Impact on Chip Prices in the Short Term

China’s recent decision to impose export restrictions on gallium and germanium has raised concerns in the global semiconductor industry. These two elements are crucial for the production of high-performance chips and have become even more vital as the demand for advanced electronics continues to surge. The export curbs are expected to have both short-term and long-term implications, with the immediate impact being felt in the form of increased chip prices.

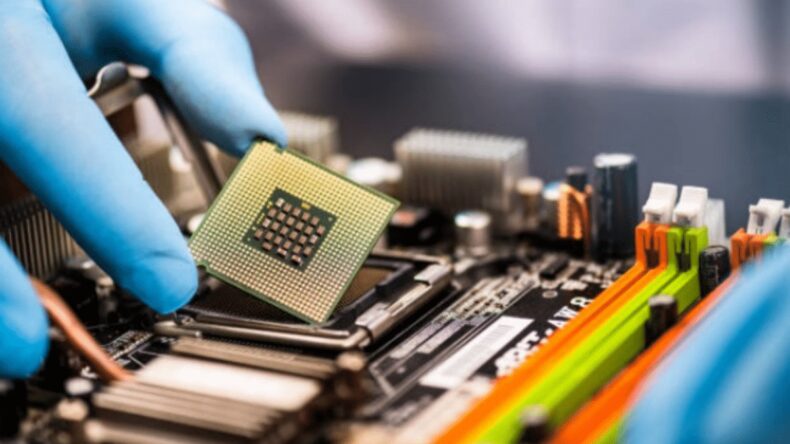

Gallium and germanium are essential materials used in the manufacturing of semiconductors, particularly in the production of high-frequency devices and optoelectronic components. With China being a major supplier of these elements, the export restrictions are likely to disrupt the global supply chain and lead to a shortage of raw materials for chip manufacturers. As a result, chip prices are expected to rise in the short term as companies face higher production costs and reduced availability of key materials.

The impact of increased chip prices will be felt across various sectors that rely heavily on semiconductor technology. Industries such as consumer electronics, automotive, telecommunications, and aerospace, which are already facing chip shortages, will face additional challenges as the cost of production rises. Consumers may also experience the effects of these price hikes, with potentially higher prices for smartphones, laptops, and other electronic devices.

Diversifying the Supply Chain in the Long Term

While the short-term consequences of China’s export curbs on gallium and germanium are concerning, there is also a silver lining in the long term. The restrictions have prompted many countries and companies to reassess their overreliance on a single source for critical materials and take steps towards diversifying their supply chains.

The semiconductor industry has long been aware of the risks associated with concentrated supply chains, as demonstrated by previous disruptions caused by natural disasters, geopolitical tensions, and other factors. The current situation serves as a wake-up call, accelerating efforts to reduce dependence on a single country for essential materials.

Countries like the United States, Japan, South Korea, and Taiwan, among others, are ramping up their efforts to enhance domestic production capabilities and forge strategic partnerships with other nations to ensure a stable supply of gallium and germanium. Additionally, chip manufacturers are exploring alternative materials or developing new technologies that can reduce the reliance on these restricted elements altogether. These initiatives will not only mitigate the impact of the current export curbs but also contribute to a more resilient and diversified supply chain for the future.

Implications for the Global Semiconductor Landscape

China’s export curbs on gallium and germanium highlight its growing influence and control over the global semiconductor industry. As the world’s largest producer and consumer of semiconductors, China holds a significant sway over the supply and pricing dynamics in the market. The recent restrictions on critical materials demonstrate its ability to disrupt global supply chains and exert pressure on other countries.

The geopolitical implications of China’s actions extend beyond chip prices and supply chain diversification. They raise concerns about the future competitiveness of other semiconductor-producing nations and the potential for increased tensions in the global technology landscape. As countries seek to reduce their dependence on China, they may intensify efforts to develop their own domestic semiconductor industries or form alliances to collectively address the challenges posed by China’s dominance.

The export curbs also present an opportunity for emerging semiconductor-producing nations to step up their efforts and gain a larger share of the global market. Countries like India, Vietnam, and Malaysia, which have been actively investing in their semiconductor industries, could benefit from the shift in supply chain dynamics. They could attract investments and partnerships from multinational corporations seeking to diversify their operations and mitigate risks associated with concentrated supply chains.

Gallium and germanium are expected to raise chip prices in the short term, leading to challenges in various industries. However, the long-term impact may drive positive change by diversifying the global supply chain and reducing dependence on a single country. These restrictions emphasize the need for countries to enhance domestic production capabilities and forge strategic partnerships. Furthermore, they highlight the geopolitical implications and potential for increased competition in the global semiconductor landscape. The industry is now faced with the task of building a more resilient and diversified ecosystem to ensure stable chip supply in the face of future challenges.