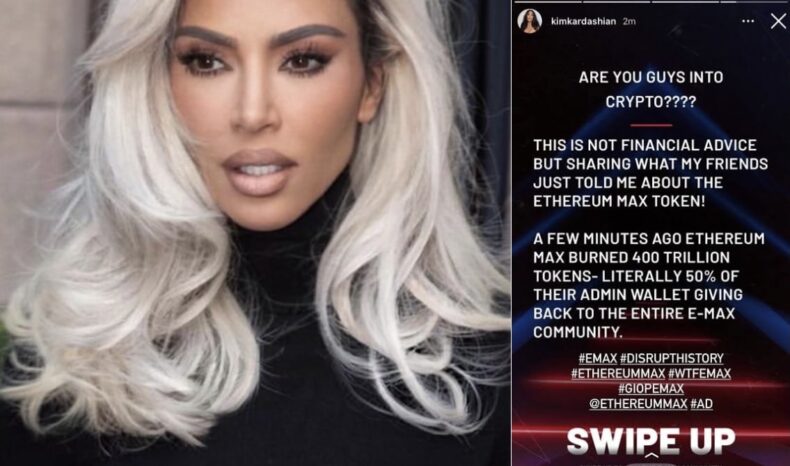

Kim Kardashian will fork out $1.26 million (or £1.12 million) as per the settlement agreement between her and EthereumMax.

What is EthereumMax

The question of what is EthereumMax (EMAX), the token she shilled, is just one of several that arise in the wake of Kim Kardashian’s $1.26 million regulatory sanction this week for improperly pushing a cryptocurrency.

Ethereum is not the second largest cryptocurrency, but rather the foundation upon which this token is constructed. Much like other cryptocurrencies, it makes grandiose claims about how it will change the world of money. Flashy advertisements and sidewalk stencils imploring readers to buy in to that vision are used to broadcast that vision to the world.

The Securities and Exchange Commission (SEC) ruled on Monday that any EthereumMax investor who read about the company’s plans to sign partnerships that “push value” into EMAX or heard its proponents anticipate price spikes would have a “reasonable expectation” of generating money.

EMAX is a form of investment.

The Kim Kardashian Case’s Specifics

According to the US Securities and Exchange Commission, the reality TV personality was paid $250,000 to promote cryptocurrency, but she neglected to disclose this.

Kim promised not to promote any assets backed by virtual currencies for the following three years.

Lawyer Robert Khuzami told BBC News that “Ms Kardashian is glad to have handled this problem with the SEC.”

The lawyer said that Kardashian had helped the SEC from the outset and would continue to do so.

She wanted to end this discussion as soon as possible to avoid a dispute that could drag on for a while.

To pursue her multiple business interests, “The arrangement she reached with the SEC permits her to do that so that she may move forward with her many diverse business pursuits.” The sentence makes sense.

Adopt a deceptive marketing strategy.

In January, investors launched a lawsuit against Ms. Kardashian, the boxer Floyd Mayweather Jr., the basketball star Paul Pierce, and the inventors of EthereumMax.

The lawsuit claims they conspired to “misleadingly promote and sell” the cryptocurrency as part of a “pump and dump” fraud, in which the value of the cryptocurrency is artificially inflated so that it may be sold to investors at a higher price.

At the time, EthereumMax fought back against the accusations.

Despite the name, EthereumMax has no official or commercial ties to the Ethereum cryptocurrency.

Uncertainty in the presentation

Review of the scenario by Joe Tidy, a cyber reporter

Each member of the public is capable of minting their own cryptocurrency coin.

To do this, all you need is a few extra pounds, a catchy name, and a YouTube tutorial.

There will be dozens of new token launches this month alone, all of which will boast that their coin is the next great thing.

Due to the low intrinsic worth of the product, the marketing of it is crucial, and, as in so many industries today, the involvement of a famous face can make all the difference.

At first glance, it seemed like EthereumMax’s plan of spending a lot of money to get famous people like Kim Kardashian was paying out.

But just as the rise in many cryptocurrencies was quick, so too was the fall.

Even if EthereumMax had maintained the value it gained from the celebrity pump, regulators in the US and UK would have been extremely wary of the manner the cryptocurrency was being promoted.

Although the Bitcoin industry as a whole remains mostly unregulated, Kim Kardashian joins a growing list of individuals and businesses that have been punished for promoting extremely risky products.

A shade of opacity in the presentation

Extremely open to speculation “reminder” remarked Gary Gensler, who chairs the SEC. “Ms. Kardashian’s case also serves as a reminder to celebrities and others that the law compels them to disclose to the public when and how much they are paid to encourage investing in securities,” said Gary Gensler, emphasising that just because a celebrity endorses a product doesn’t mean it’s a good investment.

Later, in a YouTube video dedicated to the topic of cryptocurrency investments, he commented on this idea as follows: “Celebrity endorsements… don’t mean that an investment product is good for you or even, frankly, that it’s legitimate. “

Even if the endorsement of a celebrity is authentic, every investment comes with its own unique set of possibilities and hazards.

Remember that many cryptocurrency assets are quite volatile.

It’s understandable if you’re wondering if this is actually anything useful or if it’s just a hoax.

READ MORE: https://tdznkwjt9mxt6p1p8657.cleaver.live/xrp-scam-hacked-omans-indian-embassy-twitter/