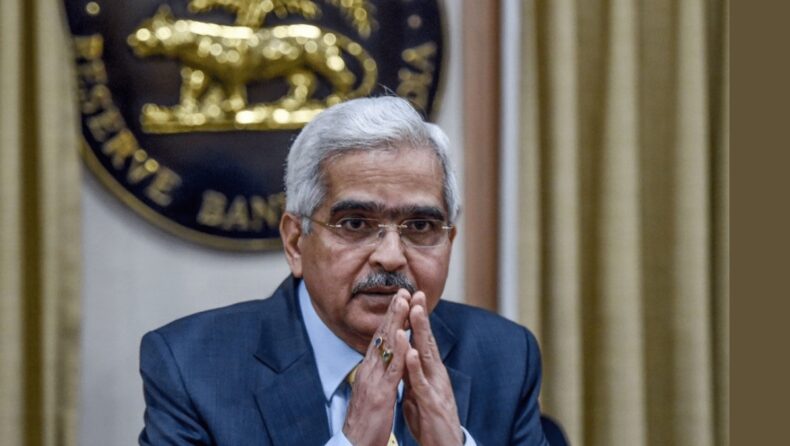

On Friday, Governor Shaktikanta Das of the Reserve Bank of India stated that, despite market uncertainty, the central bank’s forex reserve umbrella has maintained its strength.

He said that the RBI has been constantly evaluating the current and changing circumstances when it has intervened in the forex market.

The governor stated that valuation adjustments brought about by a stronger US dollar and higher bond yields in the United States account for approximately 67% of the decline in reserves that occurred during the fiscal year that began on April 1st.

On a balance of payments (BOP) basis, the governor stated that the foreign exchange reserves increased by $4.6 billion in Q1-2012.

“India’s additional external indicators, including the ratio of external debt to GDP; the ratio of net international investment to GDP; the proportion of reserves to short-term debt, as well as a lower debt service ratio when compared to the majority of other major EMEs.”

In fact, among major EMEs, India has the lowest ratio of external debt to GDP. Shaktikanta Das, governor of the Reserve Bank of India, stated in the briefing that followed the monetary policy meeting that the real GDP growth for the fiscal year 2024 is anticipated to be 7%.

During the same time period a year ago, real GDP growth was 13.5%. According to Shaktikanta Das, due to the impact of the global slowdown on India’s domestically driven economy, S&P Global Ratings has maintained its 7.3 percent growth forecast for the country’s economy for the years 2022 and 2024.

It anticipates real GDP growth of 6.5% in 2024-24, followed by 6.7% in 2024-25, and 6.9% in 2025-26. In May, S&P lowered its 2022-23 growth forecast from 7.8 percent to 7.3 percent due to rising inflation.

Das stated, “We remain confident of comfortably meeting our external financing requirements in the end.”

Additionally, he stated that a stable exchange rate is a sign of market confidence and stability across the macroeconomic and financial sectors.

He stated that the rupee is a freely floating currency whose exchange rate is determined by the market and that the RBI has no fixed exchange rate in mind. “Maintaining macroeconomic stability and market confidence is the overarching focus.”

“The return of capital inflows since July demonstrates that our actions have contributed to fostering investor confidence,” he said.

The issue of adequate forex reserves is always taken into consideration. Shaktikanta Das, governor of the Reserve Bank of India (RBI), provided a report to the nation on Friday, September 30, following the conclusion of the three-day monetary policy meeting.

The RBI’s Monetary Policy Committee (MPC) decided to raise the repo rate by 50 basis points to 5.90 percent in an effort to reduce inflation.

Intense imported expansion pressures felt toward the start of the monetary year have facilitated however stay raised across food and energy things. Due to government actions and improved supply from key producing nations, edible oil price pressures are likely to remain contained.

Due to softer industrial metal and crude oil prices and lessening supply conditions, selling price increases may taper in the future. Despite the strong rebound in services activity and some improvement in pricing power, there are still risks of higher input cost pass-through.

The umbrella’s strength remains. “In the week ending September 16, India’s foreign exchange reserves were reduced by an additional $5.22 billion, reaching their lowest level since October 2, 2020.”

Reserves of foreign currency also decreased for the seventh week in a row.

According to Reserve Bank of India data, the reserves stood at $545.65 billion, down from the all-time high of $642.453 billion on September 3 of last year. Over the previous two weeks, reserves had decreased by more than $15 billion.

Although outflows of dollars are the primary cause of this depletion, a change in the valuation of reserves held in currencies other than the US dollar is also partially to blame for this trend.

Foreign currency assets made up $484.90 billion of the current reserves, while gold reserves were worth $38.19 billion.

According to Deutsche Bank, India’s overall foreign exchange reserves will decrease further this year as a result of the central bank’s interventions to support the rupee and a growing current account deficit.

India’s government officials have stated that, despite the rapid decline, the country has substantial reserves to weather the market turmoil.

Read More: ST quota increased to 10% in Telangana, orders issued