Rakesh Jhunjhunwala withdrew his stake from one of the Tata companies. His move has left analysts and investors in question about their investment in the company.

Rakesh Jhunjhunwala cut down his stake in Tata Motors. He is reported to have a shareholding of 1.09 percent in the company. The total amount cut down by him is recorded to be ₹30 lakhs. In the first quarter of this financial year, Jhunjhunwala had withdrawn a certain amount resulting in his shareholding to reduce by 0.9 percent. His earlier shareholding was 1.18 percent.

According to BSE, he holds 3,62,50,000 shares in Tata Motors. His shareholding was reduced when he first cut down his investment in the company in March 2022. Tata land rover sale has seen a decline and is further expected to reduce. One of the reasons for this as well as for the withdrawn investment could be the bluechip shortage. Even though the company has stated the measures and alternatives for the shortage, it has brought down the numbers.

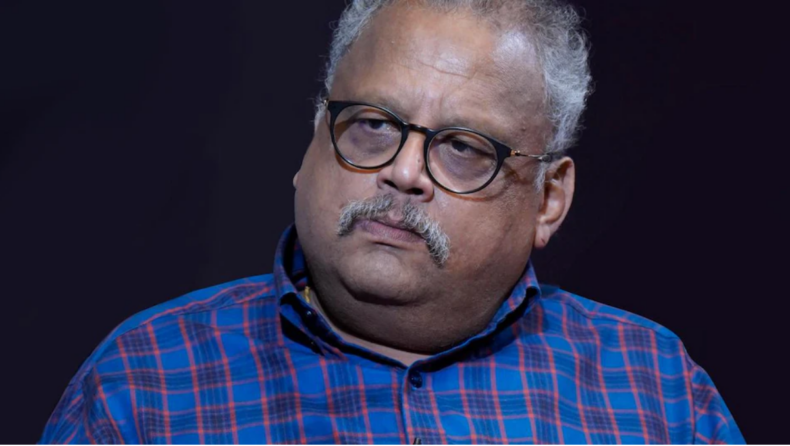

About Rakesh Jhunjhunwala

Rakesh Jhunjhunwala is one of the biggest investors in the Indian stock market. Born on 5 July 1960, he has been investing in the stock markets since 1985. His father used to be an investor and Jhunjhunwala too developed an interest in the stock markets. He was taught by his father about investing and he observed how the share market works along with his father. He started with his first capital amount of ₹5,000. Within a year of starting he had generated a profit of ₹5 lakhs. His current investment in the market is estimated at ₹11,000 crores. He has invested the highest amount of ₹7,298.4 crores in Titan company by Tata. His portfolio of investments is considered the most prestigious in the market.

He is also referred to as the ‘Big Bull’ or ‘Warren Buffet of India’. Apart from being the leading investor, he is also on the board of many companies. He acts as an advisor as well as a mentor for the companies. He is the chairman of Aptech Limited and Hungama Digital Media Entertainment Pvt. Ltd. He is on board for companies like Prime Focus Ltd, Bilcare Ltd, Praj Industries, Concord Biotech Ltd, etc. He is also reported to start an airline company with Vinay Dubey, former CEO of Jetairways named Air Akasa.

Tata Motors

The company’s stock price has grown about 45 percent last year and has shown a decline of 11 percent in the current year. The company with its global distribution at wholesales for its brands like Jaguar and Land Rover has shown growth in the first quarter of the year. 48 percent year-on-year growth is reported.

Apart from the supply of luxury vehicles, the commercial vehicles by the company have also been traded globally. Their global company Tata Daewoo has shown a year-on-year growth of 97 percent. Their commercial vehicle sale globally has helped the company to generate higher profits. On the other hand, the sale of their passenger vehicles has increased by 32 percent in the first quarter compared to last year. Currently, LIC has a shareholding of 4.96 percent which is an increase from 4.75 percent.

Tata Motors has not stated anything about the decline in the sale or the current situation in the company. These are the predictions made by analysts and investors. It was reported that Jhunjhunwala withdrew his shares during the April-June period as his shareholding in March was higher. His actions are monitored by other investors as well as stakeholders. He has a great knowledge of the market and his strategic moves are always highlighted. With this move by him, the investors are alerted. Surely, the reasons are not mentioned but it is expected to be a blue chip shortage and concerns about the future of the company.