Author: Tushar1912garg

Reliance Industries Limited (RIL), the parent company of Jio Financial Services (JFS), is likely to announce the listing date for the latter during its upcoming annual general meeting. This move comes after JFS recently formed a joint venture with BlackRock Inc, a US-based financial services firm, to introduce asset management services in India. The listing of JFS is seen as a strategic step by RIL to expand its presence in the promising financial services sector, leveraging its existing non-bank financial company license. Expanding in the Financial Services Sector The demerger of JFS from RIL reflects the conglomerate’s ambition to grow…

LIC Housing Finance, a prominent player in the Indian housing finance sector, reported robust earnings for the first quarter of the fiscal year 2024. The company’s net profit surged by an impressive 43 percent, reaching Rs 1,324 crore, driven by strong demand for housing loans in the country. Robust Growth in Net Profit and Net Interest Income (NII) LIC Housing Finance started the fiscal year on a high note, with a remarkable 43 percent increase in standalone net profit during the first quarter. The company’s net profit soared to Rs 1,324 crore, fueled by robust demand for housing loans across…

Varthana Finance, a prominent school finance company based in Bengaluru, faced a decline in scale over the past two fiscal years. Its revenue, which stood at Rs 211 crore in FY21, dipped to Rs 190 crore in FY22, and further decreased to Rs 183 crore in the fiscal year ending in March 2024. The company’s revenue from operations contracted by 3.4% during FY23, as indicated by its annual financial statements filed with the Registrar of Companies. Empowering Education in India: Established in 2013, Varthana Finance operates as a non-banking finance company (NBFC) specializing in providing credit to low-budget private schools…

Shriram Housing Finance, a fast-growing Housing Finance Company (HFC) in India, has revealed its plans for fundraising and the factors impacting its financial performance in an exclusive interview on August 2, 2024. The company’s Chief Financial Officer, GS Agarwal, shared insights on their strategy to raise capital, the increasing cost of funds, and the shifts in the loan portfolio. Fundraising Plans: NHB Refinancing and Debt Capital Market Instruments Shriram Housing Finance plans to raise Rs 300-500 crore through the refinancing scheme of the National Housing Bank (NHB) in Q2FY24. This initiative comes after the company successfully raised Rs 740 crore…

Five Transformative Trends Shaping the Financial Landscape which are crucial for World Finances. On World Fintech Day 2024, fintech experts unveil five trends revolutionizing money interactions and financial services, reshaping the financial industry’s landscape. India’s fintech ecosystem, with its large tech-savvy population and increasing smartphone penetration, has experienced significant advancements. A report by Chiratae Ventures and Ernest and Young (EY) projects that the Indian fintech market is set to achieve a 10X growth, reaching $1 trillion in Assets Under Management (AUM) and $200 billion in revenue. These trends are transforming how individuals engage with money, payments, and financial services, paving…

SBFC Finance Ltd, a prominent non-banking finance company, is all set to open its initial public offering (IPO) for subscription on August 3, offering a window of opportunity to investors to be part of its growth journey. With a price band set between ₹54 to ₹57 per equity share, the IPO comprises a fresh issuance of equity shares worth ₹600 crore and an offer for sale (OFS) of ₹425 crore. The total offer size of the SBFC Finance IPO now stands at ₹1,025 crore. The IPO has garnered significant interest from investors, evident from the grey market premium of +38…

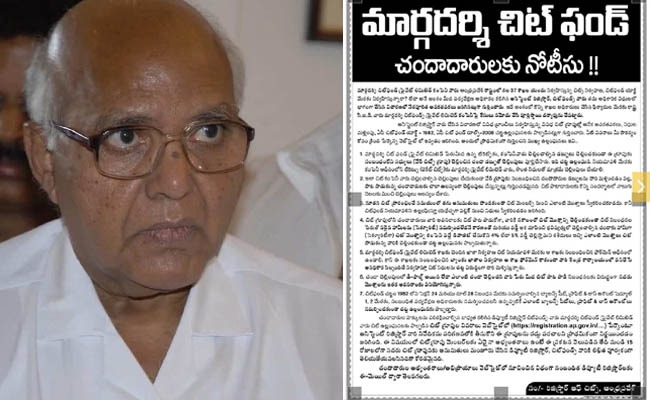

The relationship between the YSR Congress Party (YSRCP) government and the media house Eenadu has always been marked by tension and controversy. While YS Rajasekhara Reddy, the former Chief Minister of Andhra Pradesh, expressed concerns about the daily’s alleged bias against his government, his son and current Chief Minister YS Jagan Mohan Reddy has taken a different approach. Rather than relying on verbal accusations, the YSRCP government is now using financial measures to counter the influence of Margadarsi Finance and Margadarsi Chits, entities associated with the Eenadu group. This article explores the recent actions taken by the government, their impact…

BJP State President, Daggubati Purandeswari, has brought the alleged financial irregularities committed by the Andhra Pradesh government to the notice of Union Finance Minister, Nirmala Sitharaman. In a representation submitted in New Delhi on July 27, Purandeswari highlighted concerns about the State government’s approach to raising loans and managing its fiscal responsibilities. She accused the YSR Congress Party (YSRCP) government of mismanagement, resulting in a significant increase in the State’s debt burden. The accusations of mismanagement, reliance on speculative revenues, and diversion of funds demand prompt attention and action. Financial Mismanagement and Rising Debt: Purandeswari raised concerns about the State…

Singapore-based non-banking finance company (NBFC) SBFC Finance, backed by Clermont Group, is set to launch its initial public offering (IPO) on August 3. The IPO aims to raise Rs 1,025 crore, with a combination of fresh issuance of shares worth Rs 600 crore and an offer for sale (OFS) of Rs 425 crore by the promoters. With a focus on the MSME sector, SBFC Finance has recorded impressive financial performance, attracting investor interest as it enters the public market. Offer Details and Timeline: The public issue will remain open for subscription from August 3 to August 7. Before the IPO…

Asirvad Microfinance, a subsidiary of the listed non-banking financial company (NBFC) Manappuram Finance, is gearing up for an initial public offer (IPO) to raise around Rs 1,500 crore. The firm has selected three investment banks, JM Financial, Nomura, and Kotak Mahindra Capital, to manage the IPO. Asirvad Microfinance’s decision to go public comes as the regulatory environment for the microfinance segment becomes more favorable, coupled with positive analyst outlook for the sector and the buoyant capital markets. This move underscores the company’s ambitions for expansion and growth while riding on the optimism in the microfinance industry. Trigger for IPO Plans:…

Contact us:

Copyright © 2024 Asiana Times. All Rights Reserved