Some of the biggest banks in the world have been directing trillions of dollars into fossil fuel expansion in the global south, according to a new report.

Table of Contents

“Fossil fuelling” the climate crisis

Often the very first ones to feel the wrath of climate change, developing countries also lack the material resources and the necessary amount of funds to bring in crucial changes in their climate policies, according to an UN-backed report published in November last year. The same report urged developed countries and their banks to invest and channel at least $1 trillion annually into the global-south if the world wants to have a chance against climate change.

However, according to a new report by an international NGO, ActionAid International, banks have been dead set at progressing in the opposite direction, with funds flowing into fossil fuel industries and agrobusinesses based in the global south. Teresa Anderson, global lead on climate justice for the organisation, pointed at the saying; “money makes the world go round” by quipping how wealth is actually “making the world go backwards”, while answering reporters.

With assistance from Profundo, an international trade consulting firm on the report, “How the Finance Flows: the banks fuelling the climate crisis”, ActionAid has compiled data on loans and underwriting provided to fossil fuel and industrial agriculture corporations by some of the biggest names in international banking. It is estimated that between 2016—a year after the Paris Agreement was signed which necessitated climate financing—and 2022, nearly 3.2 trillion dollars were funnelled into fossil fuel industries to help with their expansion in developing countries.

Which banks have been accused?

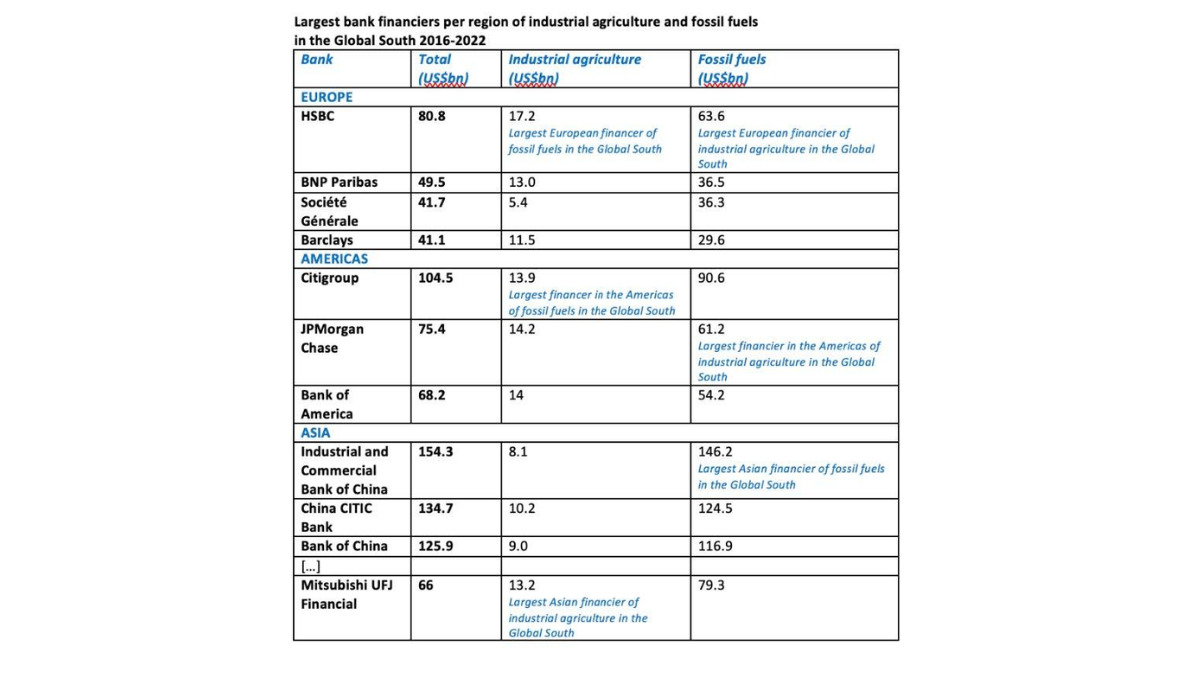

Banks with the highest contributions were HSBC, BNP Paribas, Societe Generale and Barclays in Europe, Citibank, JPMorgan Chase and Bank of America in both the American continents, and several top Chinese banks and Mitsubishi UFJ Financial leading the charge in Asia, with some of the recipients being Saudi’s Aramco and Exxon, amongst others.

Additionally, some $370 billion have been loaned and underwritten by major international banks to some of the largest industrial agriculture companies based in the global south within the same timeframe. Bayer, the pharmaceutical giant who acquired Monsanto in 2016 and the world’s second largest agrochemical-maker, has been suggested to be the biggest beneficiary of industrial agriculture financing, receiving an estimated $20.6 billion for its operations in the global south since 2016. HSBC from Europe, along with America’s Bank of America, JPMorgan Chase and Citigroup have been noted to be biggest contributors to companies like Bayer, ADM, Cargill and ChemChina.

