In the midst of an economic slowdown, China is in four-year “trade war” with the United States. It has resulted in a total loss of USD 550 billion in import tariffs. Also, the vast majority of which are aimed at Beijing.

The trade war, combined with a slowing Chinese economy and the impact of the COVID-19 pandemic, has resulted in the World Bank. Therefore, predicting a significant slowdown in the global economy, as well as lower estimates for economic growth in the United States and China.

Why are the United States imposing new tariffs on China?

While China is not the only country that has been targeted, it is one of the most severely punished. So far, the United States has a massive trade deficit with the Asian giant. Another likely reason for the harsh action is the “theft of intellectual property” as mentioned in Trump’s announcement of the tariffs.

According to media reports, the tariff is intended to help correct the trade imbalance while also warning China to rein in its own aggressive trade practices. It remains to be seen whether this improves China’s behavior or leads to additional retaliatory measures. According to the two governments joint statement to the global media, while China does not want a trade war. Hence, it is preparing to defend its position if one occurs.

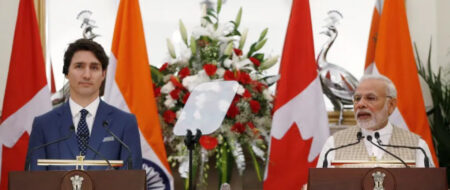

The Impact on India

For quite some time, India has been feeling the effects of the United States’ trade protectionism. The decline in US off-shore jobs and the latest H-1B visa rules, which may make it difficult for Indian IT professionals in the US to renew their visa applications, are two examples.

Although the full extent of the US-China trade war on India is unknown. The trade analysts have warned of deteriorating export volumes if the conflict escalates.

The impact on global trade

Trade experts are divided on whether this will have a positive impact on the global economy. Some argue that countries with the ability to provide replacement products to the US may benefit from Chinese import restrictions.

Meanwhile, the negative effects of the impending US-China trade war have already been felt, with global markets falling following the announcement of tariffs. The standoff between the two powerful economies may have an impact on global growth rates.

Inflation is another issue being highlighted as a result of the US-China fallout. The price increase would also have an impact on the US market, with imports becoming more expensive and possibly scarce.

Why is the shipping industry seriously concerned?

The shipping industry, which is the primary mode of international trade, may suffer as a result of all of this. Tariffs on imports could lead to low demand for those products, resulting in a drop in shipping volumes, which would impact ocean freight rates. This could be devastating for an industry emerging from a period of slow growth.

A trade war can destabilize growth at a time when the global economy has finally begun to show signs of recovery following the 2008 economic recession. A trade war, or even the threat of one, will create a negative economic and political environment in the long run.

Conclusion

It is impossible to separate the impact of the trade war from other factors influencing economic variables. The global cycle was already old and the output gap created by the global financial crisis had largely closed. The monetary policy had evolved, making it even more difficult to separate cyclical from structural factors. Furthermore, manufacturing has always been more volatile than the economy as a whole.

Nonetheless, an examination of the size of bilateral trade in goods between China and the United States in relation to their economies and the rest of the world. As well as, the size of manufacturing, suggests that the tariffs impact was always likely to be limited. Also, much of the commentary blaming the tariffs for various outcomes has been exaggerated.

The trade war has most likely had a minor impact on Chinese growth. It’s also true that the overall deterioration in the US-China relationship has hastened the exit of manufacturing from China. Thus, it initiated a trend away from reliance on China for global value chains.