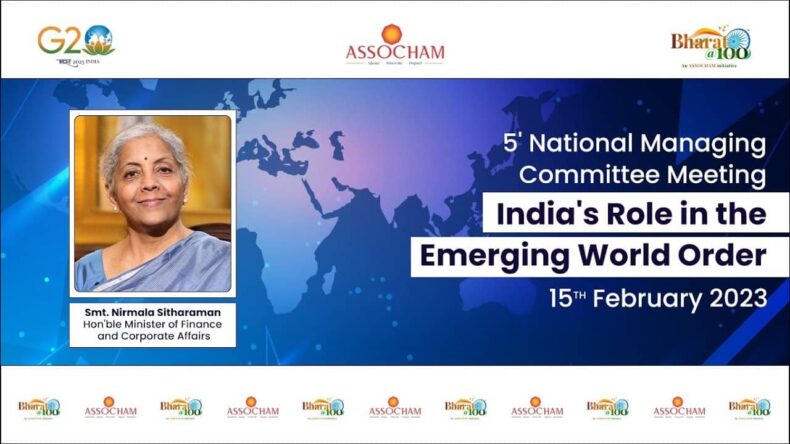

The Associated Chambers of Commerce & Industry of India

(ASSOCHAM) conducted an interactive session with Smt. Nirmala

Sitharaman, Hon’ble Minister of Finance and Corporate Affairs on India’s

Role in the Emerging World Order.

Table of Contents

CAPITAL EXPENDITURE

While addressing the meeting, Finance Minister Nirmala Sitharaman said that

the government would ensure that for the upcoming year, the long-term goal

of spending the allotted capital expenditure of Rs 10 lakh crore is actually

achieved. On being asked about how the government of India perceives the

global challenges influencing the Indian economy, she replied that there are

extra cushion funds that the government keeps in case of any sort of

“extraneous shocks” such as the COVID-19 pandemic.

She recalled the time when the government of India continued to import fertilizers even when the prices of the same had inflated almost 10 times. Further, she insisted and

reassured that the basic consumers of fuel, diesel, fertilizers, etc. would not

have to deal with any such volatile global shocks as the government will always

be ready with a buffer stock .

Coming forth she talked about how the budget is a balanced, growth-oriented

people’s budget and was specifically made with the aim that it is readable,

precise, without any technical jargons, and without any hidden meanings in order for the common man to read and understand.

PRIORITY SECTORS FOR THE UPCOMING YEAR

As for the priority sectors the Finance Minister mentioned the government’s focus on

decreasing the consumption of fossil fuels and adapting renewable energy

through the introduction of e-vehicles and greener energy-producing

technologies for the industries, which also includes India’s aim of 45% fewer

carbon emissions to be achieved by the year 2030 and net-zero carbon

emission by 2070. The other area of priority is making the youth of the country

ready for the technologically advanced jobs by introducing the Skill and Upskilling

programs under Industry 4.0. Inclusion of livestock farmers in the agriculture

area and providing them support is the other priority area as discussed by the

Finance Minister.

BUDGET 2024 PRESENTED BY THE FINANCE MINISTER

The Union Budget 2024-24 has been called as one of the best budgets of

Finance Minister Nirmala Sitharaman. These are few of the most significant

actions taken in the budget:

- Proposal to increase the rebate limit to 7 lakh in the new tax regime. Thus,

persons with income up to 7 lakh will not have to pay any income tax.- Change in Income tax slabs which were earlier starting from INR 2.5 lakhs to

3 lakhs under the new regime.

a. 0-3 lakh Nil

b. 3-6 lakh 5%

c. 6-9 lakh 10%

d. 9-12 lakh 15%

e. 12-15 lakh 20%

f. Above 15 lakh 30%

- Change in Income tax slabs which were earlier starting from INR 2.5 lakhs to

- Exemption of excise duty on GST-paid compressed bio gas contained in

blended compressed natural gas. - Micro enterprises with turnover up to 2 crore and certain professionals

with turnover of up to 50 lakh can avail the benefit of presumptive taxation. - National Calamity Contingent Duty (NCCD) on certain cigarettes is proposed to be revised upwards by about 16 per cent.

- Relief in customs duty on import of certain parts and inputs like camera lens and continue the concessional duty on lithium-ion cells for batteries for another year

- New co-operatives that commence manufacturing activities till 31.3.2024 shall get the benefit of a lower tax rate of 15 per cent, as is presently available to new manufacturing companies.

- Enhanced limits of 3 crore and 75 lakh respectively, to the tax payers whose cash receipts are no more than 5 per cent. MSMEs in timely receipt of payments, deduction allowance for expenditure incurred on payments made to them only when payment is actually made.

Catch the session video here:

https://www.youtube.com/live/cQnr-QDQ0HA?feature=share

For more latest news and updates visit: https://tdznkwjt9mxt6p1p8657.cleaver.live/author/neeti-joshi/