According to the analysis provided by the report, industrial agriculture has been flagged as the second biggest perpetrator of global warming, due to the greenhouse gas emissions from the use of fertilisers, pesticides and deforestation caused by companies like Bayer to create farms.

ActionAid shines light on banks’ “absurd” hypocrisy

Arthur Larok, secretary general at ActionAid demanded the attention of the banks listed in the report, claiming that since the Paris Agreement in 2015, the global south has received nearly 20 times more funds for fossil fuel expansion and industrial agriculture from the global north, than what gets provided to climate solutions in the same regions. “This is absurd and must stop”, he added.

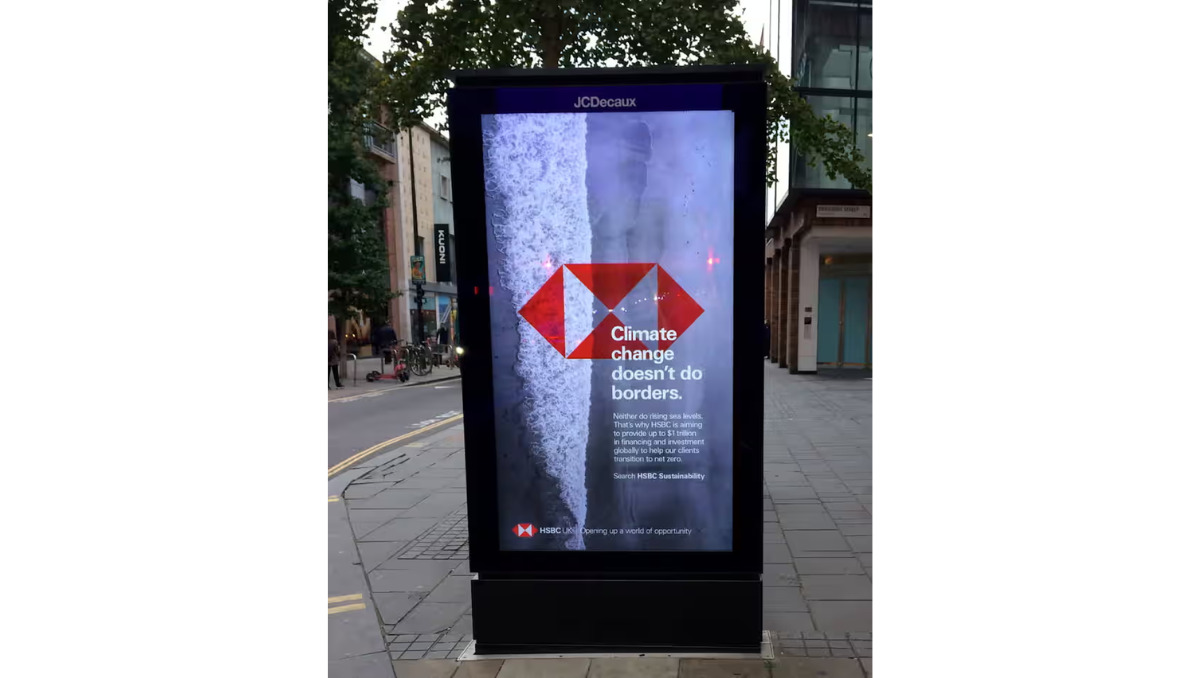

The research, according to Anderson, displayed the wide expanse between what these banks claim as part of their “green initiatives” and their actual actions. She accused them of hypocrisy when making public declarations on climate change, considering the “staggering” scale of their financial support to high emitting industries like fossil fuels and industrial agriculture.

HSBC, one of the banks finding a mention in the report, was in hot water in October last year when the Advertising Standards Authority (ASA) banned the bank’s climate ad campaign in the run-up to the Cop26 conference at Glasgow. After a litany of complaints over HSBC posters and electronic ads installed at bus stops, the UK advertising watchdog ruled that despite the bank advertising its $1 trillion worth of “green” efforts, it failed to acknowledge its own contribution towards climate change, thus guilty of misleading consumers.

Investing in the “future”

The report has also provided some suggestions like renewable energy and agroecology centred around female and young leadership in the global south, while being supported by “progressive public financing”. Mary Afan, the coordinator of small-scale women farmers in Nigeria highlighted agroecology’s capability to feed the world while keeping temperatures low, but mentioned how these efforts are being diminished by “overly funded large multinational industrial agriculture companies”.

She also called for governments and funders to prioritise their funding towards agroecological training for small farmers, while leading a charge against the use of chemicals and deforestation. Steps toward agroecology, in her opinion, is a move towards “funding our future, rather than our destruction”. Anderson echoed her beliefs, asserting that banks should be held accountable to the harm “wrecked by fossil fuels and industrial agriculture”. “With this report, banks can no longer pretend that the issue is out of sight, out of mind”, she said.