On Wednesday, Joe Biden signed an executive order with a narrow scope, aimed at restricting specific US investments in sensitive technological areas within China. Additionally, the order mandates that government notification is required for funding in other technology fields.

Caption: On August 9, 2024, President Joe Biden discusses the impact of “Bidenomics” on clean energy and manufacturing at Arcosa Wind Towers in Belen, New Mexico.

This highly anticipated order grants authority to the US Treasury Secretary, allowing them to limit or prevent certain American investments in Chinese companies operating within three sectors: semiconductors and microelectronics, quantum information technologies, and specific artificial intelligence systems.

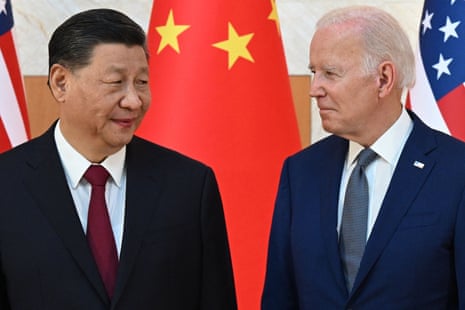

In a communication addressed to Congress, Biden explained that he was invoking a national emergency to address the risk posed by countries like China advancing in areas crucial to military, intelligence, surveillance, and cyber capabilities.

China’s substantial progress in these domains is viewed as “an exceptional and uncommon threat to the national security of the United States.” The order asserts that particular US investments “have the potential to worsen this threat,” as reported by Reuters news agency.

US Worries: China’s Military Rise and Tech Dependence

Washington’s apprehensions revolve around two main concerns. Firstly, there’s the worry that China’s People’s Liberation Army (PLA) could potentially outstrip the overall military might of the US. Secondly, there’s the fear that China could exploit American technology to achieve this.

President Xi Jinping has mandated the transformation of the PLA into a “world-class” military force by 2049, marking the 100th anniversary of the Chinese Communist Party’s (CCP) rule. A significant aspect of this transformation involves the development of autonomous weaponry, including hypersonic missiles, and the integration of artificial intelligence (AI) across various applications, including electronic warfare.

Caption: The rivalry in cutting-edge technology between the US and China continues unabated.

The extent of China’s progress towards this objective remains unclear. According to the US Department of Defense’s annual report on China’s military capabilities, the PLA is actively “pursuing next-generation combat capabilities” that heavily incorporate advanced technologies like artificial intelligence at all levels of warfare.

While China holds a leadership position in specific AI applications, such as facial recognition, its domestic semiconductor industry is not yet capable of producing the most advanced chips that power these technologies. As a result, Chinese enterprises, including the military, rely on imports to acquire these sophisticated chips.

The United States aims to halt this dependency by severing this supply line.

Undermining China’s semiconductor sector

The order aims to increase pressure on China’s semiconductor sector, which heavily relies on foreign-made equipment for chip design and manufacturing tools.

Beijing has been actively nurturing its fledgling domestic industry and investing significantly in establishing robust fabrication plants, also known as fabs. This field has traditionally been dominated by the US, Japan, and the Netherlands.

Caption: Next year, the order curbs investments in Chinese semiconductors, microelectronics, quantum tech, and AI.

The Biden administration contends that these restrictions target the most pressing national security concerns, without intending to sever the closely intertwined economies of both nations.

Meanwhile, the response to this move has been mixed, with the Democratic Party commending the decision while the Republicans argue that the prohibitions should have encompassed broader areas.

Democrats approve, Republicans demand more

Chuck Schumer, Senate Democratic Leader, remarked, “American funding has contributed to China’s military ascent for too long. Today marks the initial strategic move to prevent US investments from supporting Chinese military progress.”

Schumer emphasized the necessity of formalizing these limitations in legislation and refining their scope.

In contrast, Republicans expressed dissatisfaction, stating that the Biden order fell short.

Michael McCaul, Chair of the House Foreign Affairs Committee, commended the restriction on new investments in China but voiced concerns about the exclusion of existing technology investments, biotechnology, and the energy sectors.

The imposed restrictions will exclusively impact forthcoming investments, leaving existing ones unaffected, according to a statement from an administration official provided to Reuters.

An informed senior US official stated that the directive will become operational in the subsequent year, following multiple rounds of public feedback, which will include an initial 45-day period for comments.