The emotional and cognitive components of financial behaviour are covered by the psychology subfield known as financial psychology. It examines the connection between a person’s feelings, ideas, and actions in respect to money, investments, and financial choices. When someone values saving money but spends excessively, cognitive dissonance may occur. This person’s financial actions do not reflect their financial values, which causes them to feel uncomfortable.

Although financial psychology is a relatively new discipline, it has recently attracted a lot of attention as a result of increased understanding of the influence of psychological variables on financial decisions.

Table of Contents

Cognitive dissonance

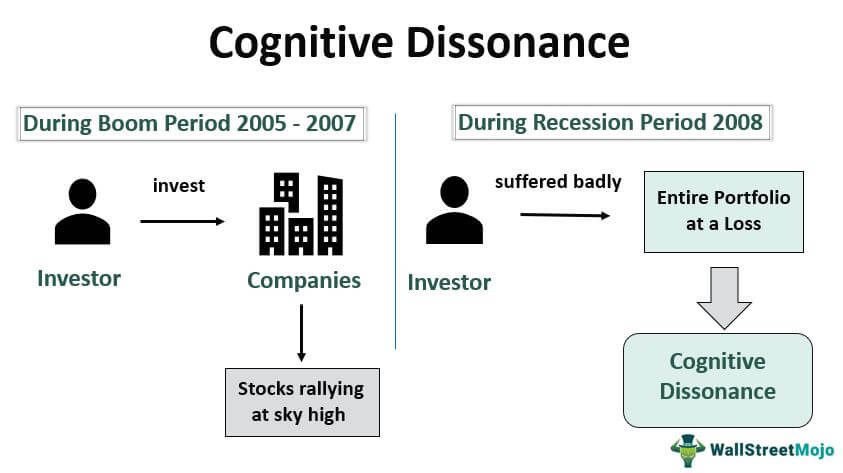

In psychology, cognitive dissonance is the uncomfortable mental state that results from having two or more opposing beliefs, values, or attitudes. Individuals are compelled to alter their attitudes, beliefs, or behaviours in order to alleviate the psychological pain or tension that this contradiction causes. The cognitive dissonance theory has profound effects on how people behave, make decisions, and persuade others.

When people make financial decisions that conflict with their prior decisions, cognitive dissonance can also develop. For instance, if someone who has continuously invested in a certain company decides to sell their shares, they can face cognitive dissonance. This person’s investment choice does not correspond to their prior investing behaviour, which causes psychological distress.

Image source- WallstreetMojo

Examples of cognitive dissonance affecting investment decisions

- Overconfidence Bias: Investors with overconfidence bias may have inflated expectations for their investment performance and experience cognitive dissonance as a result. An investor who thinks they can consistently outperform the market, for instance, can feel cognitive dissonance if their assets lag the market. The investor can be reluctant to acknowledge that they made a bad investment choice, which might encourage them to keep buying the failing stock.

- Confirmation Bias: Those who suffer from cognitive dissonance as a result of confirmation bias may disregard or reject information that goes against their expectations or beliefs. For instance, a shareholder who thinks a certain company is inexpensive can ignore unfavourable news about the business and keep holding the stock. The investor can be reluctant to acknowledge that they made a bad investment choice, which might encourage them to keep buying the failing stock.

- Social proof bias: Investors that suffer from social proof bias may base their investment decisions less on their own analysis and research and more on the actions of others. In the event that their assets underperform, for instance, an investor who heeds the counsel of a well-known financial guru can suffer from cognitive dissonance. It’s possible that the investor won’t admit they made a bad investment because they don’t want to look foolish, which may encourage them to keep buying the failing stock.

- Endowment Bias: Investors who suffer from endowment bias may place an excessive amount of value on the investments they already own. For instance, even if a stock’s price has decoupled from its fundamental worth, an investor who has a share that has appreciated greatly may overvalue the stock and still hold on to it. The investor can be reluctant to accept that they made a bad investment choice, which might encourage them to keep buying the overpriced stock.

How to reduce cognitive dissonance?

People can take a number of actions to lessen cognitive dissonance while making financial decisions.

First, people can aim to make their financial decisions consistent with their values and beliefs by being conscious of these. For instance, if a person prioritises ethical investing, they can look out for companies that share those beliefs and invest in them.

Second, people can look for knowledge and guidance that validates their investment philosophies and ideals. People might lessen the psychological pain brought on by cognitive dissonance by looking for facts that support their investment beliefs.

Third, people might utilise cognitive techniques like reappraisal or reframing to lessen the psychological pain brought on by cognitive dissonance.