On Friday the Reserve Bank of India to control the rising inflation raised lending rates straight 4 times in a row.

5.9 Repo Rate hike by RBI

The (MPC) Monetary policy committee with three members from the RBI and three external members lent the 5.9 repo rate by 50 bps (basic points) in favor of this there were almost five out of six voted for this.

Since the first unscheduled meeting hike in May the RBI now has raised rates by a total of 190 basis points but inflation is still becoming high day by day. It is one of the problems and it is a concern for the global economy.

Earlier the depreciation of the Rupees made the US feds hike the interest rate by triple with 75 basis points so the other major central banks adopted to become more aggressive in the matter of raising rates.

The retail inflation rate has risen above 7% again and the Rupees by 9.5% since the RBI’s last policy meeting, after the meeting with US Federal Reserve last week the pressure on the currency is increasing.

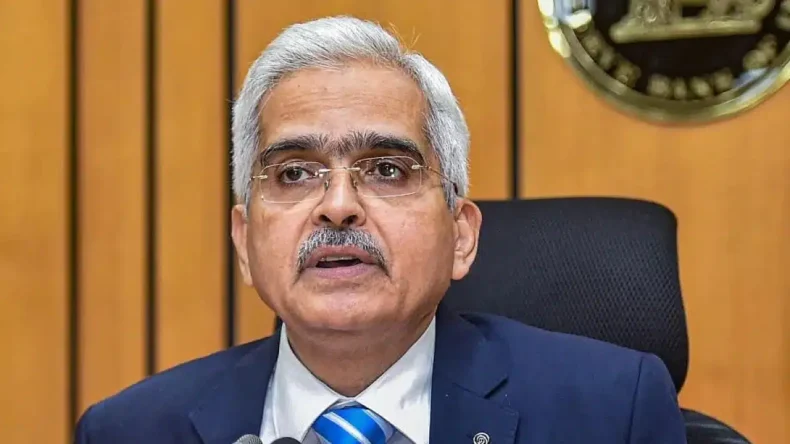

According to the Governor of RBI Shantikanta Das, the effect of global inflation is dependent on the domestic market.

In April the Central bank slashed the GDP growth to 7.2 percent from its earlier 2022-23 forecast of 7.8 percent.

As Mr. Das accompanied the MPC’s decision he stated that the rise of inflation is due to all geo-political problems and the sentiments of the nervous global financial market.

He also stated that the MPC already viewed the endurance of the high inflation, but the demand withdrew monetary accommodation to avoid the price pressure, and the expectation of anchor inflation contained the effects of the second round.

Read More: PFI is banned in India for five years: why it happened and what are its effects?