The government and LIC will support the merger if the new acquirer wants to combine IDBI Bank with itself or must do so. This would lessen investor worries about the bank’s continued government and LIC ownership, a common issue with prospective buyers. The new owners aim to reduce the amount of IDBI Bank stock they own to comply with established standards for private banks.

The Life Insurance Corporation (LIC), which was enlisted as a corporate defender during India’s bad loan crisis, and the government jointly own a 60.7% share in IDBI Bank. The government has started the process of selling this stake strategically. At that time, a special dispensation was granted so that LIC could assume control of the majority of the bank’s shares.

With its IPO, LIC’s unique status has been somewhat diminished, and its ownership of a bank is peculiar. In the interim, IDBI Bank has recovered following the capital infusion. After the bank’s lending resumed, this second attempt at a strategic sale of IDBI Bank has a better chance of succeeding. The sale was swiftly approved by the government, and now that several roadshows have concluded, the transaction may help close a small gap in the fiscal year’s disinvestment target.

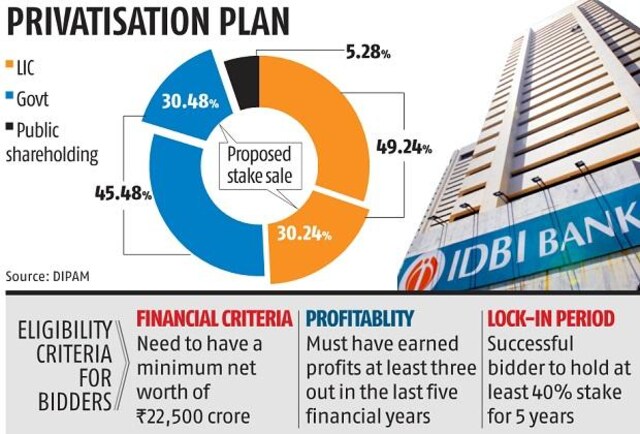

LIC, the bank’s current promoter, owns 49.24% of the company; the government owns 45.48%. 5.28% are held by public shareholders.

Only parties who meet the requirements for the deal, obtain clearance as a “Fit & Proper” firm from the Reserve Bank of India, and then obtain a security clearance from the Government of India/Ministry of Home Affairs would be given consideration as eligible bidders.

Strategic investors who are interested in buying the bank have until October 28 to submit any questions they may have regarding the preliminary information memorandum released on Friday. Expressions of interest must be submitted by December 16 of this year.

The IDBI Bank Limited (IDBI Bank or IDBI), a division of the Life Insurance Corporation of India (LIC), is owned by the Indian government’s Ministry of Finance. The Industrial Development Bank of India, a development finance organisation that offered financial services to the industrial sector, was founded in 1964. The organisation was grouped under the “other public sector banks” category after merging with its commercial division, IDBI Bank, in 2005 to create the current banking company.

Later in March 2019, the Government of India asked Life Insurance Corporation to manage the bank to comply with regulatory requirements as well as to inject capital into the bank due to high NPA and capital adequacy issues. The RBI immediately corrected IDBI, and on March 10, 2021, IDBI was released from PCA.

The bank employed 16,555 people as of the end of March 2015, including 197 people with impairments. On that date, bank employees were 34 years old on average. During the fiscal year 2012–2013, the bank recorded a business of 25.64 crores and a net profit of 12.17 lakhs per employee. During the same financial year, the corporation lost 1,538 crores on employee benefit expenses. The employees will continue to receive the same perks and have the same level of job security as guaranteed by the bank’s MD and CEO even if LIC is granted promoter status.

The Center has hired “Link Legal” as its legal counsel and KPMG India as its transaction advisor to provide advisory services and manage the deal.

On October 7, 2022, the government issued a preliminary information document to solicit expressions of interest from potential buyers, kicking off the process for the strategic disinvestment of IDBI Bank with the transfer of management control.