A cognitive bias known as the Dunning-Kruger effect may have an impact on startups. It causes people who are less skilled or knowledgeable in a given field to overestimate their skills and knowledge.

Table of Contents

Dunning-Kruger effect

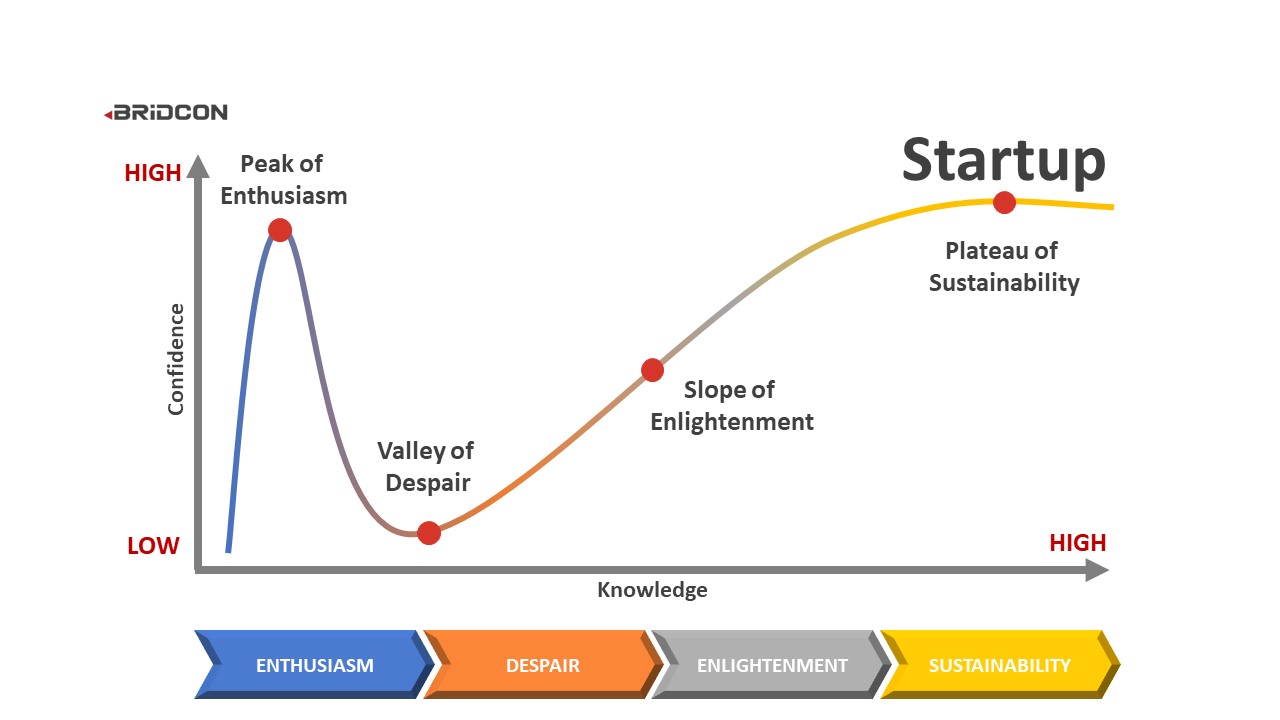

The tendency of people with limited aptitude or competence in a certain subject to overestimate their abilities and knowledge is known as the Dunning-Kruger effect, which is a cognitive bias. Those who suffer from this bias may be overconfident in their talents, which can cause them to make poor decisions and overestimate how tough a task would be. On the other hand, those with high degrees of proficiency or ability may undervalue their skills and knowledge since they are aware of how much they still need to acquire or master.

Several facets of life, such as decision-making, leadership, finances, and even business, are affected by the Dunning-Kruger effect. It is critical to be conscious of this prejudice and take action to lessen its impacts, including seeking out different viewpoints and comments, completing in-depth research, and engaging in acts of self-awareness and humility.

Due to their inability to recognise their deficiencies due to a lack of expertise, entrepreneurs are more prone to make bad choices and draw incorrect conclusions. In other words, they are unaware of their ignorance.

Entrepreneurs with less experience succumb to an illusion of superiority and overestimate their level of understanding. But, occasionally we observe the opposite, where more seasoned business people underestimate their degree of expertise and slide into an illusion of inferiority.

Impact of Dunning-Kruger Effect on startups

First off, founders who experience the Dunning-Kruger effect could exaggerate their capacity to recognise and respond to market demands. This may result in inadequate market research and a poor product-market fit, which could ultimately lead to failure.

Second, founders who experience the Dunning-Kruger effect could overestimate their capacity to handle money and run a profitable company. This may result in careless money management, excessive spending, and eventually bankruptcy.

Thirdly, the team dynamics within a start-up can be impacted by the Dunning-Kruger effect. Overconfident founders may be less open to criticism and less ready to work together with team members, which can result in poor communication and a lack of team cohesion.

The Dunning-Kruger effect also causes traders to overestimate their capacity to evaluate financial data and place profitable deals. This may result in trading losses and poor performance as a result of overconfidence and a lack of discipline.

Image Source- Manchester Digital

How to mitigate the impact of the Dunning-Kruger Effect

- Seek out feedback from others: Feedback from others should be aggressively sought by founders. This group of people should be diversified and include advisors, potential consumers, and industry professionals. This can assist them in finding blind spots and gaining a more impartial perspective of their service or enterprise.

- Conduct thorough market research: To understand their target market, market trends, and rivals, founders should perform thorough market research. They can avoid overestimating their capabilities and have a more accurate view of the market as a result.

- Work together as a team: Founders should encourage a spirit of cooperation and open communication among their employees. They can avoid the traps of overconfidence and have a deeper grasp of their company as a result.

- Practice self-awareness and humility: Self-awareness and humility are virtues that founders should cultivate. They should be conscious of their own limits and biases and take steps to overcome them. This may entail looking for chances for both professional and personal growth as well as pausing to consider their choices more carefully.

By following these steps, founders of startups can mitigate the impact of the Dunning-Kruger effect and result in the success of the startup.