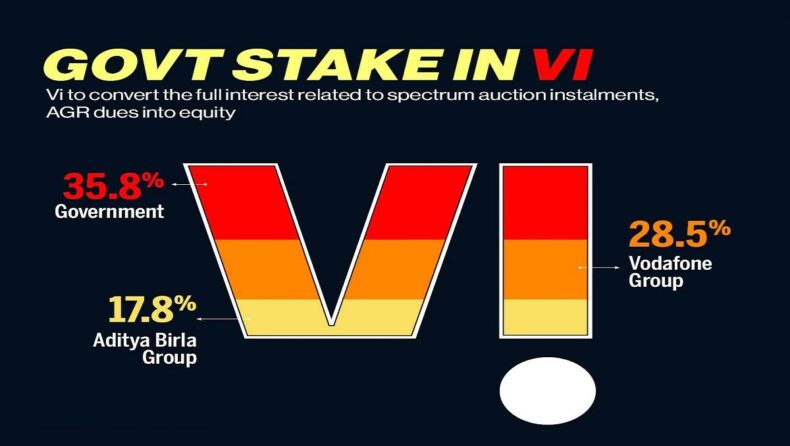

According to a regulatory filing, VIL has converted approximately $16,000 crore in interest dues liabilities to the Government into equity, resulting in a 35.8% stake in the Company.

With a debt load of about 1.95 lakh crore, the Government will become the Company’s most significant investor if the plan is approved.

By transforming the NPV of the accumulated interest into equity, the Government has given telecom operators the option of paying interest on postponed spectrum instalments and AGR dues for four years.

In the form of equity shares, the stock will be accessible for purchase to the Government at a par value of $10 per share, subject to the Department of Transportation’s final approval. At the relevant date of August 14, 2021, the average price of the Company’s shares was less than the par value.

“As a result of the conversion, all Company’s current shareholders, including the promoters, will be diluted. Following conversion, the Government own roughly 35.8% of the Company’s total outstanding shares.

In contrast, promoter shareholders will own around 28.5 per cent (Vodafone Group) and 17.8 per cent (Aditya Birla Group) “a Group),” according to the filing.

Vodafone Idea shares crack 19% after board offers 35.8% stake to Government

According to reports, the Government will become the Company’s single-largest stakeholder, with a 35.8% stake. Vodafone Idea‘s stock has dropped 19% today. The telco’s board of directors approved converting the whole amount of interest related to spectrum auction instalments and AGR dues into equity.

The Vodafone Idea stock began at Rs 13.40, down 9.76 per cent from its previous finish of Rs 14.85 on the BSE.

In the last three days, the telecom stock has dropped 13.4 per cent. The price of Vodafone Idea is higher than the 50-, 100-, and 200-day moving averages but lower than the 5- and 20-day moving averages.

On the BSE, 797.1 lakh Vodafone Idea shares changed hands, resulting in a turnover of Rs 102.32 crore. The telco’s market capitalization has dropped to Rs 38,792 crore.

In a year, Vodafone Idea’s stock has risen 14.88 per cent, but it has fallen 14.12 per cent since the beginning of this year. The promoter shareholders will own 28.5 per cent of the Company (Vodafone Group) and roughly 17.8 per cent of the Company (Aditya Birla Group).

“According to the Company’s best calculations, the Present Net Value (NPV) of this stake will be around Rs 16,000 crore, pending confirmation by the DoT. The stock will be available for purchase in the form of equity shares.

To the Government at par value of Rs 10/- per share, subject to final confirmation by the DoT, because the average price of the Company’s shares at the relevant date of 14.08.2021 was below par value.

Result of the conversion, all existing shareholders of the Company, including the Promoters, will be diluted. “According to the firm.

Tata Teleservices, like Voda Idea, has decided to convert AGR dues into equity.

According to a regulatory filing, the Government expects to retain around 9.5 per cent of the total outstanding shares of the telco after conversion.

Tata Teleservices announced on Tuesday that it would convert the entirety of its interest adjusted gross revenue dues (AGR) into equity.

According to a regulatory filing, the Government expects to retain around 9.5 per cent of the total outstanding shares of the telco after conversion. According to the telco, the Present Net Value (NPV) of this interest is projected to be around Rs 850 crore, subject to DoT approval.

Based on the interest amount, the NPV will be calculated. According to the statement, this interest sum will be recognized as a loan to the Company until the equity infusion process is completed—the day of option execution.

“According to the computation technique specified in the DoT Communication, at the relevant time, the average price of the company’s shares date of August 14, 2021, works out to be roughly Rs 41.50 per share, subject to final approval by the DoT.”

In a conversion, all of the Company’s existing shareholders will be diluted.

The Government has provided telecom operators with the option of paying interest on postponed spectrum instalments and AGR dues for four years by converting the NPV of the interest amount into equity.

According to a telecom regulatory filing, business, debt-ridden Vodafone Idea (VIL) has chosen to convert roughly Rs 16,000 crore in interest dues liabilities payable to the Government into equity, which will equal around 35.8% share in the Company.

Vi’s stock fell more than 20% today on the BSE after the announcement, closing at Rs 11.80 a share. Tata Teleservices’ stock closed at Rs 291.05 per share on the BSE on Tuesday, up 5%. Over a year, the scrip has increased in value.