If other countries do not follow suit, analysts presume that the US ban on Russian imports of crude oil will have minimal impact on Moscow

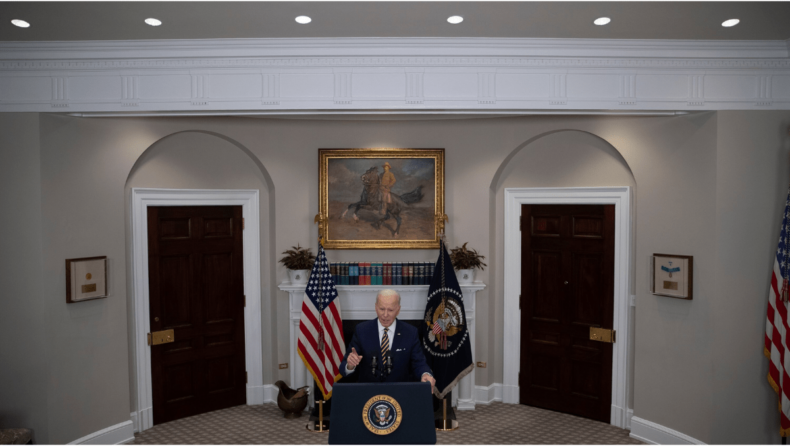

As US President Joe Biden announced a ban on Russian imports of energy, gas, and oil into the USA, crude oil prices recorded huge surges, along with record peaks in nickel prices.

President Joe Biden said that the USA plans to carry this ban out till the end of 2022. Whereas the USA has banned all crude oil imports from Russia, EU nations have announced that they would cut down Russian gas imports by two-thirds. EU nations receive nearly 40% of their gas supply from Moscow.

Moscow had already issued a warning that it would retaliate with its own set of sanctions if nations impose trade sanctions on Russian imports.

Russian President Vladimir Putin had warned that Russia would retaliate by cutting off natural gas supplies to all of Europe through the Nord Stream 1 pipeline.

How will this US ban on Russian crude oil imports impact the USA?

Less than 10% of the USA’s oil imports come from Russia. Nevertheless, analysts say that this symbolic move was an important step taken by the USA.

After the announcement, the USA recorded its highest ever peak at oil prices at $4 per gallon. This marks the highest surge in oil prices since the depression of 2008.

At this point, EU nations seem apprehensive about imposing an all-out ban on Russian oil imports which would seriously tamper diplomatic relations between the EU and Kremlin.

German Chancellor Olaf Scholz had already clarified that Germany, being Europe’s largest importer of natural gas from Russia has not made any plans about any potential ban on Russian imports.

This announcement puts inordinate pressure on the Biden administration to control oil prices in the USA having American middle-class families in their ambit of concern.

Details about Russian oil exports

Russia is one of the largest producers of oil in the world providing one of every ten barrels of the world consumed by all countries of the world.

However, since the latest issue of a range of sanctions on Russian imports by the USA, oil prices have surged across the world leading to the greatest oil crisis since the 1970s crisis of the Middle East.

Russia exports an average of 5 million barrels of oil in a day. Very few alternatives remain to the West to substitute such a huge amount of oil that Russia provides to the world.

This oil crisis comes right in the middle of an already worsening global oil crisis close in the heels of COVID 19 lockdowns in multiple countries across the world. Oil investment had greatly reduced due to COVID 19 market insecurities for the last two years.

Analysts presume that the latest sanctions on crude oil imports from Russia declared by the US will only worsen this already complicated global oil crisis.

What do energy analysts warn about future oil prices?

Energy analysts have warned that oil prices in the months ahead could go up to $160 or $200 per barrel if countries start banning Russian imports of crude oil.

At such high global oil rates, a gallon of oil in the US could cost up to $5, a situation that the Biden administration fears and intends to avoid at all costs.

On the other hand, commodities are recording an upsurge in prices ever since the declaration of the US ban.

The London Metal Exchange dropped trading in nickel after the metal recorded a price of $101,365 per tonne. Gold prices have surged to a record $2069.25, which marks the highest recorded gold price since August 2020.

The Russia-Ukraine crisis is expected to record skyrocketing prices of important commodities, including the oil in the months ahead.

Edited By: Kiran Maharana

Published By: Shramana Sengupta