HDFC Bank was established in Mumbai, Maharashtra, India, in 1994 as a Housing Development Finance Corporation subsidiary. Manmohan Singh, the Union Finance Minister at the time, opened the company’s first corporate office and full-service branch at Sandoz House, Worli.

On Tuesday, the private HDFC Bank reported that loans increased by 23.5% to Rs 14.80 trillion in the second quarter of this fiscal year. The private HDFC Bank said on Tuesday that loans increased by 23.5% in the second quarter of this fiscal year to Rs 14.80 lakh crore.

As of September 30 of last year, the credit book stood at Rs 11.98 lakh crore. According to HDFC Bank’s regulatory filing, the bank’s advances increased by approximately 25.8% between September 30, 2021, and that date, gross transfers made through inter-bank participation certificates and bills were discounted.

It added that as of September 30, 2022, the bank’s deposits totaled approximately Rs 16.73 lakh crore, nearly 19 percent more than September 30, 2021’s Rs 14.06 crore.

The bank purchased loans totaling Rs 9,145 crore through direct assignment during the quarter that ended September 30, 2022, as part of the home loan arrangement it had with its parent company, Housing Development Finance Corporation Limited.

HDFC Bank Shareholder:

For every 25 shares held, each HDFC shareholder will receive 42 HDFC Bank shares. According to the BSE’s observation letter, the company is advised to disclose the specifics of any and all actions taken by Sebi or any other regulator against any of the entities, including its directors/promoters and promoter group, in the petition that will be filed before NCLT.

In a deal valued at approximately USD 40 billion, India’s largest private lender HDFC Bank agreed to acquire the largest domestic mortgage lender, establishing a financial services titan. The proposed entity will have approximately Rs 18 lakh crore in total assets.

Subject to regulatory approval, the merger is expected to be finished by the second or third quarter of FY24. Public shareholders will own 100% of HDFC Bank when the deal goes into effect, and existing HDFC shareholders will own 41% of the bank.

Yes, Bank stated in a separate filing that loan growth for the quarter increased by 11.6% to Rs 1,92,809 crore, compared to Rs 1,72,839 crore in September 2021. As of September 30, 2022, the bank’s deposits totaled Rs 2,00,020 crore, an increase of approximately 13.2% from Rs 1,76,672 crore as of September 30, 2021.

FY23 Quarter

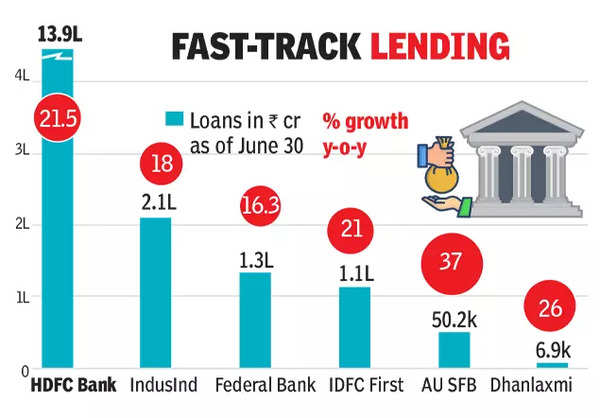

In the first quarter of FY23, advances at India’s largest private lender, HDFC Bank, increased by 21.5% year-over-year (YoY) to Rs 13.95 trillion. On June 30, 2021, advances totaled Rs 11.48 trillion. The lender informed the exchanges that the bank’s loans increased sequentially by 1.9% from Rs 13.69 trillion on March 31. HDFC Bank’s deposits increased by 19.3% year-over-year to Rs 16.05 trillion on June 30 from Rs 13.46 trillion a year earlier.

As of March 31, the bank’s deposits had increased by 2.9% on a quarterly basis to Rs 15.59 trillion. “HDFC Bank’s QoQ (quarter-on-quarter) growth was slightly softer, despite the fact that the lending sector generally experienced a weak first quarter. According to Prabhudas Lilladher research analyst Gaurav Jani, this resulted in a lower LDR (loan-to-deposit ratio), which may have a negative impact on NIM (net interest margin)

Stock exchanges have given their blessing to the proposal to combine HDFC and its banking subsidiary, HDFC Bank—the largest transaction in the history of Indian business.

Both the stock exchanges have approved HDFC and HDFC Bank. According to a filing, HDFC Bank has received observation letters stating “no adverse observations” from BSE Limited and “no objection” from the National Stock Exchange of India Limited, both dated July 2, 2022.

Scheme approvals from the Reserve Bank of India

It stated, “The scheme remains subject to various statutory and regulatory approvals, including approvals from the Reserve Bank of India, the Competition Commission of India, the National Company Law Tribunal, and the respective shareholders and creditors of the companies involved in the scheme, as may be required.”

Other regulatory approvals include the National Company Law Tribunal. Prior to that, on April 4, the largest private lender in India, HDFC Bank, agreed to acquire the largest domestic mortgage lender in a transaction valued at approximately USD 40 billion, establishing a financial services titan.

The proposed entity will have approximately Rs 18 lakh crore in total assets. Subject to regulatory approval, the merger is expected to be finished by the second or third quarter of FY24. Public shareholders will own 100% of HDFC Bank when the deal goes into effect, and existing HDFC shareholders will own 41% of the bank.