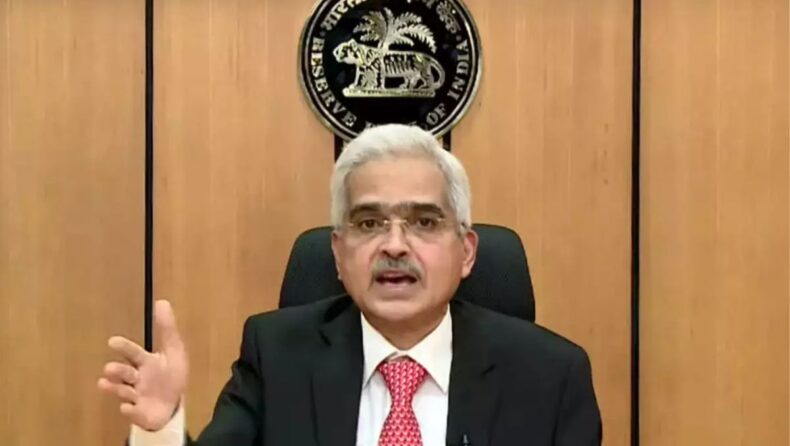

Shaktikanta Das, Governor of the Reserve Bank of India (RBI), stated on Wednesday that recent trade agreements and geopolitical conditions open up potential market opportunities for India.

Observing that India’s external sector has remained resilient in the face of formidable global headwinds, he stated that preliminary data indicate that merchandise exports will remain strong in April 2022 and services exports will reach a new high in March 2022.

Shaktikanta Das, Governor of the Reserve Bank of India (RBI) Says,

“Because of geopolitical conditions and recent trade agreements, potential market opportunities have emerged. Major information technology (IT) companies’ strong revenue guidance also bodes well for the overall external sector outlook in 2022-23.”

“Despite some recent moderation, net foreign direct investment flows have remained robust. Long-term flows, such as external commercial borrowings, remain stable as well. India’s foreign exchange reserves are substantial, with net forward assets serving as a strong backup. At 20%, the external debt-to-GDP ratio remains low.”

“As a result, I would like to emphasize that today’s monetary policy actions aimed at lowering inflation and anchoring inflation expectations will strengthen and consolidate the economy’s medium-term growth prospects.”

“We remain concerned about the potential short-term impact of higher interest rates on output. As a result, our actions will be calibrated. I’d like to emphasize that monetary policy remains accommodative, and our approach will be to focus on a careful and calibrated withdrawal of pandemic-related extraordinary accommodation, while keeping the inflation-growth dynamics in mind.”

Liquidity

In terms of liquidity, Das assured that the RBI will ensure adequate liquidity in the system to meet the productive needs of the economy in order to support credit offtake and growth.

According to the April policy, several liquidity management measures were implemented in line with the shift in monetary policy stance, including the restoration of a symmetric LAF corridor around the policy repo rate and the implementation of the standing deposit facility (SDF).

Monetary Policy

These measures operationalize the priority accorded to maintaining price stability while keeping the goal of growth in mind. According to him, monetary policy must create an environment in which inflation persistence is broken and inflation expectations are re-anchored.

With the pandemic receding and the steady broadening of growth as economic activity regains and exceeds pre-pandemic levels, he added, headroom for this reordering of priorities is becoming available.

He stated that banking system liquidity has remained comfortable since the April policy announcement, observing that liquidity conditions must be modulated in accordance with policy action and stance to ensure full and efficient transmission to the rest of the economy.

Conclusion

During April 8-29, 2022, total absorption through SDF and VRRR auctions amounted to Rs 7.5 lakh crore. Due to the large liquidity overhang in the form of daily surplus funds parked under the SDF (average of Rs 2.0 lakh crore from April 8-29, 2022), the WACR has fallen below the SDF rate.

With bid-cover ratios of 14 and 28 days for 14-day VRRR auctions as well as the USD/INR sell-buy swap auction on April 26, banks appear to be responding well.

The CRR will be increased to 4.5 percent of net demand and time liabilities (NDTL) effective May 21, 2022, in line with the earlier announcement of gradual withdrawal of liquidity over a multi-year time frame.

The amount of liquidity withdrawn as a result of this increase in the CRR would be in the range of Rs 87,000 crore. Sustained high inflation inevitably harms savings, investment, competitiveness, and output growth, and that it has a pronounced negative impact on the poorer segments of the population by eroding their purchasing power.

Published By : Chittajallu H S Kumar

Edited By: Kiran Maharana