The rupee weakened to 79.62 to the dollar, hitting a lifetime low on Tuesday, while the dollar rose further against major currencies. Foreign Exchange experts have claimed that there is a good possibility of the Rupee weakening to the key level of 80 to the dollar soon. This prediction was made considering how the Indian Rupee’s yield curve has been downward sloping for three days straight.

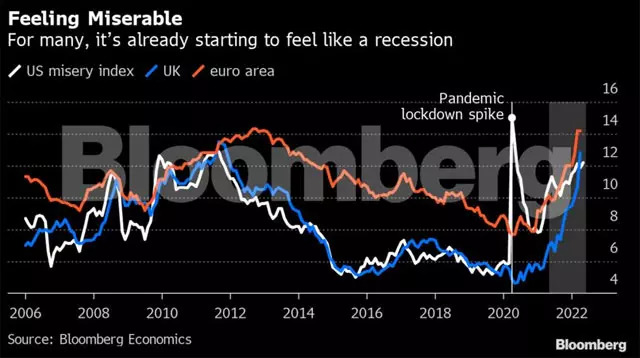

The high inflation rates worldwide, nations’ fleet to safe haven assets , the oil crisis brought in due to the Russia- Ukraine conflict, hiked interest rates, and the fearful possibility of an upcoming worldwide recession have pushed the USD to higher rates against several currencies. The otherwise exorbitant Euro too reached parity with the Greenback recently.

In such a scenario, the depreciation of the Indian Rupee doesn’t come off as a surprise. In fact, according to the analysts at Yes Bank, the Rupee may touch a low level of 81 to the dollar by the end of the current fiscal year, here’s why.

Depreciated Rupee results in poor state of Indian Forex reserves

In India, the country’s central bank RBI or the Reserve Bank of India, has been monitoring and regulating the Indian markets for ages. In order to uplift the Rupee, the Reserve Bank recently intervened in the foreign exchange market and purchased Rupees while selling US Dollars. The principle behind this is that when there are more US Dollars available in the market, their demand will fall and as a result their price too will decrease.

“The dollar index rallied as demand for safe haven increased on worries about slowing global economic growth,”- ICICI Securities.

Although this move is useful in increasing the value of the Indian Rupee, this comes at the cost of the country’s foreign exchange reserves. Due to the Rupee’s recent depreciation, the forex reserves have forcefully depleted and they have reached a 14 month low of $588.3 billion.

Deficit in the Current Account as INR based imports cost more

A current account deficit occurs when a country’s value of goods and services imports exceeds the value of goods and services exports. India is currently in a current account deficit, which if not taken care of may become unsustainable.

It is being speculated that due to the reduction in the Rupee’s value, the current account deficit will be increasing from 1.2 per cent (as of 2021) to 3.3 per cent this year. The deficit is said to have begun worsening since the beginning of the Russia- Ukrainian conflict and has been expanding thereafter.

Stagnant demands, rising unemployment and high inflation worldwide

Stagnant demands combined with unemployment and inflation reaching the peak have become a major concern worldwide. The Russian war with Ukraine that caused a hike in the prices of crude oil and other commodities forced several nations throughout the globe into stagflation. Prior to the war, inflation rates were regulating moderately but the war took a toll on the country, especially with Russia being one of the primary exporters of essential goods like crude oil.

With this crisis hovering over India, the central bank has taken upon itself to introduce certain measures to revamp the Indian economy and appreciate the Rupee.

Measures taken by the RBI to increase Rupee’s value

In order to find a way out of this crisis, the Reserve Bank of India has devised several policies to establish financial stability in the country. To ensure a ‘soft- landing’ for the Indian economy, the RBI has set up plans to allow several trade transactions to be carried out using the Indian currency. This will prevent the depletion of India’s foreign exchange reserve to some extent. It is expected that a positive result of this plan would be the increase in India’s trade with Russia especially in terms of crude oil purchases. Another solution implemented by the RBI was increasing the import duty on gold from 5 per cent to 15 per cent. This will cause a reduction in gold imports which are performed in dollars.

Read more: RBI: Settle Global Trade Agreements in Indian Rupees