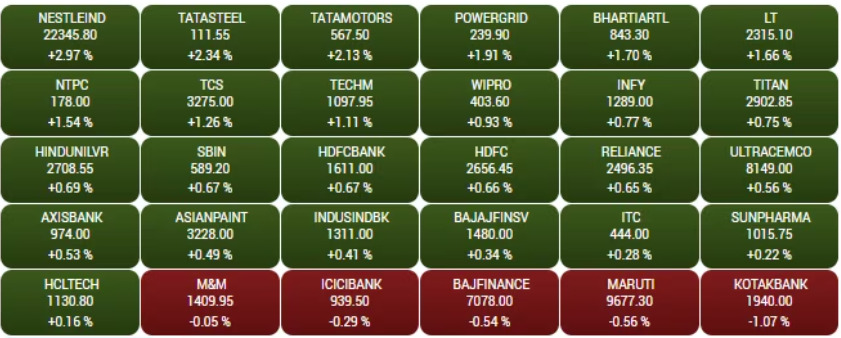

On Wednesday, June 7th, the Nifty closed at 18,726, and the Sensex closed at 63,142, setting up to make history again in the context of Indian markets. Nifty metals, FMCG, and realty stocks were the top supporting stocks today.

Although Kotak Mahindra Bank and Cipla were among the top losers, both drowned by 1%, Britannia Industries made a fresh 52-week high of 4,907.95, along with BPCL, which made a high of 369.50, both of which were up by more than 3.5% at the NSE.

Indian equities were higher on the strength of FMCG, Energy, and Metal sectors, as well as PSU Bank, amid multiple favourable global indications and ahead of the Reserve Bank of India’s monetary policy meeting, where investors are hoping for an interest rate pause.

Nifty expert view

” The alternate hour of the trading session brought fresh cheers to bulls with Nifty making new highs every hour indeed while Banknifty continued to struggle,” said Gaurav Bissa, VP- InCred Equities. Nifty saw a fresh hourly breach over 18650 situations, paving the path for a move towards 18800- 18850 situations. Banknifty has also closed above its swing rout hedge of 44200, indicating that a prolonged rally to 45000 situations is possible. The immediate support situations for the Nifty are 18630 and 43900 for the Banknifty. Both of the pointers continue to show a good trend.”

Markets in Asia performed unevenly, with a few indexes gaining optimism for Chinese stimulus and a favourable sign in geopolitics.

The Nikkei 225 index plummeted the most in 12 weeks as investors were wary of a rally, while there were sell-offs ahead of the setting of special quote prices after the week.

The Nikkei index plummeted 1.82%, the most since March 14, snapping a four-day gain streak. The Topix index as a whole fell 1.34%.

Shanghai’s major corporations fell as weaker-than-expected May export statistics impacted the market mood, but Hong Kong tech stocks rose, buoyed by US Secretary of State Antony Blinken’s planned visit to China in the coming weeks.

The Hang Seng Index in Hong Kong increased by 0.80%, while the index for Hang Seng China Enterprises increased by 0.95%.

European stock markets fell and the US dollar rose as investors worried about slowing global demand due to disappointing Chinese trade data, with attention shifting to next week’s crucial inflation data and the US central bank meeting.

British main stock markets fell as homebuilder shares fell following disappointing domestic house price data, while speciality chemicals firm Croda International fell to the bottom of the index FTSE 100.

Conclusion on Nifty

In conclusion, the Indian markets exhibited strength as the Nifty closed strong above 18,700, registering a surge of 0.68%. Sectors such as metals, FMCG, and realty contributed to this upward momentum. While Kotak Mahindra Bank and Cipla experienced losses, stocks like Britannia Industries and BPCL reached new highs, showcasing the market’s overall resilience.

Investors remained optimistic as multiple global indicators favored Indian equities, coupled with expectations of a possible interest rate pause from the Reserve Bank of India’s monetary policy meeting. The Nifty breached key resistance levels, setting the stage for a potential move towards 18,800-18,850 levels, while Banknifty’s closure above its swing breakout barrier suggested the possibility of a prolonged rally towards 45,000 levels.

Asian markets had a mixed performance, with the Nikkei 225 index experiencing a notable decline due to caution among investors. Chinese markets were impacted by weaker-than-expected export data, but Hong Kong’s tech stocks benefited from positive sentiment surrounding the upcoming visit of the US Secretary of State.

European stock markets faced a decline, partly influenced by disappointing Chinese trade data, while the US dollar strengthened. Concerns about slowing global demand and anticipation for crucial inflation data and the US central bank meeting shifted investors’ attention.

In summary, while Indian markets showed resilience and positive momentum, global market dynamics, geopolitical events, and economic data from major economies continued influencing investor sentiment. It remains crucial for market participants to closely monitor these factors as they shape the future trajectory of the financial markets.